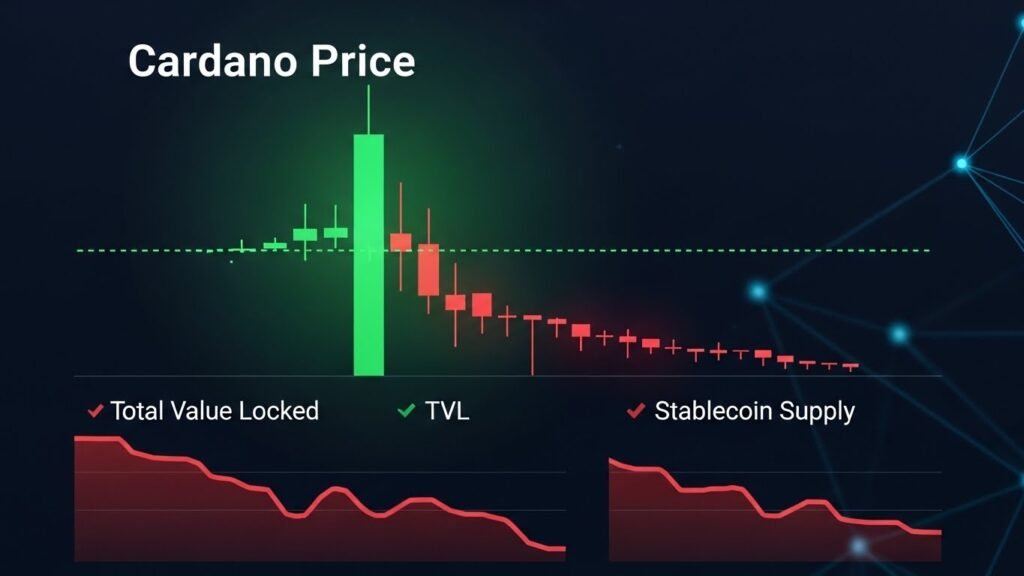

Cardano price has once again captured market attention as it flashes a bullish reversal signal at a time when several key on-chain indicators appear to be weakening. The apparent contradiction between improving price structure and declining network metrics such as total value locked and stablecoin supply has sparked debate among traders and long-term investors alike. Understanding how these signals interact is essential for accurately assessing Cardano’s near-term and medium-term outlook.

In the broader crypto market, price action often leads fundamentals during transitional phases. When sentiment shifts from bearish to cautiously optimistic, assets can begin forming higher lows and reversal patterns even before on-chain data confirms renewed growth. This dynamic is particularly relevant for Cardano, a blockchain known for its methodical development cycle and slower-moving ecosystem metrics. As the Cardano price flashes bullish reversal signals, the market is attempting to determine whether this move reflects genuine accumulation or merely a temporary technical bounce.

This article explores why Cardano price is showing signs of reversal while TVL decline, stablecoin supply contraction, and broader on-chain metrics suggest reduced activity. By examining technical structure, network fundamentals, and market psychology, this analysis provides a balanced view of where ADA may be headed next and what investors should watch closely.

Cardano Price Action and Emerging Reversal Signals

Understanding the Bullish Reversal Setup

A bullish reversal signal typically emerges after a prolonged downtrend or consolidation phase, indicating that selling pressure is weakening and buyers are beginning to regain control. In Cardano’s case, recent price behavior suggests the formation of higher lows and improving momentum indicators. These patterns often appear before a sustained trend change, especially when market sentiment begins to stabilize.

Cardano price flashing a bullish reversal does not necessarily imply an immediate rally. Instead, it signals a shift in market structure where downside risk diminishes and upside potential increases. Traders closely monitor volume behavior, momentum oscillators, and key support zones to confirm whether this reversal has strength behind it.

Technical Context Within the Broader Market

Cardano does not trade in isolation. Its price action is heavily influenced by overall crypto market conditions, particularly Bitcoin and Ethereum trends. When the broader market shows signs of stabilization or recovery, altcoins like ADA often follow with delayed but amplified reactions.

The current technical setup suggests that Cardano price is attempting to decouple slightly from its previous bearish bias. This shift is occurring despite softer on-chain data, highlighting the importance of understanding how price can sometimes move ahead of fundamentals during transitional market phases.

TVL Decline and What It Means for Cardano

Interpreting Total Value Locked Trends

Total value locked is a widely used metric to measure the amount of capital committed to decentralized finance protocols on a blockchain. A declining TVL often signals reduced user engagement, lower capital inflows, or profit-taking within the ecosystem. For Cardano, the drop in TVL has raised concerns about the health of its decentralized finance sector.

However, TVL should not be viewed in isolation. Broader market conditions, risk appetite, and cross-chain liquidity movements all influence this metric. During periods of uncertainty, capital often migrates toward perceived safer assets or exits DeFi altogether, impacting TVL across multiple networks simultaneously.

Why TVL Can Lag Price Action

One important aspect of crypto markets is that price often leads on-chain data. When Cardano price flashes bullish reversal signals, it may reflect early positioning by traders anticipating future growth rather than current network usage. In such cases, TVL may stabilize or recover only after price confidence returns and new capital re-enters the ecosystem.

This lag effect means that a temporary TVL decline does not necessarily invalidate a bullish price setup. Instead, it highlights the transitional nature of the market, where sentiment and expectations begin shifting before measurable on-chain recovery occurs.

Stablecoin Supply Drop and Network Liquidity

The Role of Stablecoins in Cardano’s Ecosystem

Stablecoins play a critical role in providing liquidity and facilitating trading, lending, and payments within a blockchain ecosystem. A declining stablecoin supply on Cardano suggests reduced transactional activity or capital migration to other networks. This trend has added to concerns about short-term network engagement. From a liquidity perspective, stablecoin supply often reflects user confidence and willingness to deploy capital. When users withdraw or reduce stablecoin holdings, it can temporarily dampen activity across decentralized applications.

Contextualizing the Stablecoin Contraction

While the stablecoin supply drop may appear bearish at first glance, it must be contextualized within broader market behavior. During uncertain periods, stablecoin flows can shift rapidly between chains as users seek yield, safety, or arbitrage opportunities. This does not always indicate a long-term loss of confidence in the underlying blockchain.

If Cardano price continues to flash bullish reversal signals, renewed interest could eventually lead to stablecoin inflows as traders position for potential upside. In this sense, price recovery may act as a catalyst for restoring network liquidity rather than the other way around.

On-Chain Metrics Versus Market Sentiment

Divergence Between Price and Network Data

Divergences between price action and on-chain metrics are not uncommon in crypto markets. In Cardano’s case, improving price structure contrasts with declining TVL and stablecoin supply, creating a mixed signal environment. Such divergences often occur near market turning points, where sentiment begins shifting before fundamentals catch up. Market participants should recognize that on-chain metrics are backward-looking to some extent. They measure what has already happened rather than what investors expect to happen next. As expectations change, price often responds first.

Investor Psychology and Accumulation Phases

During accumulation phases, informed participants may quietly build positions while broader sentiment remains cautious. This behavior can lead to bullish reversal signals on price charts even as network metrics appear subdued. Over time, if price strength persists, it can attract additional participants, eventually reflecting in improved on-chain data.

Understanding this psychological aspect helps explain why Cardano price flashing a bullish reversal signal does not necessarily conflict with short-term declines in TVL or stablecoin supply. Instead, it may indicate the early stages of a sentiment shift.

Cardano’s Development Narrative and Long-Term Outlook

Ongoing Ecosystem Development

Cardano’s development approach has always emphasized research-driven upgrades and long-term scalability. While this methodical pace can result in slower short-term growth metrics, it also provides a foundation for sustainable expansion. Network upgrades, governance improvements, and developer tooling continue to progress, even during periods of reduced activity. For long-term investors, these developments matter more than short-term fluctuations in TVL or stablecoin supply. If Cardano’s infrastructure continues to mature, the network may be well-positioned to capture renewed interest during the next growth cycle.

Adoption Cycles and Market Timing

Blockchain adoption often occurs in waves rather than steady linear growth. Periods of consolidation and declining metrics are frequently followed by renewed expansion when market conditions improve. Cardano’s current situation may represent a pause rather than a reversal of its long-term trajectory. If the bullish reversal signal in Cardano price proves sustainable, it could mark the beginning of a new adoption phase where on-chain metrics gradually recover alongside rising market confidence.

Technical Levels and What Traders Are Watching

Key Support and Resistance Zones

Technical traders pay close attention to support and resistance levels when evaluating reversal signals. For Cardano, maintaining price above recently established support zones is critical for confirming bullish intent. A failure to hold these levels could invalidate the reversal setup and reintroduce downside risk. Resistance levels, on the other hand, represent areas where selling pressure may re-emerge. A decisive break above these zones would strengthen the bullish case and potentially attract momentum-driven participants.

Volume and Momentum Confirmation

Volume plays a crucial role in validating any reversal signal. Increasing volume during upward price movement suggests genuine demand rather than a low-liquidity bounce. Momentum indicators, when aligned with price structure, further support the case for a sustained trend shift. As Cardano price continues to flash bullish reversal signals, traders will watch for consistent volume expansion and follow-through to confirm that the move has depth and durability.

Broader Market Conditions and External Influences

Influence of Bitcoin and Macro Sentiment

Cardano’s price trajectory remains closely tied to broader market sentiment, particularly Bitcoin’s performance. If the overall crypto market stabilizes or trends higher, altcoins like ADA are more likely to see sustained recoveries. Conversely, renewed macroeconomic uncertainty or market-wide sell-offs could limit upside potential. Understanding these external influences is essential when evaluating Cardano’s reversal signal. Even strong technical setups can fail if broader conditions deteriorate.

Risk Management in a Mixed-Signal Environment

Given the conflicting signals between price and on-chain metrics, risk management becomes especially important. Investors should consider position sizing, time horizon, and tolerance for volatility. A cautious approach allows participation in potential upside while mitigating downside risk if the reversal fails. This balanced mindset is particularly relevant in transitional markets where clarity emerges gradually rather than immediately.

Conclusion

Cardano price flashing a bullish reversal signal while TVL and stablecoin supply drop presents a complex but not uncommon market scenario. Price action suggests that selling pressure may be easing and early accumulation could be underway, even as on-chain metrics reflect reduced activity and liquidity. This divergence highlights the forward-looking nature of markets, where expectations often shift before fundamentals visibly improve.

While the decline in TVL and stablecoin supply warrants caution, it does not automatically negate the bullish technical setup. Instead, it underscores the importance of viewing Cardano’s market behavior through a multi-dimensional lens that considers price structure, network development, and broader market conditions. As always, sustained confirmation will depend on follow-through, improving sentiment, and eventual recovery in on-chain metrics. Until then, Cardano remains at a pivotal point where patience and informed analysis are key.

FAQs

Q: Why is Cardano price flashing a bullish reversal signal despite falling TVL?

Cardano price can show bullish reversal signals even when TVL declines because price often leads fundamentals in transitional market phases. Traders may begin accumulating ADA based on expectations of future growth, causing price structure to improve before on-chain metrics reflect renewed activity. TVL typically responds later once confidence and capital inflows return.

Q: How important is stablecoin supply for Cardano’s price outlook?

Stablecoin supply is an important indicator of liquidity and network usage, but it is not the sole driver of price. A temporary drop in stablecoin supply may reflect broader market caution rather than a loss of long-term confidence in Cardano. If price momentum strengthens, stablecoin inflows can resume as traders re-engage with the ecosystem.

Q: Can Cardano sustain a rally without immediate improvement in on-chain metrics?

It is possible for Cardano to sustain a short- to medium-term rally without immediate improvement in on-chain metrics, especially if broader market sentiment turns positive. However, for long-term sustainability, price strength is usually accompanied by gradual recovery in metrics such as TVL, stablecoin supply, and active addresses.

Q: What risks should investors consider when trading a bullish reversal signal?

Investors should be aware that bullish reversal signals can fail, particularly in uncertain market environments. Risks include false breakouts, low volume moves, and broader market downturns. Proper risk management, including cautious position sizing and clear invalidation levels, is essential when trading such setups.

Q: How does Cardano’s long-term development affect its current price behavior?

Cardano’s long-term development provides a foundation that can support future adoption and value growth. While this does not guarantee short-term price appreciation, it helps explain why investors may be willing to accumulate during periods of weak on-chain metrics. Over time, successful development milestones can translate into renewed network activity and stronger price performance.