The Web3 investment trends ecosystem has seen a notable investment increase. The subsequent development of the internet through distributed technologies like blockchain. Data from Crunchbase’s Web3 tracker shows that venture capital (VC) funding for Web3 firms in the first three quarters of 2024 was an astounding $5.4 billion. This significant money flow has prepared the ground for ongoing Web3 space innovation and growth over 2025.

Investment Surge in 2024

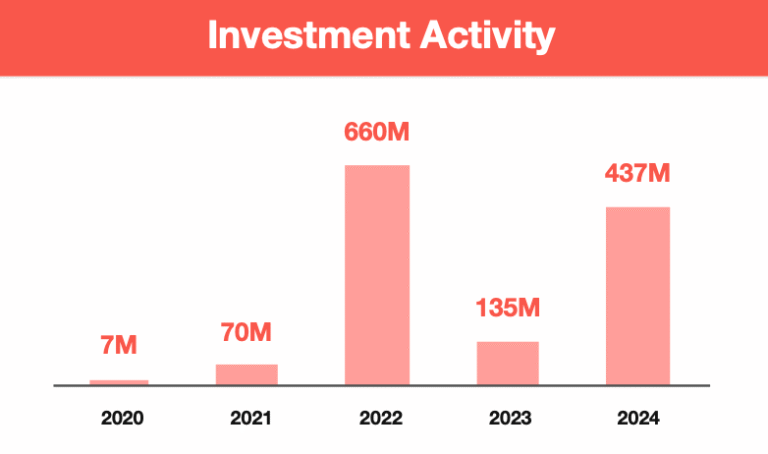

There are multiple reasons for the rise in VC money in 2024. Early in the year, developments including Bitcoin ETFs and the launch of meme currencies stoked market optimism, which resulted in a 51% rise in Web3 venture capital against 2023. Post-halved market instability, however, slowed investment momentum and underlined the intimate link between Web3 fundraising and liquidity cycles.

Web3’s Transformative Trends in 2025

For Web3, 2025 looks to be a transformative year. Emerging trends point to a move toward immersive technology, distributed finance solutions, and dispersed security as well as towards the sector is projected to be changed by the combination of artificial intelligence (AI) with blockchain, the development of distributed physical infrastructure networks (DePIN), and blockchain gaming improvements. These changes are expected to inspire more Web2 technology adoption and investment.

VC Firms Fueling Web3 Innovation

Some venture capital companies have been crucial in fostering Web2 innovation through their investments. Among them are notable:

-

Paradigm: Specializes in Web3 investments, supporting projects that aim to build decentralized networks and applications.

-

Outlier Ventures: Recognized as a leading Web3 accelerator, it has a portfolio of over 250 projects and fosters growth in the decentralized tech space.

-

Blizzard Fund: Aims to boost growth and innovation in the Avalanche ecosystem and beyond, investing in projects that enhance blockchain scalability and usability.

Web3 Investor Shift

Investor attention in the Web3 sector started to turn in 2024 toward fields offering initiatives at decentralization and novel ideas. Growing interest in distributed autonomous organizations (DAUs), artificial intelligence integration, regulatory compliance, and asset tokenizing shows this change. These developments are changing the scene of blockchain investments and drawing investors looking for chances in distributed governance systems and new technology.

Challenges in Web3 Scalability and User Experience

The Web3 industry must resolve issues despite the positive investing environment if we are to keep progress. Scalability is still an issue since blockchain systems must control more transaction volumes without sacrificing performance or raising expenses. Another area needing work is user experience since attracting and keeping mainstream users depends on streamlining the onboarding process for Web3 apps. Dealing with these difficulties allows developers and investors to help the Web3 ecosystem grow more mature.

Final Thoughts

The significant VC money for 2024 has set a solid basis for Web3’s expansion and will help it grow constantly in 2025. The Web3 ecosystem is poised to revolutionize several sectors. However, as investments into creative ideas and new trends change the digital terrain. These investments provide distributed solutions that empower people and propel technological development. The changing Web3 landscape offers plenty of chances for investors and businesspeople to lead the next internet revolution.