Cardano price prediction for 2026 is becoming one of the most searched topics among long-term crypto holders and active traders, and the reason is easy to understand: 2026 sits at the intersection of multiple powerful trends. The crypto market is maturing, institutions are becoming more selective, regulation is tightening in many regions, and new narratives like AI-driven crypto tools are reshaping what “value” even means in digital assets. At the same time, the market is still capable of extreme speculation, and the cycle mentality has not disappeared. It has simply evolved.

Cardano has always been a unique case in crypto. It is one of the most recognizable Layer-1 networks, known for its research-driven approach and a community that tends to think in multi-year horizons rather than quick flips. Yet it has also faced criticism: slower ecosystem expansion compared to some competitors, a history of hype cycles, and the question of whether it can capture enough real-world usage to justify long-term valuations. Those conflicting perceptions make Cardano price prediction for 2026 both exciting and challenging. ADA is a high-beta asset, and its upside can be significant in strong market conditions, but it also needs credible catalysts to outperform in an increasingly competitive environment.

What makes the 2026 conversation even more intense is the broader crypto market framing that’s emerging from major industry voices. Coinbase has discussed several areas that it believes are positioned to boom across crypto in 2026, and these areas connect directly to how investors might value networks like Cardano. At the same time, the market is seeing a surge in presale activity, especially in AI-related projects such as DeepSnitch AI, where limited-time promotions like 100% Christmas bonuses create urgency and attention. Whether you love presales or dislike them, the reality is that they influence liquidity rotation and narrative momentum, which can spill over into larger coins like ADA.

Cardano Price Prediction for 2026: The Big Picture Before the Numbers

Any serious Cardano price prediction for 2026 should start with one idea: ADA will not move based on Cardano alone. Like most major cryptocurrencies, Cardano trades within a broader cycle of liquidity, sentiment, and narrative leadership. If Bitcoin is strong and the overall market is expanding, ADA generally has more room to rally. If liquidity tightens and risk appetite falls, ADA can underperform even if the network continues building.

Cardano’s long-term case depends on adoption. The market is becoming more impatient with chains that do not show clear traction in users, developers, and real activity. At the same time, the market still rewards strong communities and recognizable brands. Cardano has one of the strongest brand identities in crypto, which means it can attract capital during bullish waves, but it must translate that attention into expanding ecosystem depth if it wants sustainable strength in 2026.

A realistic ADA price forecast should be framed as scenarios rather than a single number. Crypto is too volatile for fixed certainty. The more useful approach is to identify the catalysts that could push ADA into a bullish 2026 narrative, the risks that could keep it range-bound, and the technical structures traders will watch.

What ADA Needs for a Strong 2026 Performance

For Cardano price prediction for 2026 to skew bullish, the market typically looks for a combination of improving on-chain activity, growing applications, and clearer real-world use cases. Investors want to see an expanding Cardano ecosystem where developers build products people actually use. They also want confidence that Cardano remains competitive in performance, usability, and incentives compared to rival Layer-1 networks.

Another important driver is perception. Crypto markets are not purely fundamental. If Cardano becomes associated with one of the dominant narratives of 2026, it can receive attention and liquidity that lifts ADA price even before adoption fully catches up. That is why Coinbase’s view of “areas set to boom” matters so much, because narratives often define which chains become market leaders.

Why Cardano Can Still Surprise the Market

Cardano is often underestimated because it does not move at the speed of meme-driven ecosystems. But this is also its advantage. Cardano’s approach appeals to long-term builders and risk-aware investors who value stability and governance. If 2026 is a year where the market rewards infrastructure, compliance-friendly development, and sustainable ecosystems, ADA could outperform expectations.

Coinbase’s 3 Areas Set to Boom in 2026 and Why They Matter for Cardano

When Coinbase identifies areas that could boom across the crypto market in 2026, the biggest takeaway is not “buy everything.” The takeaway is that crypto is shifting from purely speculative cycles toward more structural growth themes. Those themes tend to attract institutional capital, and institutional capital often prefers ecosystems that are scalable, reliable, and regulatory-aware.

The three areas Coinbase emphasizes can be interpreted as broad trends that are likely to define how crypto evolves in 2026: stronger market infrastructure, regulation-driven growth, and real-world utility. Even if individual commentators describe these areas differently, the common idea is that crypto is maturing. The market is increasingly rewarding networks that support meaningful usage rather than purely hype-driven pumps.

For Cardano price prediction for 2026, this is important because Cardano has always positioned itself as a long-term infrastructure chain. If 2026 becomes a year where crypto markets reward sustainable networks, Cardano’s reputation can become an advantage rather than a drag.

How Infrastructure Growth Supports ADA’s Bullish Case

Infrastructure growth is one of the best drivers for longer-term crypto value. When infrastructure expands, it creates an environment where applications can scale, user experience improves, and the chain becomes more attractive to developers.

For ADA, infrastructure growth can show up in better tooling, improved network efficiency, smoother DeFi experiences, and more seamless cross-chain connectivity. If 2026 sees a wave of infrastructure investment across crypto, Cardano could benefit if its ecosystem captures a meaningful share of that growth.

Infrastructure also impacts market liquidity. A more mature ecosystem often attracts deeper liquidity pools, which reduces volatility and encourages larger traders to participate. That participation can help ADA sustain rallies rather than pump and fade.

Regulation as a Tailwind Instead of a Threat

Many traders fear regulation because it can create short-term uncertainty. But in 2026, regulation could be a tailwind for networks that are aligned with compliance, transparency, and long-term governance. Institutions want frameworks. They want predictability. They want lower legal risk.

Cardano’s governance focus and careful development philosophy could resonate if regulation becomes a key factor in market selection. For Cardano price prediction for 2026, the more the market shifts toward regulated capital flows, the more important it becomes to be viewed as a “safe” Layer-1 from an institutional perspective.

Real-World Utility and the Battle for Sustainable Adoption

The third major theme is real-world utility. In 2026, the crypto market may reward networks that support payments, tokenized assets, supply chain solutions, or verifiable identity systems. The competition here is fierce. Every Layer-1 claims it can support real-world utility, but only a few will prove it at scale.

If Cardano expands into practical use cases and demonstrates measurable adoption, ADA could see a stronger valuation narrative. Investors will look for evidence: consistent user activity, growing transaction demand, and applications that generate meaningful economic throughput.

Cardano’s Ecosystem Outlook in 2026: What Could Drive ADA Demand

Cardano price prediction for 2026 depends heavily on whether the ecosystem converts its long-term vision into user-facing growth. A token’s value is ultimately supported by demand. Demand can come from speculation, but sustainable demand comes from utility, staking participation, and ecosystem activity that keeps capital engaged.

Cardano already benefits from staking culture. Many ADA holders stake rather than trade daily, which can reduce circulating supply and stabilize the market. In a bullish environment, staking can also encourage long-term holding behavior, which amplifies price moves when demand rises.

Staking Rewards and Long-Term Holder Dynamics

Staking rewards can influence ADA price in two ways. First, they reduce the urge to sell because holders earn yield by participating in network security. Second, staking creates a base of committed participants who may hold through volatility.

However, staking can also create sell pressure if rewards are constantly sold. For Cardano price prediction for 2026, the key is whether new demand outpaces reward distribution. If new demand is strong, staking becomes a bullish feature. If demand is weak, staking rewards can add slow sell pressure.

DeFi and the Competition for Liquidity

The crypto market’s DeFi space remains one of the most important growth drivers for Layer-1 networks. DeFi brings liquidity, users, and activity. But DeFi is also competitive, and networks must offer strong incentives and smooth user experience to attract capital. For ADA price forecast discussions, a key question is whether Cardano can grow its DeFi ecosystem meaningfully in 2026. If Cardano’s DeFi activity expands, it can create stronger token utility and a more compelling reason for capital to rotate into ADA.

Developer Adoption and Narrative Leadership

Many investors believe developer activity is one of the strongest long-term indicators of ecosystem health. Developers build products, and products attract users. If Cardano can show expanding developer engagement and meaningful application launches, its narrative could strengthen significantly. In 2026, narrative leadership matters. If Cardano becomes associated with one of the market’s dominant themes—such as privacy-friendly infrastructure, governance innovation, or regulated adoption—it can attract a new wave of interest.

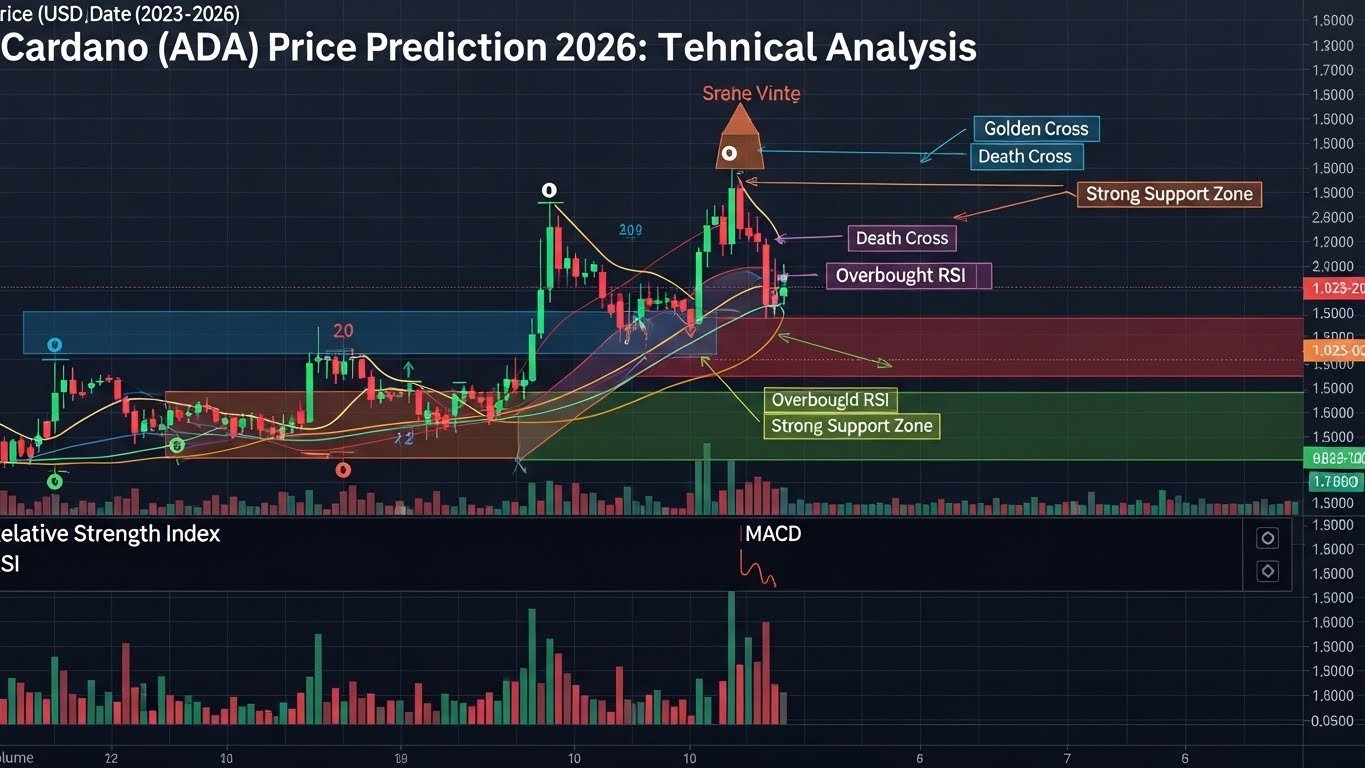

Technical Analysis for Cardano Price Prediction for 2026: What Traders Watch

Technical analysis plays a big role in Cardano price prediction for 2026 because even long-term investors often use price structure to time entries. In crypto, technical levels often become self-fulfilling because large numbers of traders watch them.

While specific price targets vary widely across analysts, ADA traders typically focus on a few key concepts: long-term support zones, multi-year resistance levels, and the ability of ADA to reclaim high-volume price areas. When ADA breaks above major resistance and holds, it can trigger strong momentum because sidelined capital re-enters.

Key Structures That Usually Define ADA Trends

ADA trends often develop in phases. First, a long accumulation range forms. Then a breakout happens, often driven by Bitcoin strength or a sector narrative shift. Finally, either continuation occurs or ADA returns to range if momentum fades. For 2026, the most important technical question is whether ADA can establish higher lows on longer timeframes. If ADA forms a consistent uptrend structure, it can attract both traders and long-term investors.

The Importance of Market Cycles and Bitcoin Dominance

ADA rarely rallies in isolation. It often benefits when the market rotates from Bitcoin into altcoins. That rotation typically happens when Bitcoin stabilizes and traders become more comfortable taking risk. For Cardano price prediction for 2026, Bitcoin dominance and broader altcoin sentiment are major drivers. If 2026 becomes an altcoin expansion year, ADA could see stronger upside. If Bitcoin remains dominant and altcoins lag, ADA may struggle to break out.

DeepSnitch AI Presale Bonuses Ending on New Year’s Day: Why Presales Affect ADA Narrative

It might seem strange to mention an AI presale in a Cardano price prediction for 2026, but this is exactly how crypto markets work: capital flows toward narratives, and presales often capture attention at key times. When a presale offers strong incentives—such as limited-time bonus allocations ending on New Year’s Day—it creates urgency and amplifies social engagement. That engagement can influence the broader market mood, especially among retail traders.

Presales can indirectly impact ADA because they affect liquidity rotation. If a large amount of speculative capital moves into presales, it can temporarily reduce flows into established altcoins. On the other hand, presale excitement can also create a more bullish environment overall, increasing risk appetite and lifting altcoins later through broader market optimism.

Why AI Narratives Are Dominating Crypto Speculation

AI has become one of the strongest narratives in technology, and crypto markets tend to adopt major tech narratives quickly. AI-related crypto projects attract traders because they combine two powerful themes: automation and speculation. Many traders believe AI tools can improve market insights, detect whale activity, and generate trading signals faster than humans can.

Whether those tools deliver real value is a separate debate. The point is that AI narratives drive attention, and attention drives liquidity. For Cardano price prediction for 2026, this matters because narrative-driven liquidity can spill into Layer-1 assets when the market enters a broad risk-on phase.

Presales and the Psychology of “Early Access”

Presales create the strongest form of crypto temptation: the belief that you are early. When traders believe they are early, they tolerate risk, hold longer, and recruit others. Promotions like 100% bonuses intensify this effect, encouraging larger buys in exchange for more tokens. This behavior fuels speculation, which can shape market sentiment going into 2026. If speculation accelerates, altcoins often benefit later because traders rotate profits into larger assets like ADA, especially if the broader market becomes bullish.

The Risk Side: Why Presale Hype Can Also Drain Liquidity

Presales can also create a liquidity drain. When retail capital focuses heavily on presales, established altcoins may see reduced inflows. This can keep coins like ADA range-bound even in a moderately positive environment. That’s why Cardano price prediction for 2026 should consider not only Cardano’s ecosystem but also the broader liquidity cycle and the narratives capturing attention.

Cardano Price Prediction for 2026: Bullish, Base, and Bearish Scenarios

Instead of offering one overly confident price target, a better Cardano price prediction for 2026 should be scenario-based. Crypto markets are too volatile to guarantee a single outcome, but we can outline what conditions would support each scenario. In a bullish scenario, ADA benefits from a strong crypto market expansion, increased altcoin rotation, and meaningful Cardano ecosystem growth. In this case, ADA could potentially reclaim key historical levels and build sustained upside momentum.

In a base scenario, ADA grows gradually but remains constrained by competition and market selectivity. The price may trend upward but with long consolidations, reflecting a market that prefers Bitcoin and a handful of leading narratives. In a bearish scenario, ADA underperforms due to weak liquidity, lack of adoption momentum, or a risk-off macro environment. ADA could remain range-bound or decline if capital concentrates elsewhere.

What Could Push ADA Into a Bull Market in 2026

A strong ADA price forecast in 2026 would likely require a combination of positive market liquidity conditions, a thriving Cardano DeFi and application ecosystem, and renewed investor confidence in Cardano’s long-term trajectory. If the market increasingly values infrastructure and regulated adoption—areas often associated with Coinbase’s view of where crypto is headed—Cardano could benefit from narrative alignment.

What Could Hold ADA Back Even If Crypto Rallies

ADA can still underperform even in a bullish market if it fails to capture mindshare and capital compared to faster-growing ecosystems. Layer-1 competition remains intense, and the market often rewards chains that show rapid adoption and strong developer momentum. This is why Cardano price prediction for 2026 depends not only on market direction but on relative performance compared to other Layer-1 networks.

Risks to Consider Before Trusting Any Cardano Price Prediction for 2026

Every price prediction must include risk. The crypto market can change quickly, and ADA faces both market-wide and Cardano-specific risks. Market-wide risks include macroeconomic shifts, unexpected regulatory crackdowns, exchange liquidity disruptions, or major security events that reduce confidence. Cardano-specific risks include slower ecosystem expansion than competitors, weaker developer traction, or narrative fatigue if investors feel Cardano is not evolving fast enough.

The Biggest Risk Is Not Price Volatility, It’s Market Selection

In 2026, the market may become more selective. This means not all major coins will benefit equally from bullish conditions. Some assets may surge while others lag. The key risk for ADA is that the market chooses other Layer-1 ecosystems as primary winners. This risk can be reduced if Cardano proves adoption growth and ecosystem vitality.

How Long-Term ADA Holders Should Think About Risk

Long-term holders often believe in Cardano’s mission. That conviction can be valuable, but it should be paired with realistic risk management. Holding through cycles is easier when position sizing matches your tolerance and when you understand that even strong projects can underperform for long periods.

Conclusion

Cardano price prediction for 2026 sits at the crossroads of market evolution. Coinbase’s outlook on areas set to boom in 2026 highlights a broader shift toward infrastructure, regulation-aware growth, and real-world utility—trends that could support networks like Cardano if they demonstrate strong adoption. At the same time, presale-driven narratives like DeepSnitch AI show that speculation and urgency still shape crypto behavior, influencing liquidity and sentiment in ways that can indirectly affect large caps like ADA.

Ultimately, ADA’s performance in 2026 will depend on whether the Cardano ecosystem expands in meaningful ways, whether market liquidity supports a broad altcoin cycle, and whether Cardano aligns with the dominant narratives that attract institutional and retail capital. If adoption grows and the market becomes more constructive, ADA could surprise on the upside. If competition intensifies and liquidity concentrates elsewhere, ADA may remain a slower performer even in a bullish year.

The best approach is to treat any Cardano price prediction for 2026 as a framework, not a certainty. Focus on trends, watch the ecosystem signals, and respect risk. In a market that is maturing but still volatile, discipline matters as much as conviction.

FAQs

Q: How realistic is a Cardano price prediction for 2026 when crypto markets are so volatile and narrative-driven?

A Cardano price prediction for 2026 can be useful as a scenario framework, but it should never be treated as a guarantee because crypto markets are influenced by liquidity cycles, macro risk appetite, and shifting narratives. ADA can rally strongly when altcoins rotate upward, but it can also lag if capital concentrates in Bitcoin or other Layer-1 ecosystems. The most realistic approach is to track adoption indicators, ecosystem growth, and long-term price structure rather than relying on one fixed target, because the conditions that drive ADA’s upside can change quickly.

Q: Why does Coinbase talking about areas set to boom in 2026 matter for Cardano and ADA holders?

When Coinbase highlights areas expected to boom in 2026, it signals how major market participants think crypto will evolve, especially in areas like infrastructure maturity, regulation-driven growth, and real-world usage. This matters for Cardano because ADA’s valuation depends heavily on whether Cardano is seen as a serious infrastructure chain that can support sustainable adoption. If the market increasingly rewards networks that align with these trends, ADA could benefit from renewed confidence and stronger long-term capital inflows, especially from institutions that prefer scalable and governance-aware ecosystems.

Q: How can AI-focused presales like DeepSnitch AI influence ADA even though they are separate projects?

AI presales can influence ADA indirectly by shaping the flow of retail liquidity and overall market sentiment. When presales offer aggressive bonuses or limited-time incentives, they can absorb speculative capital that might otherwise go into established altcoins, which can slow ADA inflows temporarily. However, presale hype can also boost overall risk appetite, and profits from early speculation sometimes rotate into major coins like ADA later. In 2026, the impact depends on whether presales create lasting market optimism or whether they drain liquidity from the broader altcoin market.

Q: What are the most important ecosystem signals to watch when evaluating Cardano price prediction for 2026?

The most important signals include growth in on-chain activity, expanding DeFi participation, increasing developer engagement, and evidence that Cardano applications are attracting real users. Investors should also monitor whether liquidity within Cardano’s ecosystem is deepening, because stronger liquidity supports more sustainable rallies and improves market confidence. Another key signal is whether Cardano becomes associated with major 2026 narratives like regulated adoption, scalable infrastructure, or privacy-friendly innovation, because narrative leadership often determines which Layer-1 assets attract the strongest inflows.

Q: What are the biggest risks that could cause ADA to underperform even if the overall crypto market performs well in 2026?

The biggest risk is market selection, meaning investors may choose other ecosystems as the primary winners of the cycle. ADA can underperform if Cardano adoption remains slower than competitors, if developer activity fails to expand meaningfully, or if the ecosystem struggles to capture mindshare compared to faster-moving Layer-1 networks. Another risk is liquidity concentration in Bitcoin and a small set of top narratives, which can reduce capital available for mid-tier altcoins. For long-term holders, the key is recognizing that even strong projects can face multi-year periods of relative underperformance, making risk management and realistic expectations essential.