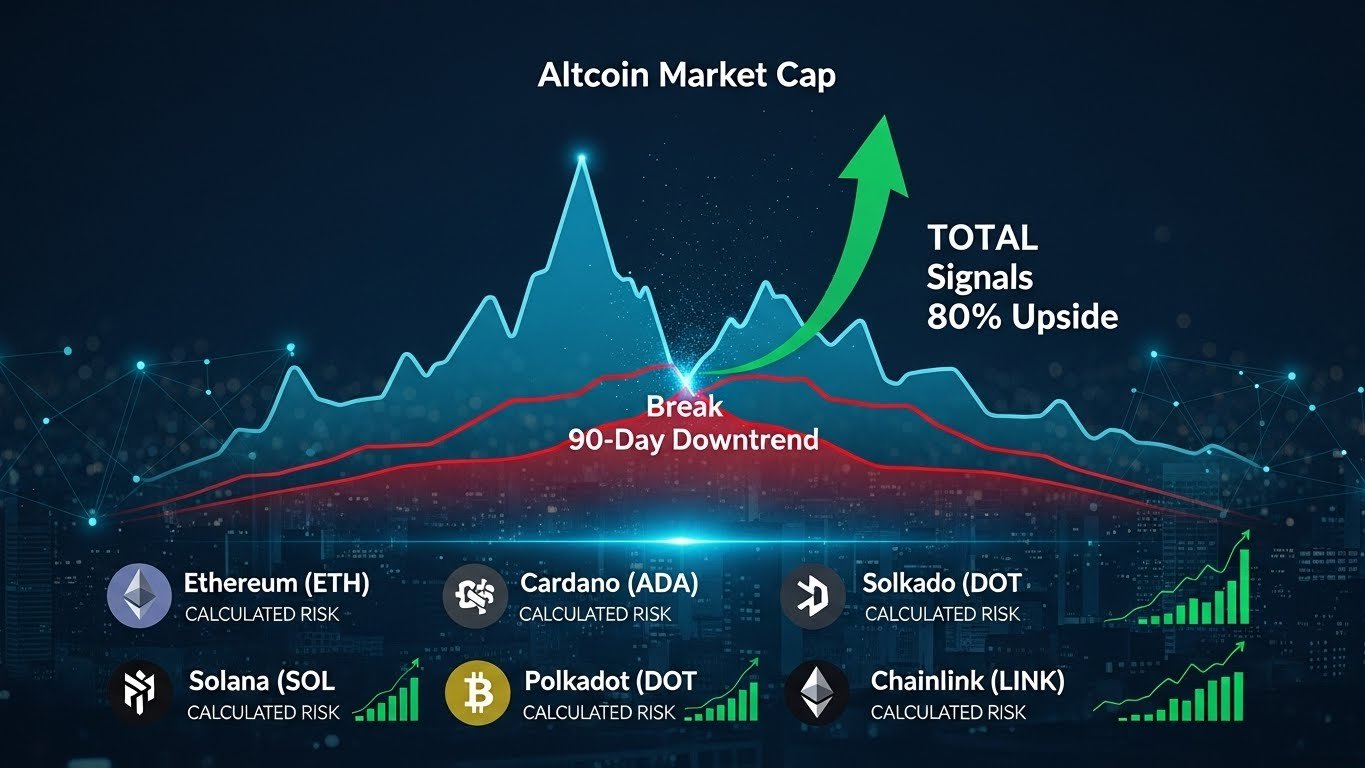

The altcoin market cap breaking a 90-day downtrend has become one of the most talked-about developments in recent crypto market analysis. After months of persistent weakness, declining volumes, and cautious investor sentiment, the broader altcoin sector is finally showing signs of renewed strength. Market participants are closely watching TOTAL, the total cryptocurrency market capitalization excluding Bitcoin, as it flashes a potential bullish reversal with projections pointing toward an ambitious 80% upside move.

For many traders and long-term investors, this shift marks a possible transition from consolidation to expansion. Historically, when the altcoin market cap decisively breaks prolonged downtrends, it often signals the early stages of a broader altcoin cycle. Such phases are characterized by capital rotation from Bitcoin into higher-risk, higher-reward assets, creating opportunities for select projects to outperform the wider market.

This article provides an in-depth analysis of why the altcoin market cap breaking its 90-day downtrend matters, what the TOTAL chart suggests about future price action, and which five crypto coins may be worth risking capital on if the projected upside materializes. Rather than focusing on hype, the discussion emphasizes market structure, crypto market trends, and risk-reward dynamics to help readers better understand the current landscape.

Understanding the Altcoin Market Cap and TOTAL Index

What the Altcoin Market Cap Represents

The altcoin market cap represents the combined valuation of all cryptocurrencies excluding Bitcoin. It serves as a crucial indicator of risk appetite within the digital asset ecosystem. When capital flows into altcoins, it typically reflects growing investor confidence and a willingness to pursue higher returns beyond Bitcoin’s relative stability.

Movements in the altcoin market cap often lag behind Bitcoin’s price action. Bitcoin usually establishes a trend first, followed by Ethereum, and then capital gradually spreads into mid-cap and small-cap altcoins. This cascading effect is why analysts pay close attention to TOTAL, as it captures the collective behavior of non-Bitcoin assets. The recent altcoin market cap break of a 90-day downtrend suggests that selling pressure has weakened and accumulation may be underway, setting the stage for a potential trend reversal.

Why TOTAL Is a Critical Market Indicator

TOTAL is widely used to assess the overall health of the altcoin market. Unlike individual coin charts, it smooths out project-specific noise and highlights macro-level shifts in sentiment. When TOTAL breaks key resistance levels after a prolonged decline, it often indicates that capital is returning to the broader altcoin space.

The current structure of TOTAL shows a clear deviation from its previous bearish pattern. Higher lows, improving momentum, and expanding volume point toward a possible continuation move. Analysts projecting an 80% upside are basing this outlook on historical patterns where similar breakouts led to strong multi-month rallies. Understanding TOTAL helps investors contextualize individual coin performance within the broader market cycle rather than viewing price movements in isolation.

Why the 90-Day Downtrend Break Matters

Technical Significance of the Breakout

From a technical analysis perspective, breaking a 90-day downtrend is significant because it represents a shift in market control from sellers to buyers. Prolonged downtrends often reflect distribution phases where participants exit positions due to uncertainty or fear. Once this structure is broken, it suggests that demand has absorbed supply.

The altcoin market cap breaking this downtrend indicates that buyers are stepping in with conviction. This change is often accompanied by improving indicators such as relative strength and momentum oscillators, reinforcing the bullish thesis. Such breakouts do not guarantee immediate gains, but they substantially increase the probability of sustained upward movement, especially when confirmed by broader market participation.

Psychological Impact on Market Participants

Beyond technicals, the psychological impact of a downtrend break cannot be overstated. For months, many investors remained sidelined due to persistent losses and lack of direction. A clear structural shift restores confidence and encourages capital deployment. This renewed optimism can create a feedback loop. As prices rise, fear of missing out draws in additional buyers, further fueling momentum. In previous cycles, similar psychological shifts marked the early stages of powerful altcoin rallies. The current environment suggests a cautious but growing willingness among investors to re-engage with altcoins, particularly those with strong narratives and fundamentals.

TOTAL’s Potential 80% Upside Explained

Historical Context of Similar Breakouts

Looking at historical data, TOTAL has demonstrated a tendency to produce sharp upside moves following extended consolidation and downtrend phases. In prior cycles, breakouts from comparable structures resulted in rallies ranging from 60% to over 100%, depending on macro conditions and liquidity. The projected 80% upside is not arbitrary. It aligns with previous resistance zones and measured move projections derived from the height of the consolidation range. If TOTAL follows this historical playbook, the altcoin market could experience a broad-based expansion over the coming months.

Macro and On-Chain Factors Supporting the Outlook

Several macro and on-chain factors support the bullish case for TOTAL. Stabilizing interest rates, improving liquidity conditions, and reduced regulatory uncertainty have created a more favorable backdrop for risk assets. At the same time, on-chain data suggests increasing accumulation across select altcoins.

Wallet growth, transaction activity, and declining exchange balances point toward long-term holders positioning ahead of potential upside. These signals, combined with the technical breakout, strengthen the argument that the altcoin market cap may be entering a new expansion phase. However, it is important to recognize that macro shocks or sudden sentiment shifts can still disrupt this trajectory.

5 Crypto Coins Worth Risking if Altcoins Rally

Evaluating Risk in the Altcoin Market

Before examining specific coins, it is essential to define what “worth risking” means in this context. Altcoins inherently carry higher volatility and downside risk compared to Bitcoin. The coins discussed here are not guaranteed winners but represent projects with favorable risk-reward profiles if TOTAL achieves its projected upside. These selections are based on liquidity, ecosystem relevance, development activity, and alignment with prevailing narratives such as scalability, interoperability, and decentralized finance.

Ethereum as the Foundation of Altcoin Momentum

Ethereum often acts as the gateway between Bitcoin dominance and broader altcoin rallies. When Ethereum outperforms Bitcoin, it typically signals the beginning of capital rotation into altcoins.

Ethereum’s role as the backbone of decentralized applications, smart contracts, and layer-two scaling solutions positions it well to benefit from a rising altcoin market cap. Continued improvements in efficiency and network activity can amplify its upside during a TOTAL-driven rally. As a relatively lower-risk altcoin, Ethereum provides exposure to the broader trend while maintaining strong liquidity.

Solana and High-Performance Blockchain Narratives

Solana represents the high-performance blockchain narrative, emphasizing speed, low fees, and scalability. During previous altcoin cycles, platforms offering faster transaction throughput attracted significant developer and user activity. Solana’s ecosystem growth and resilience after past setbacks have restored investor confidence. If TOTAL pushes higher, Solana’s beta to the altcoin market could result in outsized gains relative to larger-cap assets. However, its higher volatility underscores the importance of disciplined position sizing.

Chainlink and the Infrastructure Thesis

Chainlink occupies a unique position as critical infrastructure within the crypto ecosystem. By enabling decentralized oracle networks, it connects smart contracts with real-world data, making it indispensable to many applications. Infrastructure tokens often perform well during sustained altcoin rallies because their value accrues from widespread adoption rather than speculative hype alone. Chainlink’s consistent development and partnerships support its long-term thesis. In an environment where TOTAL trends upward, Chainlink could benefit from renewed interest in utility-driven projects.

Avalanche and Modular Ecosystem Growth

Avalanche has gained attention for its modular approach to blockchain design, allowing customized subnets and scalable deployment. This flexibility aligns with growing demand for application-specific chains.

As developers seek alternatives that balance decentralization and performance, Avalanche’s ecosystem expansion positions it as a strong contender in the altcoin space. If the altcoin market cap continues to rise, Avalanche’s growth narrative could attract fresh capital. Its performance will likely be sensitive to broader market sentiment, making it a higher-risk, higher-reward option.

Emerging Mid-Cap Projects With Strong Fundamentals

Beyond established names, select mid-cap projects with active development and clear use cases may offer exponential upside during an altcoin expansion. These projects often lag initial breakouts but catch up rapidly once momentum builds. Investors considering such opportunities should prioritize transparency, community engagement, and real-world adoption metrics. While risk is higher, the potential rewards during a TOTAL-driven rally can be substantial for disciplined participants.

Risk Management in a Potential Altcoin Rally

Avoiding Overexposure Despite Bullish Signals

Even if the altcoin market cap breaking its downtrend proves to be the start of a larger move, risk management remains essential. Overexposure to volatile assets can quickly erase gains if the market reverses. Allocating capital incrementally and maintaining diversification can help mitigate downside risk. Using TOTAL as a macro guide rather than a timing tool allows investors to stay aligned with broader trends without chasing short-term price spikes. A measured approach increases the likelihood of benefiting from upside while preserving capital.

Monitoring Confirmation and Invalidation Levels

No market thesis is complete without invalidation criteria. If TOTAL fails to hold above key breakout levels, it may signal a false breakout or extended consolidation. Monitoring volume, momentum, and relative performance versus Bitcoin can provide early warning signs. Staying adaptable and responsive to new information is crucial in fast-moving crypto markets. Successful participation in altcoin rallies depends as much on exit strategy as on entry timing.

Broader Implications for the Crypto Market

Capital Rotation and Market Cycles

The altcoin market cap breaking a 90-day downtrend reinforces the cyclical nature of crypto markets. Capital rotation from Bitcoin into altcoins is a recurring pattern driven by risk appetite and profit-seeking behavior.

Understanding this rotation helps investors anticipate shifts rather than react emotionally. TOTAL serves as a valuable lens through which to observe these cycles and adjust strategy accordingly. If the projected 80% upside unfolds, it may mark the beginning of a broader altcoin season rather than a short-lived bounce.

What This Means for Long-Term Investors

For long-term investors, the current setup offers both opportunity and caution. While short-term traders may focus on momentum, longer-term participants should evaluate how individual projects fit into evolving narratives. The altcoin market cap’s behavior provides context, but sustainable returns ultimately depend on fundamentals. Balancing exposure between established platforms and selective growth projects can align portfolios with both stability and upside.

Conclusion

The altcoin market cap breaking its 90-day downtrend represents a potentially pivotal moment for the crypto market. With TOTAL signaling a possible 80% upside move, conditions are aligning for renewed interest and capital inflows into altcoins. While no outcome is guaranteed, historical patterns, technical structure, and improving sentiment suggest that the risk-reward balance may be shifting in favor of cautious optimism. Identifying crypto coins worth risking requires a disciplined approach that combines macro awareness with project-specific analysis. As TOTAL evolves, investors who remain informed, patient, and risk-conscious are best positioned to navigate the opportunities and challenges ahead.

FAQs

Q: What does it mean when the altcoin market cap breaks a 90-day downtrend?

It means that the combined valuation of altcoins has moved above a prolonged bearish structure, signaling a potential shift from selling pressure to accumulation and increasing the likelihood of a broader altcoin rally.

Q: Why is TOTAL important for analyzing altcoin market trends?

TOTAL aggregates the value of all cryptocurrencies excluding Bitcoin, making it a key indicator of overall altcoin health and investor risk appetite across the crypto market.

Q: Is an 80% upside move for TOTAL realistic?

An 80% upside is based on historical breakout patterns and measured move projections. While realistic under favorable conditions, it depends on sustained momentum, liquidity, and supportive macro factors.

Q: Are altcoins safe investments during this phase?

Altcoins carry higher risk and volatility compared to Bitcoin. While the current setup may offer opportunities, investors should manage risk carefully and avoid overexposure.

Q: How should investors approach altcoins if TOTAL continues to rise?

Investors should focus on projects with strong fundamentals, maintain diversification, monitor market confirmation signals, and have clear exit strategies to navigate potential volatility effectively.