When it comes to blockchain technology and cryptocurrency in a world, that is moving so fast that only a few companies are as visible as Riot Blockchain. Riot Blockchain is one of the most robust conclusions in the cryptocurrency mining industry. The organization’s savvy strategy and technological advancement made it extreme. Despite the unpredictable market, Riot Blockchain ultimately achieved success. The question, “Will Riot Blockchain soon reach the $100 level?” captured everyone’s attention. Consequently, this piece provides readers with a comprehensive understanding of Riot Blockchain’s remarkable aspects. These most recent developments impact Riot Blockchain’s future and the potential gains for those who may be interested in it.

The Current Landscape of Riot Blockchain

Riot Blockchain, established in 2000 as a biotech firm, shifted to cryptocurrency in 2017. This move not only transformed Riot into a crypto mining and blockchain technology company but also boosted its growth in this area. Situated in Castle Rock, Colorado, Riot mainly mines Bitcoin. The company is also very concerned about using clean and renewable energy to run its facilities.

Rising cryptocurrencies are expected to increase demand for mining services like Riot’s, making it a top player in this sector. Riot has improved its mining power by upgrading many ASIC miners, and its efficiency has grown significantly. Riot is now ahead of its rivals. Investors are watching how it compares to Bitcoin’s price.

Analyzing Market Trends

Bitcoin Price Volatility

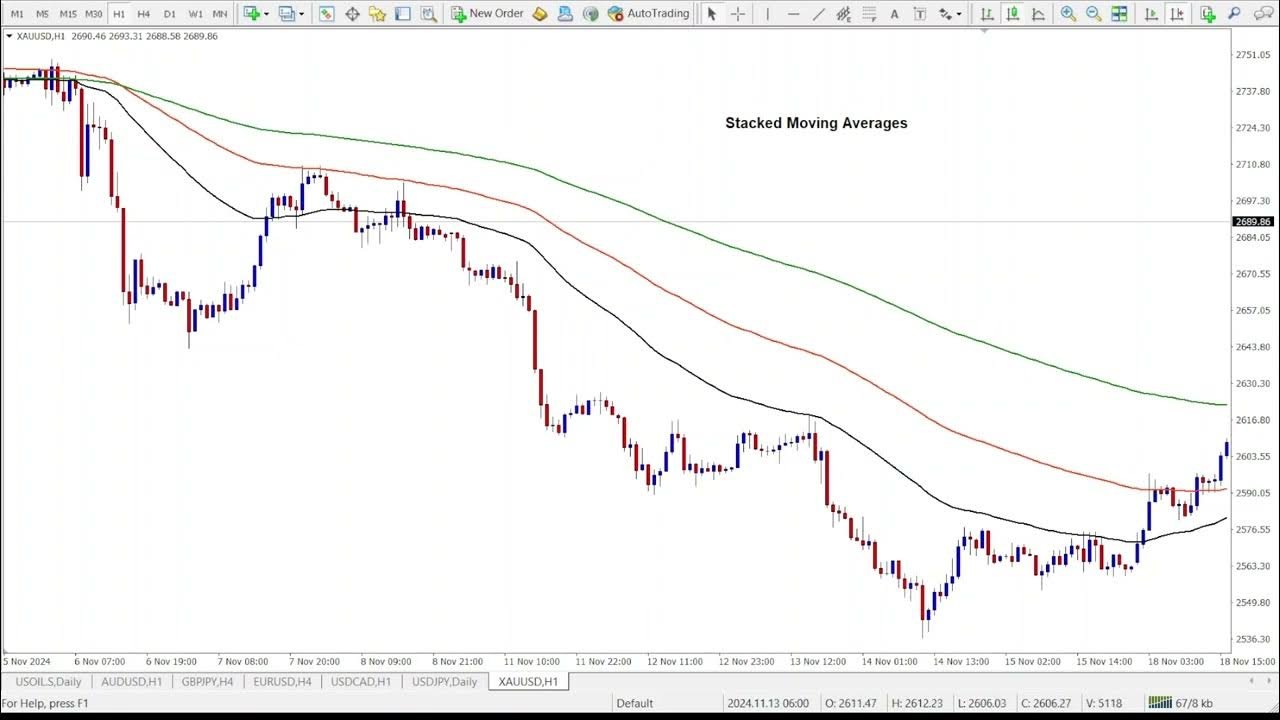

One of the main factors responsible for the changes in Riot Blockchain’s stock price is the price of Bitcoin. Historically, Bitcoin’s price movements have directly influenced Riot’s company’s performance. When Bitcoin prices are soaring, higher returns usually mean higher investor interest and the resultant increase in the stock price. Presently, analysts suggest that Bitcoin’s price future will be upward, which supports the optimism of companies in the mining business, like Riot’s.

Despite its inherent volatility, Bitcoin introduces risks. Market sentiment can change suddenly due to regulatory changes, macroeconomic factors, and technological developments. Hence, investors need to be watchful of such factors and make sure they consider them. The implications of Bitcoin’s price movements and the consequent profitability of Riot.

Regulatory Environment

As for the blockchain review company, Riot Blockchain is a reputable company. That is said to be listed on the US stock exchange, and its firm commitment to the regulations can only be described as an approach in the crypto environment. Making this public could help. The authorities invest in Riot Blockchain and thus enhance investor confidence, especially if the regulation becomes clear over the next year.

New regulations are allowing the cryptocurrency market to flourish. As time passes, investors are increasingly likely to believe in and invest in it.

Technological Advancements

As the Bitcoin mining industry continues to evolve, technological advancements are significantly influencing profitability. Parks Associates’ cutting-edge mining technologies, including high-efficiency ASIC miners that Riot Blockchain is investing in, are vital for staying competitive. These innovations can further reduce utility costs, lower operational costs, and increase the hash rate, directly influencing profit margins.

Furthermore, the firm’s alliance with renewable energy providers is key to positioning it strongly. The growing focus on sustainability provides Riot with the best opportunities to be seen by environmentally conscious investors, who are increasingly prioritizing this area.

Financial Performance and Projections

It would be prudent to examine aspects of Riot Blockchain’s financial performance to ascertain whether it can attain the anticipated $100 limit. The latest quarters have seen Riot report revenue and exponential increases, which are the main sources of its market price stability, along with Bitcoin production. The news from last quarter showed that the megacompany was on the rise because it was planning to raise its mining output and increase the efficiency of its operations.

Industry experts assume that if Bitcoin stays at its current prices or even goes higher, Riot’s revenues will most likely take off. Their estimates of growth have been virtually tied to the refurbishment of financial institutions’ investments in cryptocurrencies, which are likely to push Bitcoin’s prices even higher. This will significantly increase the value of ThususRiot’s shares.

Market Capitalization and Stock Trends

It’s crucial to take into account the company’s current market capitalization when analyzing its potential to reach $100. By January 2025, Riot’s stock price was well under the threshold of $100. Note that reaching that threshold would require a significant increase in market capitalization.

If recent trends are any indication, mining companies now hold the most significant position in the crypto ecosystem. The stock price is likely to go up if Riot can keep its production capacity while optimizing operational expenses and the investors would change their sentiments for the better. Furthermore, a greater scope of media coverage and retail investors’ increased attention would also be instrumental in creating more dynamics of buying.

Practical Implications for Investors

The potential amount to be earned and the potential risk of loss in specific stocks, such as Riot Blockchain, are the two components to consider for cryptocurrency-related investments. Essentially, this involves gaining a comprehensive and critical understanding of the numerous risks associated with this industry.

- Market Research: Conduct thorough research on the cryptocurrency landscape, monitoring Bitcoin trends, regulations, and global economic factors.

- Risk Tolerance: Assess your risk tolerance. High risks balance the potential for high returns, particularly in the context of technological and regulatory volatility.

- Long-Term vs. Short-Term Strategies: Decide whether to approach your investment from a long-term or short-term perspective. Long-term holders may benefit from the overall trend of increasing Bitcoin prices, while short-term investors might thrive on market volatility.

- Diversification: Consider diversifying your portfolio. While Riot Blockchain may offer significant upside potential, it’s crucial to balance investments across various sectors to mitigate risk.

Conclusion

Despite substantial hurdles that Riot Blockchain has to overcome to reach its target, from the regulatory environment’s adoption to Bitcoin’s performance. The company’s strategic initiatives and operational improvements make it bullish and hence allow. The company to position itself advantageously for future growth. In a more mature cryptocurrency and blockchain landscape, Riot Blockchain is expected to be a “game-changer,” and ambitious price targets may be possible. The potential rewards could be significant for investors who are willing to engage in careful assessment and due diligence in the dynamic world of cryptocurrency.