TRUMP token surge The TRUMP token surged 273% to $13.23 in 24 hours. The market capitalization of the TRUMP token skyrocketed to $14.13 billion, and it recorded a staggering trading volume of $14.97 billion. The TRUMP token’s price increased by 273.08% over the last 24 hours, reaching an impressive $70.66.

This surge propelled its market capitalization to $14.13 billion, an increase of 274.10%. The trading volume grew by 477.41% to $14.97 billion, raising the volume-to-market-cap ratio to 116.95%. With a total supply of 999.99 million TRUMP tokens, its justified cost now amounts to $70.85 billion.

Key Technical Levels and Indicators

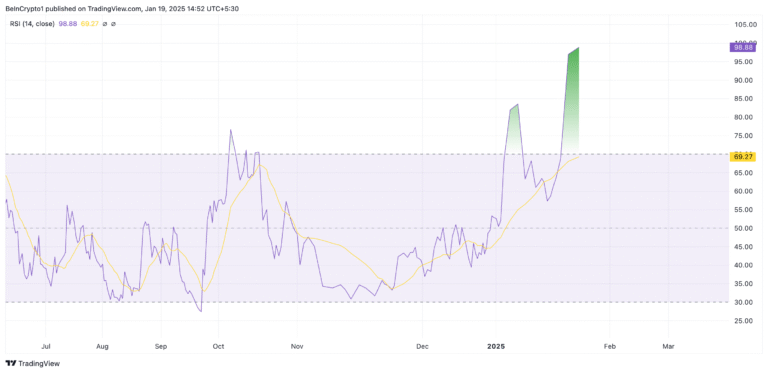

The 4-hour chart analysis of Trump’s shift on Bitcoin is an issue of significant resistance at $13.30 and support at $2.80. If the token can break above the resistance, the next target will be $15.00 or even higher. On the other hand, if the price breaks, the current support loses its bullish momentum, and the buying power might turn into a crypto seller valuing it at $2.50 or even lower. The RSI measured 68.12, indicating that the asset is nearing the overbought zone. At the same time, the RSI average is 56.99, which shows the development of buying power. However, the bullish momentum is still intact, yet it does require some consideration.

Also, the moving averages propose the bulls’ perspective. The 9-day moving average (MA) of $8.42 has broken above the previously mentioned 21-day MA (21 MA) at $5.93, known as a bullish crossover. The Chaikin Money Flow (CMF) further supports this formation, suggesting positive inflows and strong investor confidence in the token’s prospects.

TRUMP Token Surge: Bullish Signs and Key Support

A volume spike indicates colossal market interest in TRUMP. The token’s liquidity becomes practically complete, with the market cap reaching 100% and more. The list of technical components, such as bullish indicators with a high investor appetite and engagement, suggests that TRUMP will likely go further.

Meanwhile, TRUMP Token Takes the Spotlight risks are being pushed down to the key level of $3.40 to confirm the consolidation phase, meaning that the RSI got past the overbought levels—key resistance levels—and the prices were able to go up. The RSI level moving towards overbought levels could drive a bearish sentiment, leading to a correction if the buying pressure drops. In this way, the support level of 0.8083 ADA must be kept in view. If the pricing plunges lower than this level, it will not be surprising if the bears take over, prompting buying pressure to rise.

TRUMP is an excellent example of how people favor fiat currencies and buy cryptocurrencies. As the pair maintains upward momentum, many positive technical signals bolster trading activity. Thus, the bull returns and the pair potentially gets to new highs.

Summary

There was an action: the TRUMP token suddenly increased more than 24 hours to $13.23, and its Mt. MCAP figure rose to 14.13 billion. But, when the trading volume hit $14.97 billion, the token reflected a high degree of investor interest, with TRUMP’s market cap increasing by 274%. However, technical analysis says $13.30 is a strong resistance, and $2.80 is a support level. The RSI is in an overbought area, which may be followed by a correction in the event of falling buying pressure.

Nevertheless, the bullish trend is still there. Among the bullish signals are the bullish moving average crossover and the increasing Chaikin Money Flow, which indicate that investors are very confident in their investments. If the token manages to make its present momentum, you may see new highs, but it will not be without a risk of prices falling below the main support levels.