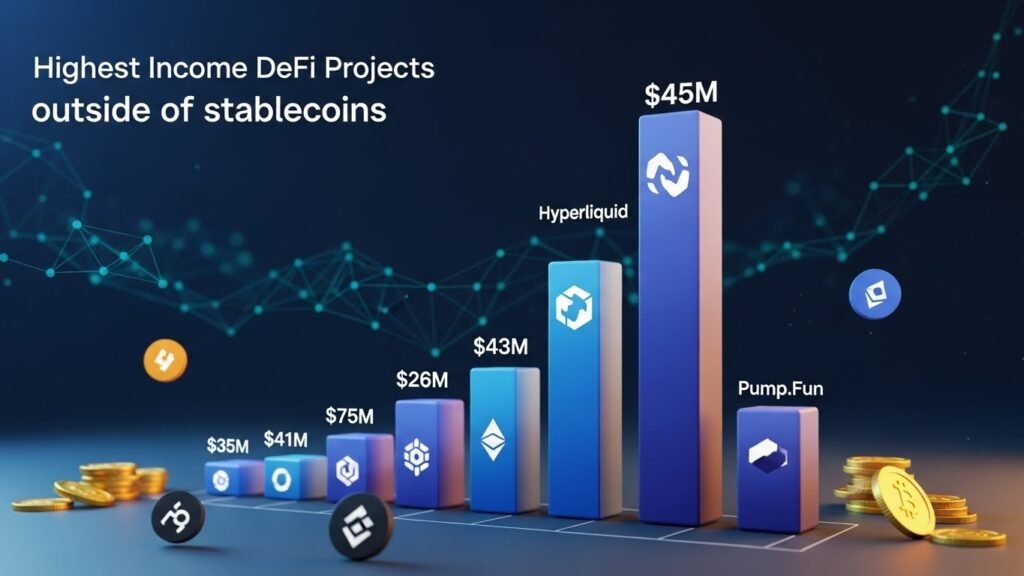

Decentralized finance (DeFi) continues to evolve beyond its initial focus on stablecoins, giving rise to high-income projects that attract both retail and institutional investors. Among these, Hyperliquid and pump.fun have emerged as standout performers, generating significant returns without relying solely on stablecoin-backed yields. The growing prominence of these platforms underscores a broader trend in DeFi: innovative protocols leveraging tokenomics, liquidity incentives, and community engagement to produce high yields while maintaining decentralized governance.

While stablecoins historically dominated DeFi yield opportunities due to their perceived stability, projects like Hyperliquid and pump.fun demonstrate that non-stablecoin ecosystems can offer compelling income streams. Their strategies combine liquidity mining, staking, algorithmic incentives, and gamified participation to enhance returns while maintaining protocol sustainability. Understanding these mechanisms is critical for investors seeking to diversify beyond traditional stablecoin-focused strategies.

This article explores the rise of Hyperliquid and pump.fun, examining how these projects generate high income, their underlying mechanisms, and their place in the broader DeFi ecosystem. By analyzing yield structures, risk considerations, and market positioning, we can better understand why these platforms are attracting attention and reshaping the non-stablecoin DeFi landscape.

The Evolution of DeFi Beyond Stablecoins

From Stablecoin Dominance to Diverse Yield Opportunities

DeFi initially centered on stablecoins such as USDT, USDC, and DAI, which offered predictable returns in lending, borrowing, and liquidity provision. While stablecoins provided low volatility, the income potential was often limited by market saturation and declining interest rates. As a result, the DeFi landscape has increasingly shifted toward projects offering high yields through non-stablecoin assets.

Hyperliquid and pump.fun exemplify this shift, creating opportunities in volatile token environments without compromising potential returns. By leveraging unique tokenomics and liquidity incentives, these protocols have carved out niches that challenge the traditional stablecoin-centric model.

The Rise of Non-Stablecoin High-Yield Projects

The emergence of high-income DeFi projects outside stablecoins reflects investor appetite for risk-adjusted returns and innovation. These projects typically offer variable yields, often dependent on platform activity, token supply schedules, and governance participation. Non-stablecoin protocols incentivize engagement and liquidity provision through mechanisms that reward active users, fostering vibrant, self-sustaining ecosystems.

Hyperliquid and pump.fun have leveraged these principles, achieving high yields that rival or exceed traditional stablecoin offerings. Their success demonstrates that DeFi can sustain income generation while embracing more complex and dynamic token models.

Hyperliquid: Driving High-Yield DeFi Engagement

Understanding Hyperliquid’s Yield Mechanisms

Hyperliquid generates income through a combination of liquidity mining, staking incentives, and dynamic token allocation. By rewarding users for providing liquidity and participating in governance, the platform encourages consistent engagement while redistributing income in a sustainable manner.

The project’s algorithmic design adjusts yield rates based on liquidity depth and market activity, creating a balance between reward distribution and protocol health. Users who stake or contribute to the liquidity pool benefit from compounding incentives, making Hyperliquid an attractive option for long-term DeFi participants.

Community and Governance as Yield Catalysts

Hyperliquid’s high-income model relies heavily on community participation. Governance token holders influence protocol parameters, including reward allocation, risk management, and development priorities. This decentralized structure aligns incentives between the platform and its users, ensuring that high yields are sustainable and responsive to market conditions.

Community-driven decisions, such as adjusting token emission schedules or modifying staking requirements, directly impact income generation. The integration of governance into yield mechanics underscores Hyperliquid’s approach to decentralized profitability.

Risk Management in Hyperliquid

While Hyperliquid offers high returns, it incorporates mechanisms to mitigate risk. Dynamic yield adjustment, liquidity monitoring, and smart contract audits aim to protect user capital and maintain protocol stability. By combining high income with risk-aware design, Hyperliquid represents a compelling model for non-stablecoin DeFi engagement.

Pump.fun: Gamified DeFi Income Outside Stablecoins

Innovative Tokenomics and Incentive Design

Pump.fun distinguishes itself through gamified mechanisms and algorithmic token distribution. Users earn rewards not only by staking or providing liquidity but also through engagement with protocol-driven events and challenges. This interactive model enhances participation while diversifying income sources.

The tokenomics design ensures that rewards are distributed proportionally to contribution, activity, and retention, creating a dynamic environment where yield is directly tied to user engagement. This contrasts with traditional passive income models, introducing a performance-oriented dimension to DeFi income generation.

Gamification and Community Participation

Pump.fun’s gamification features incentivize repeated engagement and network growth. By incorporating competitive elements, leaderboard structures, and time-sensitive challenges, the platform encourages users to actively participate rather than passively hold assets. This engagement translates into consistent yield distribution, enhancing overall income potential. Community-driven strategies also influence protocol updates and reward structures, ensuring that the platform adapts to market behavior while maintaining high-income opportunities for active participants.

Sustainability and Risk Considerations

Pump.fun addresses sustainability through algorithmic controls that prevent excessive token inflation. Reward schedules, participation caps, and liquidity management measures aim to balance high yields with long-term protocol viability. Users benefit from attractive returns while the platform mitigates risks associated with volatility and over-leveraging.

Comparative Insights: Hyperliquid vs. Pump.fun

Yield Profiles and Investment Strategies

Both Hyperliquid and pump.fun offer high-income potential outside stablecoins, but their approaches differ. Hyperliquid emphasizes liquidity depth and governance participation, providing steady, performance-driven returns. Pump.fun focuses on gamified engagement, creating dynamic income streams through interactive participation and algorithmic incentives.

Investors can select between these models depending on risk tolerance, desired engagement level, and portfolio diversification goals. Each platform offers unique advantages while maintaining robust protocols designed for long-term sustainability.

Community Engagement and Ecosystem Growth

Community engagement is central to both platforms. Hyperliquid leverages governance participation, while pump.fun incorporates gamification and interactive challenges. These strategies not only enhance yield generation but also contribute to ecosystem growth, network effects, and user retention. The success of these platforms illustrates that non-stablecoin DeFi income is closely linked to active participation and collective decision-making, reinforcing the value of decentralized, community-driven models.

Risk Mitigation and Protocol Resilience

Risk management remains a critical differentiator. Hyperliquid’s dynamic yield and liquidity monitoring complement pump.fun’s algorithmic inflation control and participation caps. Both protocols prioritize sustainable income, ensuring that high returns are not achieved at the expense of long-term viability. This balance between high yield and risk awareness is essential for attracting institutional and retail participants in a non-stablecoin context.

Broader Implications for the DeFi Ecosystem

Diversification Beyond Stablecoins

The success of Hyperliquid and pump.fun highlights a broader trend: diversification beyond stablecoins is increasingly viable in DeFi. Investors seeking higher returns now have options that combine tokenomics innovation, community engagement, and active participation to generate income without relying on fiat-pegged assets. This trend encourages experimentation and supports a more resilient, diverse DeFi ecosystem capable of attracting a wider range of participants.

Lessons for Future High-Income DeFi Projects

These platforms provide key lessons for emerging DeFi projects. Sustainable high yields require a combination of transparent tokenomics, active community engagement, and robust risk management. By integrating these elements, new projects can replicate or build upon the success of Hyperliquid and pump.fun, fostering innovation while maintaining stability.

Conclusion

Hyperliquid and pump.fun exemplify the evolution of DeFi beyond stablecoins, demonstrating that high-income opportunities can be achieved through innovative tokenomics, liquidity incentives, and gamified participation. Both projects balance yield generation with risk mitigation, community engagement, and protocol sustainability, offering investors compelling alternatives to traditional stablecoin-focused strategies. Their success signals a maturation in the DeFi landscape, where active participation, governance, and dynamic reward structures play a critical role in income generation. As these models gain traction, the broader DeFi ecosystem stands to benefit from diversified, sustainable, and high-performing non-stablecoin projects.

FAQs

Q: How do Hyperliquid and pump.fun generate high income outside stablecoins?

Hyperliquid uses liquidity mining, staking incentives, and governance participation to distribute rewards, while pump.fun employs gamified engagement and algorithmic token distribution. Both models provide dynamic, high-yield opportunities beyond fiat-pegged assets.

Q: Are these high-income DeFi projects risky compared to stablecoin yields?

Yes, non-stablecoin yields typically carry higher volatility and risk. Both Hyperliquid and pump.fun implement risk mitigation measures such as dynamic yield adjustments, liquidity monitoring, and algorithmic controls to balance returns with sustainability.

Q: Can retail investors participate in these platforms?

Both Hyperliquid and pump.fun are designed for public participation, allowing retail investors to stake, provide liquidity, and engage with gamified or governance mechanisms. Active involvement often enhances yield potential and strengthens ecosystem engagement.

Q: How do governance and community participation affect income generation?

In Hyperliquid, governance token holders influence reward allocation and protocol parameters, directly impacting yields. Pump.fun’s gamified system encourages engagement, with rewards tied to activity, retention, and performance, reinforcing the link between participation and income.

Q: What does the success of these projects mean for the broader DeFi ecosystem?

Their success demonstrates that non-stablecoin high-income DeFi opportunities are viable, encouraging diversification and innovation. Sustainable yield structures, community engagement, and risk-aware design provide a blueprint for future projects seeking to expand DeFi beyond traditional stablecoin frameworks.