Hyperliquid launches DeFi lobby efforts at a moment when U.S. crypto regulation stands at a crossroads. After years of enforcement actions, fragmented guidance, and stalled legislation, decentralized finance is entering a new phase—one where policy clarity may determine whether innovation flourishes domestically or migrates offshore. Against this backdrop, the creation of the Hyperliquid Policy Center (HPC) signals a strategic shift: rather than reacting to regulation, parts of the DeFi industry are moving to shape it.

The phrase “Hyperliquid launches DeFi lobby” is more than a headline. It reflects the growing recognition that decentralized finance (DeFi) has matured into a serious financial sector that requires structured representation in Washington, D.C. The new policy initiative arrives during what leaders describe as a “critical time” for U.S. policy, with market structure legislation, derivatives oversight, and regulatory jurisdiction all under active discussion.

As DeFi protocols handle increasing trading volume and on-chain derivatives become mainstream among crypto traders, the absence of clear rules is no longer a theoretical concern. It directly impacts developers, investors, liquidity providers, and everyday users. Hyperliquid launches DeFi lobby advocacy with the goal of ensuring that decentralized financial infrastructure can operate legally and competitively within the United States.

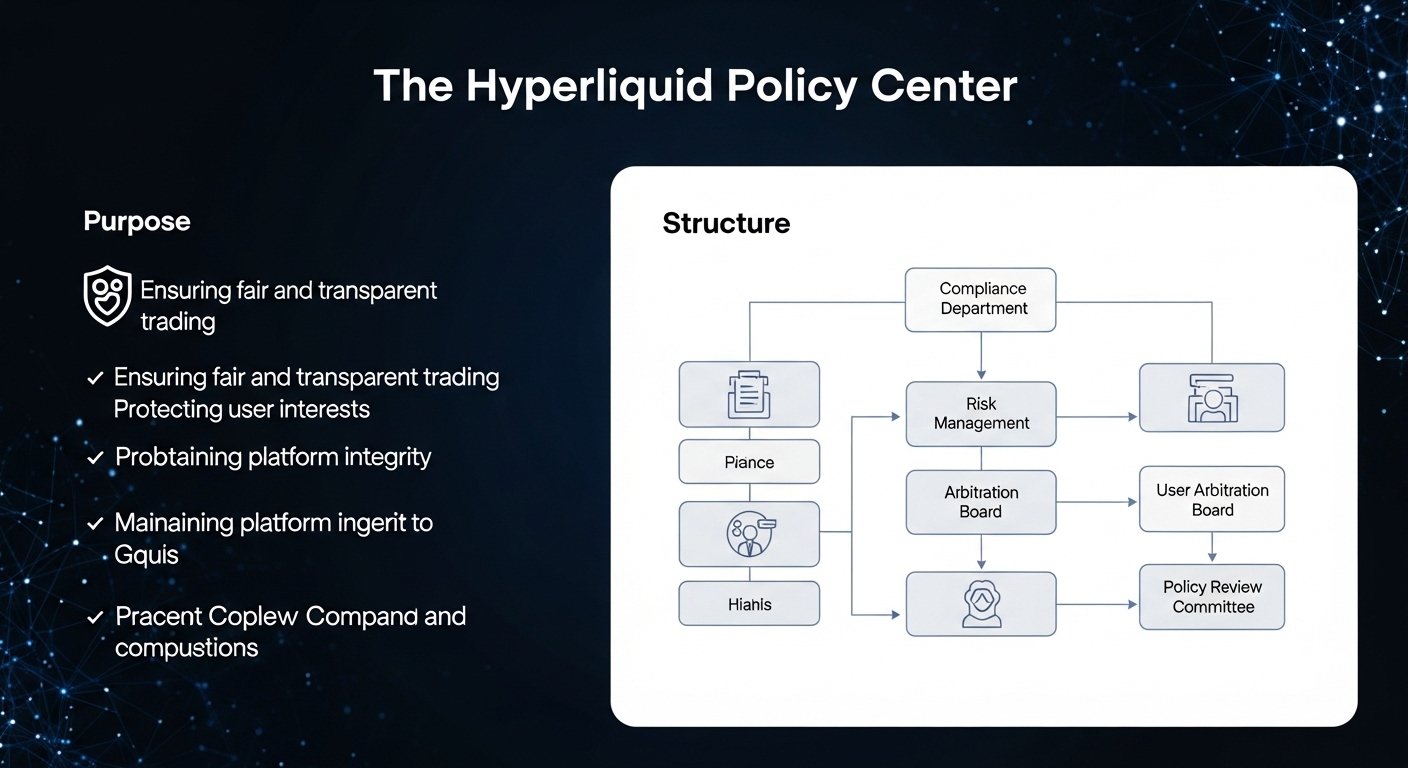

The Hyperliquid Policy Center: Purpose and Structure

Hyperliquid launches DeFi lobby operations through the formation of the Hyperliquid Policy Center, a Washington-based research and advocacy organization designed to engage lawmakers and regulators. Structured as a 501(c)(4), the center is positioned to participate directly in policy debates and lobbying efforts while maintaining a focus on research-driven proposals.

The mission of the Hyperliquid Policy Center centers on three pillars: advancing regulatory clarity for DeFi, educating policymakers about decentralized market infrastructure, and promoting practical frameworks for on-chain derivatives such as perpetual futures. This structure reflects an understanding that modern financial innovation cannot remain detached from political and regulatory systems.

Unlike early crypto advocacy efforts that focused primarily on defending against enforcement, this initiative emphasizes proactive engagement. Hyperliquid launches DeFi lobby representation to ensure that decentralized exchanges, automated trading protocols, and blockchain-based settlement systems are accurately understood within legislative discussions.

Why a Dedicated DeFi Lobby Is Emerging Now

For years, decentralized finance operated in a gray area. Regulators struggled to categorize smart contracts, governance tokens, and permissionless trading systems under frameworks originally designed for centralized intermediaries. This ambiguity created legal uncertainty, particularly for derivatives products and high-leverage trading mechanisms.

Hyperliquid launches DeFi lobby efforts during a period when Congress is debating comprehensive crypto market structure legislation. Such bills could define regulatory boundaries between agencies, establish disclosure standards, and determine how digital assets are classified. These foundational decisions may shape the industry for decades.

A dedicated DeFi lobby reflects a recognition that decentralized systems require representation tailored to their architecture. Traditional financial lobbying groups represent banks, broker-dealers, and centralized exchanges. DeFi, by contrast, operates through distributed networks, smart contracts, and algorithmic risk management. Translating these concepts into policy language requires specialized expertise.

Understanding the “Critical Time” for US Policy

When leaders describe the moment as “critical,” they refer to the convergence of legislative momentum, regulatory recalibration, and geopolitical competition. The United States is actively debating how to regulate digital assets without stifling innovation. At the same time, other jurisdictions are moving forward with clearer crypto frameworks.

Hyperliquid launches DeFi lobby initiatives amid growing pressure for regulatory certainty. Market participants want to know whether on-chain trading venues will be recognized as legitimate platforms or treated as unregistered entities. Developers want to understand whether publishing smart contracts could expose them to liability. Institutional investors want confidence that participation in decentralized markets will not trigger unforeseen compliance risks.

Market Structure and Regulatory Jurisdiction

One of the central issues under debate is market structure—how digital asset markets should be organized and supervised. This includes determining which regulator oversees spot trading, which agency governs derivatives, and how decentralized protocols fit into these categories.

Hyperliquid launches DeFi lobby engagement with a focus on ensuring that decentralized market infrastructure is not forced into ill-fitting regulatory boxes. Perpetual futures, automated market makers, and on-chain order books operate differently from traditional exchanges. Effective oversight must reflect those differences rather than ignoring them.

The stakes are particularly high for derivatives. In the United States, derivatives markets are tightly regulated, and compliance standards are rigorous. Without clear pathways for decentralized derivatives platforms, innovation may continue migrating to offshore venues, limiting U.S. competitiveness.

Perpetual Futures: The Regulatory Flashpoint

A central theme in the Hyperliquid launches DeFi lobby narrative is the importance of perpetual futures. Perpetual contracts, often referred to as “perps,” are derivatives that allow traders to speculate on asset prices without an expiration date. Instead of settling at a specific time, these contracts rely on funding rate mechanisms to maintain price alignment with spot markets.

Perpetual futures dominate global crypto trading volume. However, their regulatory status in the U.S. remains complex. Traditional derivatives oversight assumes identifiable intermediaries responsible for risk management and customer protection. Decentralized perpetual trading platforms rely instead on algorithmic liquidation engines, transparent collateral systems, and on-chain execution.

Hyperliquid launches DeFi lobby advocacy to promote frameworks that recognize these structural distinctions. Rather than banning or ignoring decentralized derivatives, proponents argue that regulators can design rules addressing risk, transparency, and consumer protection without dismantling decentralization.

Why Derivatives Policy Matters for US Competitiveness

The regulation of derivatives is not merely a technical issue; it is an economic one. If U.S. traders cannot access competitive perpetual markets domestically, liquidity will flow abroad. This shift affects tax revenue, employment opportunities, and financial innovation leadership.

Hyperliquid launches DeFi lobby efforts partly to prevent that outcome. By advocating for compliant pathways, the initiative seeks to align U.S. regulatory oversight with the realities of global crypto trading. Clear rules could attract institutional capital while maintaining safeguards against systemic risk.

Funding and Leadership: Building Credibility in Washington

The Hyperliquid Policy Center begins operations with significant financial backing from the Hyperliquid ecosystem, reportedly funded through a substantial token contribution. Adequate funding allows the organization to hire policy experts, legal analysts, and communications professionals capable of engaging effectively with lawmakers.

Leadership plays a crucial role in credibility. Hyperliquid launches DeFi lobby efforts under the guidance of experienced crypto policy professionals. Effective advocacy in Washington requires more than enthusiasm; it demands a deep understanding of legislative processes, regulatory enforcement mechanisms, and interagency dynamics.

The Importance of Policy Expertise

DeFi systems are technically complex. Smart contract governance, automated liquidation algorithms, and decentralized order books require careful explanation to non-technical audiences. Policy professionals bridge that gap by translating code-based systems into understandable legal frameworks.

Hyperliquid launches DeFi lobby engagement with the intention of producing research papers, regulatory proposals, and policy briefs. These documents can shape legislative drafts, inform hearings, and influence agency guidance. In the absence of informed input, policymakers may rely on outdated assumptions.

Decentralized Market Infrastructure as a Strategic Narrative

A recurring theme in the Hyperliquid launches DeFi lobby messaging is the concept of decentralized market infrastructure. This framing shifts the conversation from speculative trading to systemic innovation. Blockchains are increasingly seen as settlement layers, offering transparent execution and near-instant clearing.

By emphasizing infrastructure, the policy center aligns DeFi with broader financial modernization goals. Decentralized systems can provide real-time transparency, algorithmic risk management, and global accessibility. These attributes resonate with policymakers focused on resilience and technological leadership.

Transparency and Risk Controls in DeFi

One common criticism of decentralized finance is that it lacks oversight. However, DeFi protocols often operate with publicly auditable smart contracts and on-chain transaction histories. Liquidation mechanisms, collateral levels, and funding rates are visible in real time.

Hyperliquid launches DeFi lobby arguments that these transparency features can complement regulatory objectives. Instead of relying solely on periodic reporting, regulators could leverage on-chain data to monitor systemic risk. This approach requires collaboration between technologists and policymakers.

Addressing Criticism and Independence Concerns

Whenever a protocol-backed organization enters the policy arena, questions arise about independence. Critics may argue that a DeFi lobby primarily advances the interests of its founding ecosystem. Maintaining credibility requires demonstrating that policy positions reflect broader industry benefits rather than narrow commercial goals.

Hyperliquid launches DeFi lobby initiatives with an emphasis on research-based advocacy. Over time, credibility will depend on consistency, transparency, and willingness to engage with competing perspectives. Policy influence is earned through rigorous analysis, not simply funding.

The Challenge of Representing Decentralization

Decentralization inherently resists centralized representation. Yet legislative systems require identifiable interlocutors. Hyperliquid launches DeFi lobby efforts to address this tension by creating an institutional voice capable of articulating community concerns while respecting decentralized governance principles. Balancing these roles is complex. The organization must communicate effectively with regulators while preserving the ethos of permissionless innovation that defines DeFi.

Implications for Builders and Users

Regulatory clarity benefits more than policymakers. Developers gain confidence to build innovative products without fear of retroactive enforcement. Institutional investors gain assurance that participation aligns with compliance expectations. Retail users benefit from stronger consumer protections and safer platforms.

Hyperliquid launches DeFi lobby advocacy with the potential to influence how decentralized exchanges operate within the U.S. If successful, it could reduce reliance on offshore trading venues and foster domestic innovation hubs.

Long-Term Outlook for US DeFi Regulation

The next few years will likely determine whether the United States becomes a leader in decentralized financial infrastructure or adopts a fragmented approach that drives innovation elsewhere. Policy outcomes will influence capital allocation, talent migration, and global competitiveness. Hyperliquid launches DeFi lobby engagement at a decisive moment. By participating directly in regulatory design, the initiative aims to ensure that future rules recognize both the risks and the transformative potential of decentralized systems.

Conclusion

Hyperliquid launches DeFi lobby efforts at a time when U.S. crypto policy is poised for structural change. The creation of the Hyperliquid Policy Center marks a strategic evolution from reactive compliance to proactive engagement. By advocating for clear frameworks around perpetual futures, decentralized exchanges, and blockchain-based market infrastructure, the initiative seeks to align regulatory oversight with technological reality.

Whether this effort reshapes the regulatory landscape will depend on sustained engagement, credible research, and collaborative dialogue with lawmakers. What is certain is that DeFi is no longer operating at the fringes of policy discussions. As Hyperliquid launches DeFi lobby representation in Washington, the future of decentralized finance in America enters a new and consequential chapter.

FAQs

Q: What does it mean that Hyperliquid launches DeFi lobby efforts?

It means the Hyperliquid ecosystem has established a dedicated policy organization in Washington, D.C., focused on advocating for clear and practical U.S. regulations for decentralized finance and on-chain derivatives.

Q: Why is this considered a “critical time” for US policy?

Congress and regulators are actively debating digital asset market structure, derivatives oversight, and agency jurisdiction. Decisions made now could define how DeFi operates in the United States for years.

Q: What are perpetual futures, and why are they central to the debate?

Perpetual futures are derivatives contracts without expiration dates that rely on funding rates to maintain price alignment. They dominate crypto trading volume and present unique regulatory questions in the U.S.

Q: How could this lobbying effort affect everyday users?

Clearer regulations could enhance consumer protections, reduce uncertainty, and allow more decentralized platforms to operate legally within the U.S., potentially improving safety and access.

Q: Does a DeFi lobby mean decentralization is compromised?

Not necessarily. Advocacy groups can represent ecosystem interests in policy discussions without altering protocol governance. The effectiveness of such representation depends on transparency and adherence to decentralized principles.

Also Read: DeFi APR vs APY Understand Yield Like a Pro