Litecoin meme coin news discussions have increasingly highlighted the emerging presale of Solargy, a cryptocurrency project that has captured the attention of early investors and the wider crypto community. Solargy’s presale has been positioned as a high-potential opportunity, with projections of 50-100x gains for those who participate at the earliest stages. Meme coins, particularly those related to established brands like Litecoin, continue to drive market sentiment, social media engagement, and speculative trading activity. This environment creates fertile ground for new projects like Solargy to emerge, offering both technological innovation and community-driven momentum.

Solargy differentiates itself by combining structured tokenomics, blockchain scalability, and interactive community incentives. This positions the presale as more than just a speculative venture; it is a calculated attempt to create a sustainable and high-growth cryptocurrency. As Litecoin meme coin enthusiasts explore new investment avenues, Solargy represents a convergence of innovation, market excitement, and early-stage opportunity, appealing to both seasoned investors and retail participants seeking substantial upside potential. This article delves into the intricacies of Solargy’s presale, the role of community engagement, market dynamics, and the factors contributing to the Litecoin meme coin 50-100x gains.

The Rise of Litecoin Meme Coin Discussions

Litecoin meme coins have carved out a unique niche in the cryptocurrency landscape, blending recognizable branding with speculative appeal. Discussions in online forums and social media channels frequently focus on price movements, token utility, and potential growth opportunities. These conversations often influence trading behavior, highlighting the impact of community sentiment on price volatility and early-stage adoption of related projects like Solargy.

The attention generated by Litecoin meme coin news demonstrates the power of narrative and hype in driving interest in new cryptocurrencies. Enthusiasts and investors are actively searching for the next high-growth opportunity, making Solargy’s presale a natural topic of discussion. The Litecoin meme coin enthusiasm and early-stage presale access creates a unique environment where market momentum, social influence, and speculative interest can converge to produce significant price action.

Introducing Solargy: Presale Structure and Investment Potential

Solargy has entered the crypto scene with a strategically designed presale, offering early investors preferential access to tokens at discounted rates. Presales often serve as a mechanism to raise capital, build community engagement, and incentivize early participation. Solargy’s presale is structured to maximize transparency and accessibility while ensuring that early token holders benefit from potential appreciation as the project develops.

The potential for 50-100x gains is rooted in early-stage market positioning, token scarcity, and community-driven hype. While these returns are speculative and carry inherent risk, Solargy’s approach combines incentive structures with real-world use cases, includingLitecoin meme coin, governance participation, and integration with decentralized finance applications. This blend of utility and speculative potential is particularly attractive to investors familiar with the dynamics of meme coin markets and early-stage presales.

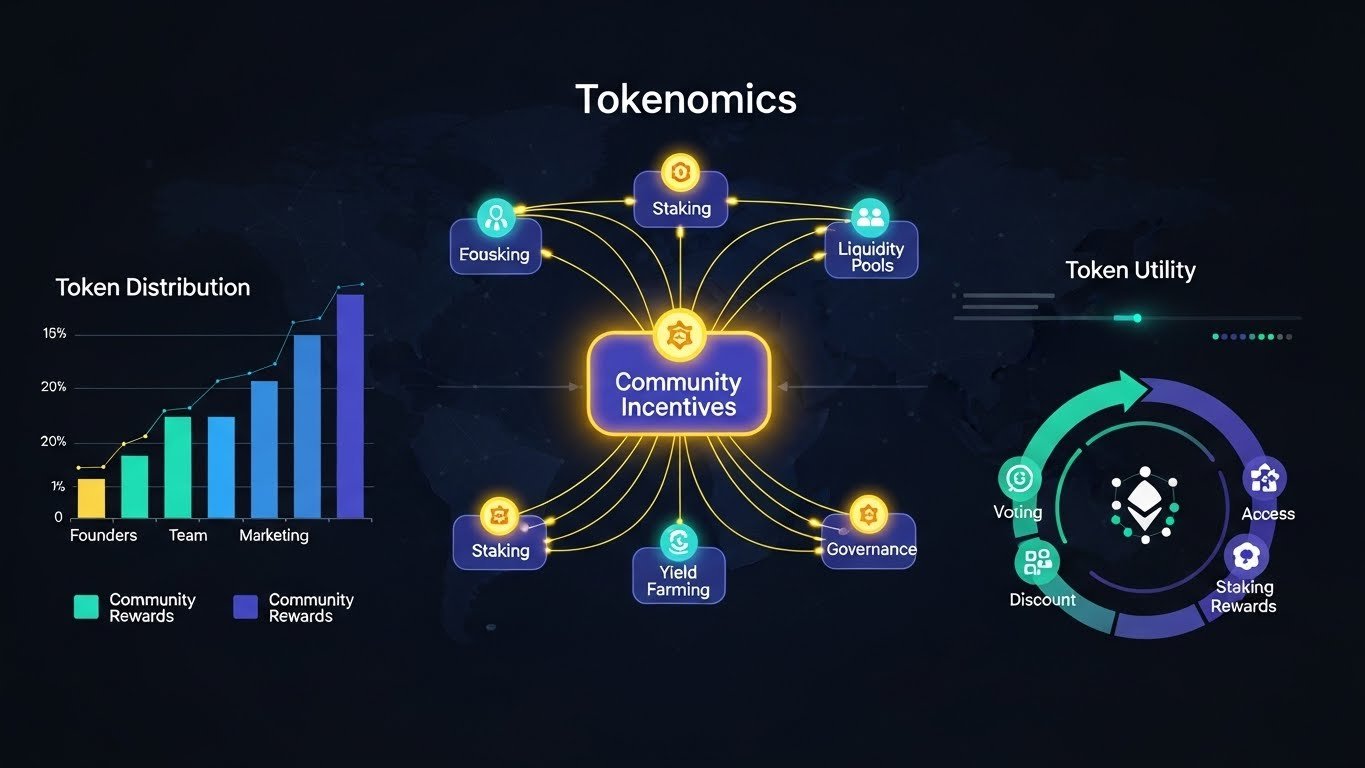

Tokenomics and Community Incentives

A key factor in Solargy’s appeal is its comprehensive tokenomics and community incentive structure. The presale allocation includes dedicated portions for early investors, liquidity pools, and ecosystem development. Such a balanced distribution is designed to reduce centralization risk, support liquidity, and ensure long-term project sustainability.

Community incentives extend beyond simple token ownership. Solargy integrates staking rewards, governance participation, and gamified engagement to create a participatory ecosystem. This approach not only fosters loyalty but also enhances the likelihood of sustained growth post-presale. The combination of structured tokenomics and active community incentives differentiates Solargy from other meme coin ventures that rely primarily on hype without a defined framework for long-term value creation.

Market Timing and Crypto Sentiment

The timing of Solargy’s presale is particularly relevant given current market sentiment. Cryptocurrency markets have experienced periods of high volatility and speculative trading, with meme coins often leading retail interest cycles. Early-stage projects like Solargy benefit from heightened engagement during these periods, leveraging the momentum generated by Litecoin meme coin discussions to attract participants.

Market timing also interacts with investor risk appetite. Those willing to participate in presales often seek high-risk, high-reward opportunities, and the current environment of altcoin speculation creates a favorable context for Solargy’s initial token offering. By aligning presale timing with periods of active community interest, the project maximizes its visibility and the potential for early adoption, which are critical components in realizing projected gains.

Technological Features and Differentiation

Solargy distinguishes itself with innovative technological features, including efficient transaction processing, blockchain scalability, and integration with decentralized finance applications. These features provide functional utility, elevating the project beyond purely speculative meme coin status. Investors are increasingly attracted to projects that combine community hype with tangible technological advancement, as this combination enhances credibility and long-term adoption potential.

Furthermore, Solargy’s platform incorporates interactive engagement elements, allowing token holders to participate in governance decisions, earn rewards, and influence ecosystem development. This participatory design strengthens community loyalty and contributes to sustained growth. By embedding utility, scalability, and engagement within the project, Solargy appeals to a broad spectrum of investors seeking both speculative and practical benefits.

Assessing the 50-100x Gain Potential

The projection of 50-100x gains is ambitious, yet it is consistent with patterns observed in early-stage meme coins and presale projects. Such returns typically require a combination of strong community adoption, viral market sentiment, and ongoing project development. Early investors benefit from lower entry prices and the potential for amplified returns as broader market interest grows.

However, it is crucial to contextualize these projections with the inherent risks of highly speculative investments. Market fluctuations, regulatory developments, and competitive altcoin dynamics can all impact price trajectories. Investors considering participation should evaluate realistic growth scenarios, balancing the potential for extraordinary gains with the likelihood of market volatility.

Risk Considerations and Investor Strategy

Participating in presales like Solargy’s carries a variety of risks. Price volatility, speculative market behavior, and regulatory uncertainties can affect outcomes. Investors should conduct thorough due diligence, including reviewing project documentation, team credentials, security protocols, and roadmap clarity.

Effective risk management involves strategic position sizing, diversification, and monitoring market trends. Combining technical analysis with a clear understanding of tokenomics and community dynamics allows investors to make informed decisions. By approaching presales with both caution and strategic insight, participants can mitigate potential losses while positioning themselves to capitalize on early-stage growth opportunities.

Community Dynamics and Social Media Influence

Social media and online communities play an outsized role in the success of meme coins and presale projects. The ILitecoin and Solargy communities actively engage in sharing updates, discussing market trends, and amplifying presale visibility. This community-driven momentum is essential for early-stage adoption, particularly for projects that rely on viral engagement to generate initial investment activity. Regular updates, transparent communication, and interactive community initiatives strengthen trust and foster loyalty. Meme coin markets have consistently demonstrated that social media sentiment can precede price action, making community engagement a critical factor in Solargy’s potential for rapid growth.

Comparing Solargy with Other Meme Coin Presales

Solargy’s structured presale, technological features, and community engagement set it apart from other emerging meme coin projects. Unlike coins that rely solely on hype, Solargy combines token utility, scalable blockchain architecture, and governance participation, creating a more balanced investment proposition.

Comparative analysis highlights the importance of differentiation, timing, and strategic marketing in determining the success of new presales. By evaluating Solargy alongside other meme coin initiatives, investors can assess its competitive positioning, potential upside, and risk profile within the broader cryptocurrency ecosystem.

Conclusion

Litecoin meme coin discussions have brought significant attention to Solargy’s presale, highlighting the potential for early investors to achieve 50-100x gains. The project combines structured tokenomics, blockchain innovation, and active community engagement to create a compelling opportunity within the speculative altcoin market. While presales inherently carry risk, Solargy’s design and positioning suggest potential for substantial early-stage growth. Investors should approach participation with careful research, risk management, and realistic expectations. By integrating community insights, market sentiment, and technological assessment, participants can make informed decisions that balance potential rewards with associated risks. Solargy exemplifies the evolving dynamics of meme coin and presale markets, merging community-driven momentum with strategic innovation in cryptocurrency investment.

FAQs

Q: How does Solargy’s presale differentiate itself from typical meme coins, and what aspects make it attractive for investors seeking 50-100x gains?

Solargy differentiates itself by integrating structured tokenomics, blockchain scalability, and community incentives, unlike typical meme coins that rely primarily on hype. Its presale offers discounted early access, staking rewards, and governance participation, providing tangible value to token holders. These features, combined with strong community engagement and strategic marketing, create conditions for high-potential returns while maintaining a sustainable ecosystem for long-term growth.

Q: What role does the Litecoin meme coin community play in generating interest and adoption for Solargy’s presale, and why is social media sentiment crucial?

The Litecoin meme coin community serves as a catalyst for visibility and engagement, amplifying awareness through discussions, forums, and social media campaigns. Community sentiment often drives speculative investment behavior, increasing trading volume and early adoption. Positive online engagement can create viral momentum, attract additional investors, and establish a loyal user base, which is critical for the success of Solargy’s presale and potential market performance.

Q: What are the primary risks associated with participating in Solargy’s presale, and how can investors strategically mitigate these risks in a volatile market?

Primary risks include price volatility, regulatory uncertainty, speculative behavior, and potential liquidity constraints. Investors can mitigate risks through careful research, diversification, position sizing, and monitoring market trends. Evaluating the project roadmap, team credibility, tokenomics, and community engagement provides insight into potential risks and rewards. Strategic planning and informed participation reduce exposure while positioning investors to benefit from early-stage growth opportunities.

Q: How do Solargy’s technological features and community incentives contribute to its long-term sustainability and adoption beyond the initial presale phase?

Solargy’s technological features, including scalable blockchain infrastructure and DeFi integration, provide functional utility beyond speculative trading. Community incentives, such as staking rewards, governance participation, and gamified engagement, encourage long-term involvement and loyalty. These elements collectively strengthen ecosystem stability, promote continued adoption, and differentiate Solargy from meme coins that rely solely on hype, enhancing its potential for sustained growth.

Q: In comparison with other emerging meme coin presales, what competitive advantages does Solargy offer that could influence investor decisions and market positioning?

Solargy offers a combination of structured tokenomics, early presale incentives, technological innovation, and active community engagement. Unlike other meme coin projects, it provides both utility and speculative potential, balancing hype with tangible benefits. These competitive advantages, along with strategic marketing and timing, position Solargy favorably within the presale landscape, making it an attractive option for investors seeking high-growth opportunities with a sustainable framework.