Current Market Performance

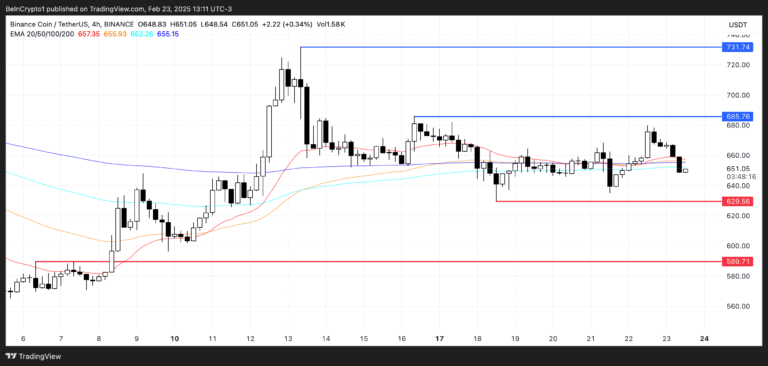

BNB price analysis Rising 3.5%, Binance’s CZ Investing Coin (BNB) has recently experienced a comeback in momentum as bulls are in charge. Having dropped below $600 early this month, BNB is rebounding now at $656. Still, it encounters several degrees of resistance, including the $640, $664, and $700 zones, which align with important moving averages and Fibonacci retracing levels.

Technical Outlook

Recently, BNB took back its 20-day exponential moving average (EMA) around $635, a positive indication. To validate more gains, BNB still has to overcome significant obstacles, including the 50 SMA, 100 SMA, and 200 SMA. Furthermore, the TD Sequential indicators and 0.382 Fibonacci retracing level suggest that resistance is still firm.

The Relative Strength Index (RSI) is 54.65, indicating neutral momentum. This implies that even if BNB has space for more expansion, a lack of robust purchasing demand could restrict temporary gains. Meanwhile, the MACD (Moving Average Convergence Divergence) indicator has seen a positive crossover, suggesting a possible short-term upward trend should buyers keep control.

Support and Resistance Levels

Key support levels for BNB price analysis include:

- $620

- $600

- $550

Key resistance levels to watch:

- $640

- $664 (0.382 Fibonacci retracement level)

- $700

A breakout over $700 could indicate more optimistic momentum, thereby guiding BNB toward its all-time high of $793.35, noted in December 2024.

Long-Term Price Predictions

The price swings between $761 and $926 over the year, and analysts estimate that BNB might hit $1,292 during a possible Altcoin Boom Peaks season looking at 2025 and forward. Many elements could be responsible for this increase, including:

- Increased demand for BNB on Binance for trading fees, staking, and token sales.

- The expansion of the Binance ecosystem, including DeFi, NFTs, and other blockchain services.

- The BNB auto-burn mechanism reduces total supply and supports price appreciation.

Some estimates foresee BNB’s price as high as $2,081 by 2030; long-term forecasts point to a possible value beyond $4,000 by 2032.

Future Catalysts and Risks

Factors Supporting BNB’s Growth

- Increased adoption of the Binance exchange and its ecosystem.

- The BNB Chain attracting more developers and projects.

- Regulatory clarity, allowing Binance to expand in key global markets.

Potential Risks

- Regulatory scrutiny: Past legal issues with U.S. authorities led to temporary price declines. Any future compliance issues could negatively impact BNB’s price.

- Competition from other blockchains, such as Solana and Ethereum, could slow down adoption on the BNB Chain.

- Overall market conditions: If Bitcoin and the broader crypto market enter another bearish phase, BNB could experience downward pressure.

Conclusion

Although BNB displays indications of strength and recovering important technical levels, it encounters strong opposition. Its capacity to break past $700 will determine short-term movements; Binance’s continued expansion guarantees great long-term development possibilities. Investors should monitor important support and resistance levels while examining more general market trends and regulatory changes.