8% APR, 20% APY, 200% “estimated yield,” or even four-digit rates on new liquidity pools. It’s tempting to compare those figures at face value and chase the biggest number. But when it comes to DeFi APR vs APY Understand, the number you see is only half the story—and sometimes it’s not even the same type of number.

APR and APY are both ways to describe returns, but they behave differently. APR is typically the simple annualized rate without compounding. APY accounts for compounding, meaning your earnings generate additional earnings over time. In DeFi, that difference matters even more than in traditional finance because compounding can happen automatically, continuously, or only if you manually claim and reinvest rewards. On top of that, DeFi yield can include multiple reward streams: interest from borrowers, trading fees from liquidity pools, and token incentives that fluctuate wildly.

This is why understanding DeFi APR vs APY isn’t just a glossary exercise—it’s a practical skill. It helps you compare opportunities more honestly, estimate realistic outcomes, and avoid common traps like confusing short-term incentive spikes for sustainable yield. In this guide, you’ll learn how APR and APY work in DeFi, what platforms usually mean when they display those rates, and how to interpret staking rewards, lending interest, and liquidity pool returns with clarity. Along the way, you’ll see key LSI keywords and related phrases—like compound interest, yield farming, crypto interest rates, and liquidity mining—so the concepts stick in real-world contexts.

What APR Means in DeFi

APR stands for Annual Percentage Rate. In the simplest terms, APR is the annualized return you’d earn if the rate stayed the same for a full year and you did not compound the earnings. In many DeFi protocols, APR is presented as a straightforward “per-year” rate calculated from current conditions, such as borrower demand or reward emissions.

In practice, DeFi APR vs APY Understand comparisons start here: APR is usually the baseline. If a lending protocol displays a 10% APR on a stablecoin market, it generally implies that, over a year, you’d earn about 10% of your deposit as interest, assuming the rate remained unchanged and you didn’t reinvest earnings. That assumption is important because DeFi rates often change block by block depending on utilization, demand, and incentives.

Another reason APR is common is that it’s easier for protocols to calculate as a snapshot. Many platforms can compute a “current” APR from the last few blocks or the last 24 hours of activity. But that convenience can also make APR misleading when market conditions are unstable, token emissions change, or a pool is brand new and experiencing early hype.

What APY Means in DeFi

APY stands for Annual Percentage Yield. APY represents the annualized return including the effect of compounding—meaning your earned rewards are added to your principal, and future rewards are calculated on the larger amount. When you see APY in DeFi, it’s usually an estimate based on a compounding frequency assumption, such as daily, weekly, or per block.

This is where DeFi APR vs APY becomes more than a minor technicality. With APY, compounding can meaningfully increase your end-of-year outcome, especially if the yield is high and compounding is frequent. For example, a 20% APR compounded daily produces a higher APY than 20%. DeFi interfaces sometimes present APY to highlight this “boost,” but it’s crucial to know whether compounding is automatic or requires action.

Many staking vaults and auto-compounding strategies—especially in yield aggregators—aim to turn a simple APR stream into a higher APY by automatically harvesting and reinvesting rewards. That’s why APY is closely associated with auto-compounding vaults, yield optimization, and compound interest in crypto. However, APY is still an estimate. If reward rates fall, token prices drop, or gas costs eat into compounding, the realized yield may be lower than the displayed APY.

DeFi APR vs APY: The Core Difference

At the heart of DeFi APR vs APY is compounding. APR assumes no compounding; APY includes compounding. That’s the clean definition. But DeFi adds a twist: whether compounding is real depends on how the protocol distributes rewards and whether you reinvest them.

If a lending protocol accrues interest directly into your balance every block, you’re effectively compounding (even if the platform labels it APR). If a staking protocol requires you to claim rewards separately, you’re not compounding unless you claim and restake. If a yield farm pays rewards in a volatile token, compounding may expose you to additional price risk—especially when reinvesting requires swapping, adding liquidity, or paying transaction fees.

So the real takeaway is this: DeFi APR vs APY is not only about math. It’s about the mechanism of rewards. Two pools might advertise the same rate, but the experience can be very different depending on whether earnings are automatically added, whether you can reinvest easily, and whether doing so is cost-effective.

How DeFi Platforms Calculate APR and APY

DeFi protocols often calculate APR and APY using recent data—sometimes the last block, the last hour, or the last day. That means rates are frequently a snapshot rather than a promise. For lending markets, the rate often depends on utilization: if many users borrow, interest rises; if liquidity is abundant, rates fall. For liquidity pools, APR/APY may include estimated trading fees plus token incentives, both of which can change rapidly.

A common complication is that platforms may combine multiple return sources into one displayed figure. For instance, a pool might show “30% APY,” but that number could include fee income, governance token emissions, and sometimes external bribes or incentive campaigns. In DeFi APR vs APY analysis, it helps to separate what is sustainable (like organic trading fees) from what is temporary (like short-term liquidity mining rewards).

Another subtle issue is token price assumptions. Incentive APY often assumes the reward token keeps its current value. If the reward token drops 50%, your realized return—measured in USD—could be far lower. This is one of the biggest reasons displayed crypto interest rates can differ from what you actually earn.

Compounding in DeFi: Automatic vs Manual

Compounding is the engine behind APY, but DeFi compounding comes in two flavors: automatic and manual. Automatic compounding occurs when the protocol or strategy reinvests earnings for you, increasing your position without requiring transactions. Manual compounding requires you to claim rewards and redeposit or restake them yourself.

This matters because compounding in DeFi can be limited by costs and friction. On networks with high fees, manual compounding too frequently can reduce returns. Even on low-fee chains, swapping rewards back into the principal asset introduces slippage and potential price impact, especially in smaller pools. In a strict DeFi APR vs APY comparison, an attractive APY assumes compoundingARE: the compounding actually happens as frequently as the formula assumes. If you compound less often, your realized APY will drift closer to APR.

Yield aggregators and auto-compounding vaults exist specifically to solve this problem. They batch transactions, harvest rewards strategically, and reduce the overhead for users. Still, you should understand that APY isn’t magic—it’s the result of a compounding schedule that must be executed in the real world.

APR and APY in DeFi Lending Markets

In DeFi lending, APR is often displayed for both suppliers (lenders) and borrowers. The supplier APR represents the interest you earn for providing liquidity, while the borrower APR represents what you pay to borrow. Some protocols also distribute incentive tokens to suppliers and borrowers, which can boost the apparent yield.

In the context of DeFi APR vs APY, lending can be tricky because interest may accrue continuously. If your supply balance increases automatically as interest accumulates, your return behaves more like a compounding yield even if the interface says “APR.” On the other hand, if incentive rewards are separate tokens that you must claim, those rewards only compound if you reinvest them.

Also, lending APRs are often variable. A stablecoin market might show 12% APR today and 4% next week depending on borrowing demand. That variability means the “annual” rate is a projection based on current conditions. When comparing platforms, the most honest approach is to look at average rates over time and understand what portion of the yield comes from organic borrowing interest versus incentives.

APR and APY in DeFi Staking

Staking returns are often expressed as APY, especially in proof-of-stake ecosystems or liquid staking protocols. However, the details vary widely. Some staking systems automatically restake rewards, creating a compounding effect. Others distribute rewards periodically, requiring you to restake manually.

This is where DeFi APR vs APY becomes a practical decision. If a protocol shows a high staking APY but rewards are paid in a token that you don’t want to accumulate, compounding might not be desirable. You might prefer to claim and diversify rather than reinvest into the same asset. Conversely, if you’re long-term bullish on the token and staking is automatic, APY can give a more realistic picture of the long-term growth of your position.

Liquid staking adds another layer. With liquid staking tokens, you may earn staking yield while also using the token in other DeFi strategies, potentially stacking returns. That can create complex “effective APY” outcomes that depend on smart contract risk, market liquidity, and the stability of peg mechanisms.

APR and APY in Liquidity Pools and Yield Farming

Liquidity pools frequently advertise eye-popping yields, and this is where many newcomers get burned. A pool might display a huge APY, but that number can be inflated by temporary incentives and doesn’t account for impermanent loss, which can reduce or negate gains.

In DeFi APR vs APY terms, liquidity pool yield often combines trading fees (which depend on volume and volatility) with token incentives (which depend on emissions and token price). Trading fees can be relatively sustainable if a pool has consistent volume. Incentive rewards, often tied to liquidity mining or yield farming, can shrink quickly when emissions decrease or when more liquidity enters the pool and dilutes rewards.

APY calculations can also assume reinvestment of rewards into the pool. In a farm paying governance tokens, compounding might require harvesting, swapping, and adding liquidity—each step introducing fees and execution risk. That’s why it’s smart to treat high farm APYs as short-lived estimates and evaluate whether the underlying pool makes sense even without incentives.

Understanding Impermanent Loss in APR vs APY Comparisons

Impermanent loss is one of the biggest missing pieces in many yield displays. It’s not directly part of APR or APY, but it affects your net return. You can earn a strong APY in a liquidity pool and still underperform simply holding the assets if price moves significantly.

When evaluating DeFi APR vs APY, you should think in terms of net yield: the combination of fee income, incentives, and price effects. If a volatile token doubles or halves relative to the paired asset, your pool position changes composition, and your final value may be lower than expected. High APY can offset impermanent loss in some conditions, but not always.

A more realistic approach is to consider whether the yield is high because the pool is risky. Sometimes protocols offer higher incentives precisely because liquidity is needed to stabilize markets or bootstrap activity. In those cases, yield is the price paid for risk.

Token Incentives, Emissions, and “Real” Yield

DeFi yields often look attractive because incentives are paid in additional tokens. But those token emissions are not free value; they’re distribution mechanisms that can create sell pressure. If rewards are paid in a token that trends downward, the displayed APY may not translate into real gains in USD terms.

This is a core lesson of DeFi APR vs APY: the rate is not the return unless the reward token holds value. Some platforms try to show “base APY” and “reward APY” separately. When available, that breakdown is extremely helpful because it tells you how much yield is coming from true economic activity—like interest paid by borrowers or trading fees—versus incentives. If you want a more conservative estimate, focus on the portion of yield that would exist even if token rewards disappeared. Then treat the incentive portion as a bonus that can help early, but may not last.

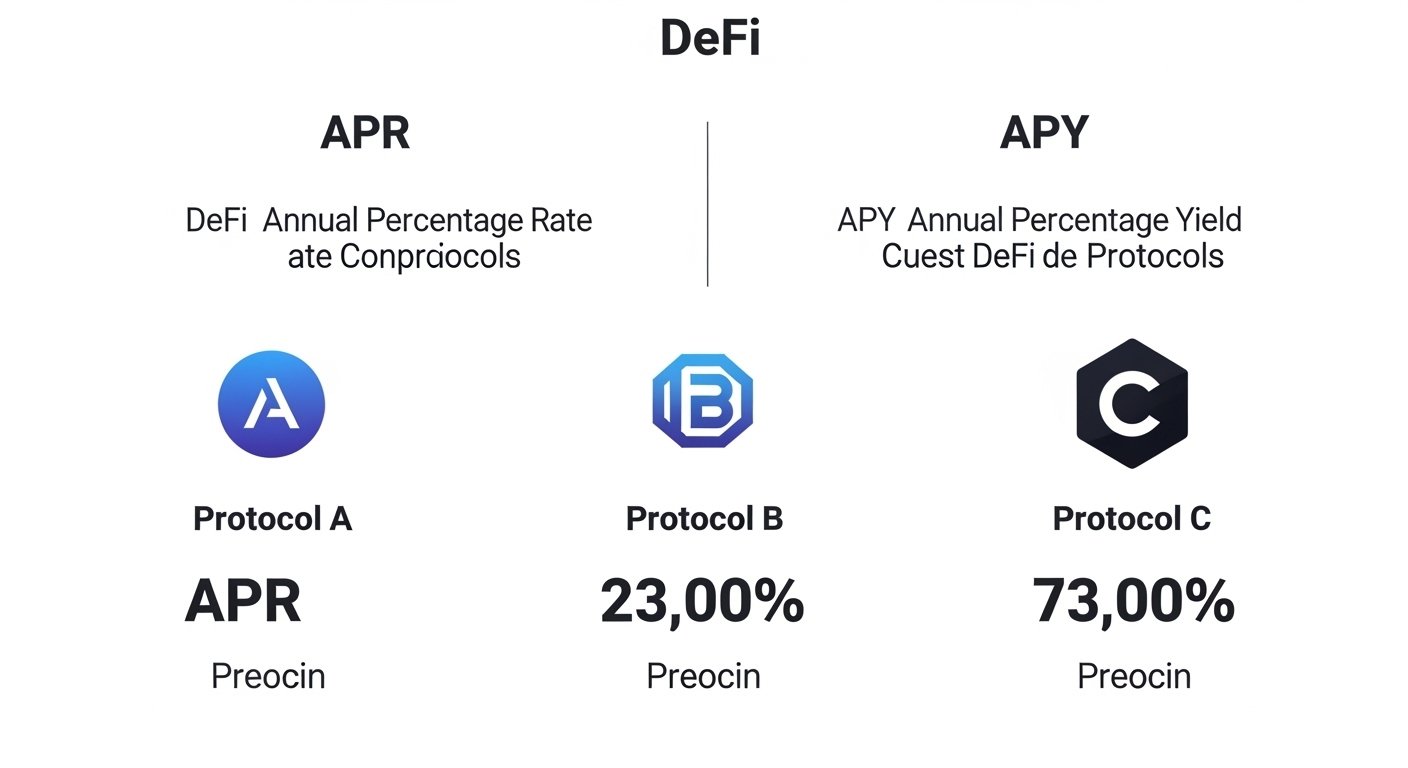

How to Compare DeFi APR vs APY Across Protocols

Comparing yields across protocols is harder than it looks because different platforms use different assumptions. One protocol’s APR may reflect only base interest, while another includes incentives. One protocol’s APY may assume daily compounding, while another assumes continuous compounding. Some include fees, others do not.

The best way to compare DeFi APR vs APY is to standardize your viewpoint. First, identify the yield sources: interest, fees, incentives. Second, determine whether the yield compounds automatically or requires manual reinvestment. Third, consider costs such as gas, slippage, and withdrawal fees. Finally, evaluate risks: smart contract exposure, stablecoin depegs, token price volatility, and liquidity conditions. In other words, don’t compare numbers alone. Compare systems. Two similar-looking APYs can lead to very different outcomes depending on mechanics and risk.

Common Mistakes People Make With APR and APY in DeFi

One common mistake is assuming APY is guaranteed. In DeFi, rates fluctuate, incentives change, and market conditions evolve. APY is usually an estimate based on current yield and a compounding assumption, not a fixed promise. Another mistake is ignoring compounding feasibility. In a manual system, compounding might require frequent transactions. If gas is expensive or rewards are small, the effective yield can drop below the advertised APY. This can make DeFi APR vs APY comparisons misleading if you don’t account for real execution.

A third mistake is overlooking token price risk. If rewards are paid in a volatile token, your return depends on what that token does. A “50% APY” in a reward token that loses 60% in value is not a win. Finally, many users ignore impermanent loss in liquidity pools, focusing only on displayed APY while missing the biggest driver of net performance.

Risk Factors That Matter More Than the Headline Rate

In DeFi, a high rate often signals high risk. Smart contract vulnerabilities, oracle failures, governance attacks, bridge risks, and liquidity crunches can all turn an attractive yield into a painful loss. Stablecoin yields can also hide depeg risk, where the principal itself becomes unstable.

This is why DeFi APR vs APY should never be evaluated in isolation. A lower yield on a battle-tested protocol may be more valuable than a higher yield on an untested farm. Similarly, a stable yield from organic activity can be more reliable than a high incentive yield designed to bootstrap liquidity. Ultimately, understanding the difference between APR and APY helps you interpret the numbers, but managing risk is what protects your capital.

Conclusion

DeFi APR vs APY comes down to compounding, but in decentralized finance, compounding is a real-world process shaped by reward mechanics, transaction costs, token volatility, and platform assumptions. APR usually represents a simple annualized rate without compounding, while APY reflects compounded returns based on a specific compounding frequency. In DeFi, the same yield stream can behave like APR or APY depending on whether rewards are automatically reinvested or require manual action.

To make smarter decisions, look beyond the headline number. Understand where the yield comes from, whether it compounds in practice, what it costs to harvest and reinvest, and how risks like impermanent loss or reward token inflation can affect net returns. When you can read these rates clearly, you stop chasing hype and start selecting strategies that align with your goals, time horizon, and risk tolerance.

FAQs

Q: Is APY always better than APR in DeFi?

Not necessarily. APY can look better because it assumes compounding, but if you can’t compound efficiently due to fees, or if rewards are volatile, your realized return may be closer to APR or even lower.

Q: Why do DeFi platforms show different APR vs APY for the same asset?

Platforms use different assumptions and may include different yield sources. One may show only base interest, while another includes incentives or assumes a specific compounding frequency.

Q: How can I estimate my real return from a DeFi APY?

Treat APY as a projection. Consider whether compounding is automatic, how often rewards are harvested, what gas and slippage costs are, and whether reward tokens might change in value over time.

Q: Does lending in DeFi compound automatically?

Sometimes. If interest accrues directly into your supplied balance, it effectively compounds. If rewards are separate incentive tokens, they only compound if you reinvest them.

Q: Can a liquidity pool APY be high but still unprofitable?

Yes. Impermanent loss, reward token price drops, and changing trading volume can reduce or erase gains. A high displayed APY doesn’t guarantee a positive net return.

See More: Bitcoin price prediction BTC range before breakout