Bolivia has just taken one of the boldest steps in its financial history. After years of strict controls and even an outright ban on digital assets, the country is now moving to integrate crypto and stablecoins into its banking system. Government officials have confirmed that banks will be allowed to offer cryptocurrency services, starting with stablecoins, so that they can be used directly through savings accounts, cards, and even loans.

This historic shift comes at a time when Bolivia is facing its worst economic crisis in decades. Dollar reserves are near zero, the boliviano has plunged on the parallel market, and inflation has climbed to levels not seen in forty years. In that context, citizens and businesses have already turned to cryptocurrencies and stablecoins as an informal hedge against currency instability. Transaction volumes have exploded since the government lifted its crypto ban in 2024, with the central bank reporting more than a fivefold increase in digital asset payments.

Now the state is no longer standing on the sidelines. By allowing banks to handle crypto and stablecoins inside the regulated financial system, Bolivia is effectively trying to turn a grassroots phenomenon into a structured national strategy. For a country that once called digital assets a threat to stability, this is a remarkable turnaround. In this article, we will explore what this decision really means, how it changes the role of banks, why Bolivia is turning to crypto and stablecoins now, and what opportunities and risks lie ahead for citizens, businesses, and the broader Latin American region.

From Ban to Banking: The Evolution of Crypto in Bolivia

It is impossible to understand the significance of Bolivia’s move without looking at how far the country has come in a short period of time. For years, Bolivia was known as one of the most hostile jurisdictions to digital assets in Latin America.

In 2014, the Central Bank of Bolivia and its financial watchdogs banned the use of any currency or digital asset not issued by the state, citing fears of fraud, money laundering, and instability. Crypto was officially classified as an illegal means of payment. That stance was reinforced in later years, with regulators repeatedly warning citizens about the risks of virtual assets.

Yet the economic reality gradually eroded this position. Persistent dollar shortages, a widening fiscal deficit, and growing frustration with capital controls pushed many Bolivians to look for alternatives. Despite the ban, underground use of Bitcoin, stablecoins, and other cryptocurrencies continued to expand, especially through peer-to-peer markets.

The 2024 Ban Lift and Surge in Crypto Activity

The turning point came in June 2024, when the Central Bank issued a new resolution that effectively lifted the blanket ban on cryptocurrencies. Financial institutions were authorized to process digital asset transactions through regulated electronic channels, opening the door for legal crypto payments and giving banks a controlled way to interact with virtual assets.

The impact was immediate. Within months, the number of purchase and sale operations in crypto jumped by more than 100%, and monthly trading volumes roughly doubled. By late 2024 and into 2025, the central bank reported that virtual asset transaction values had surged from tens of millions of dollars to hundreds of millions, with a record month surpassing 68 million dollars in volume.

This wave was driven heavily by stablecoins, which many Bolivians began using as a digital substitute for scarce dollars. Stablecoins pegged to the U.S. dollar became a practical tool for remittances, savings, and business payments, especially as the boliviano’s black-market exchange rate diverged sharply from the official rate. From an outright ban to hyper-growth after legalization, Bolivia’s path set the stage for the next, even bigger step: bringing crypto fully inside the traditional banking system.

The Historic Integration: What the New Policy Does

The latest announcement by Economy Minister Jose Gabriel Espinoza describes a clear goal: Bolivia will integrate cryptocurrencies into the formal financial system, starting with stablecoins. In practical terms, this means banks will be allowed to offer crypto-based products and services, not just act as passive intermediaries to external exchanges. The plan is to let crypto assets, especially stablecoins, function more like recognized payment instruments within the banking framework.

Starting With Stablecoins as the Anchor

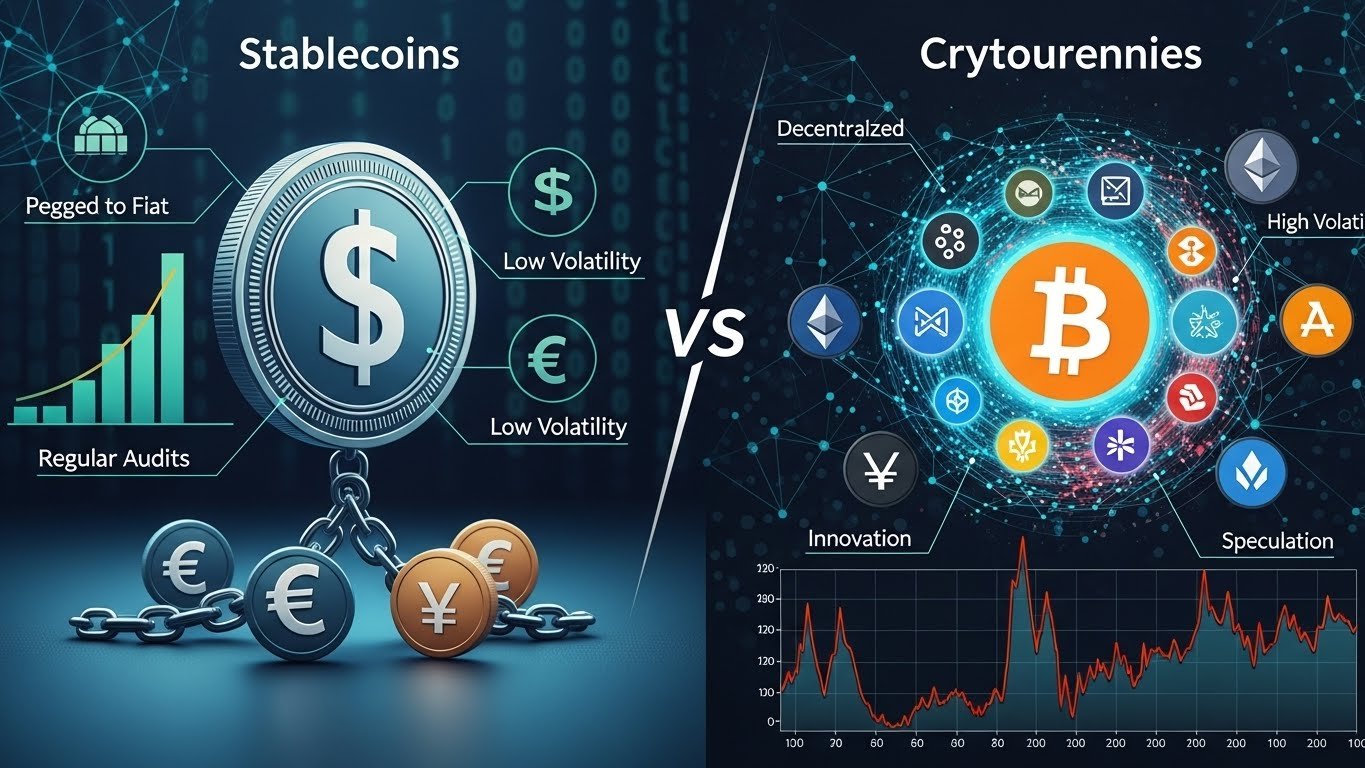

Focusing first on stablecoins is a deliberate choice. Unlike volatile cryptocurrencies such as Bitcoin or Ether, stablecoins are designed to track the value of a reference asset—usually the U.S. dollar. In a country struggling with currency depreciation and dollar scarcity, they offer a digital, easily transferable store of value that people already understand.

By prioritizing stablecoins, Bolivia’s authorities hope to achieve several objectives at once. They want to give citizens a safer digital alternative to informal dollar markets, modernize payment infrastructure, and reduce reliance on physical cash, which is costly to manage and vulnerable to loss and theft. At the same time, they can keep tighter oversight over flows than in the purely unregulated peer-to-peer world.

The plan also leaves the door open for other cryptocurrencies and digital assets to follow, but in stages. Starting with stablecoins allows regulators and banks to learn how to manage risk, monitor anti-money-laundering controls, and handle custody before dealing with more complex or volatile assets.

Crypto Services Inside the Banking System

What makes this move historic is not just recognizing crypto, but letting banks build real crypto and stablecoin services into their product lines. Espinoza has described a range of offerings that banks will be allowed to develop. These include stablecoin-denominated savings accounts, payment cards linked to crypto balances, and even loans where digital assets may be part of the collateral or payment structure.

In simple terms, a Bolivian could hold a stablecoin-based account at a local bank, use a debit or credit card to spend those balances at merchants, and potentially borrow or invest through the same interface. Instead of juggling separate offshore exchanges and informal channels, people would interact with crypto and stablecoins through familiar banking apps and branches. For banks, this integration offers a way to win back customers who abandoned the formal sector due to fees, taxes, or lack of dollar access. For the state, it is a way to bring previously opaque digital asset activity into a supervised environment where consumer protections, transparency, and tax collection are easier to enforce.

Why Bolivia Is Turning to Crypto and Stablecoins Now

Bolivia’s embrace of crypto and stablecoins in the banking system is not happening in a vacuum. It is a direct response to deep economic stress and structural weaknesses that traditional policies have failed to solve.

Economic Crisis, Dollar Shortages and Inflation

The country is facing a severe shortage of foreign currency. Official dollar reserves are dangerously low, making it hard to pay for imports and service debt. At the same time, the government has maintained a fixed official exchange rate, even as the boliviano has lost about half its value on the black market.

Inflation has climbed to multi-decade highs, and fuel shortages have led to long lines at gas stations. Together, these pressures have eroded public trust in the national currency and pushed people to seek safer stores of value. For many households and small businesses, stablecoins and cryptocurrencies have filled that role more effectively than traditional banking products. In that context, integrating crypto is less about enthusiasm for technology and more about pragmatism. As Espinoza has put it, you cannot control crypto globally, so it is better to recognize it and use it to the country’s advantage.

Remittances, Trade and Everyday Payments

Bolivia is also heavily reliant on remittances from citizens working abroad. Traditional remittance channels are often slow and expensive, especially for small transfers. By enabling crypto and stablecoin rails inside the banking system, the government hopes to lower these costs and speed up cross-border payments.

For traders and importers struggling with limited dollar access, regulated stablecoin usage through banks can provide a clearer and more compliant way to settle invoices, hedge currency risk, and manage cash flow. Some businesses in Latin America have already begun using stablecoins for cross-border trade to avoid friction in the traditional correspondent banking network. Bolivia is now setting up the infrastructure for similar patterns to emerge domestically. On the street level, everyday Bolivians have already shown they are willing to use digital assets for simple payments, from online purchases to person-to-person transfers. Bringing those behaviors into the formal system is the next logical step.

Regulatory Architecture Behind Crypto–Bank Integration

Allowing banks to handle crypto and stablecoins requires more than a political announcement. It depends on a regulatory architecture that can channel innovation without abandoning safeguards.

Role of the Central Bank, ASFI and New Frameworks

The Central Bank of Bolivia (BCB) is the primary institution responsible for setting rules on digital assets and overseeing how financial institutions implement them. It works in coordination with the Financial System Supervisory Authority (ASFI) and the Financial Investigations Unit (UIF), particularly around anti-money-laundering and counter-terrorist financing compliance. In 2024, the key shift came with Board Resolution N°082/2024, which authorized financial entities to transact with crypto assets through approved electronic channels. That resolution laid the groundwork for today’s decision to deepen the integration and expand the types of services banks can offer.

More recently, the government has spoken about developing a “comprehensive regulatory framework” for fintech firms and digital asset service providers, aligned with standards from the Financial Action Task Force of Latin America (GAFILAT). This framework will need to address how banks custody digital assets, how stablecoins are vetted and approved, how customer funds are protected, and how disputes are resolved.

Building on the El Salvador Partnership

Bolivia’s decision to integrate crypto into its banking system is also influenced by regional cooperation. In mid-2025, the BCB signed a memorandum of understanding with El Salvador’s National Commission of Digital Assets to exchange expertise on digital asset regulation, blockchain infrastructure, and risk tools. El Salvador, of course, was the first country to make Bitcoin legal tender. While Bolivia is not simply copying that model, it is learning from El Salvador’s experience in legal frameworks, wallet infrastructure, and public-private partnerships. This cooperation supports Bolivia’s effort to craft a tailored approach that fits its own economy and institutions.

Opportunities: Inclusion, Innovation and Modernization

The upside of integrating crypto and stablecoins into the banking system goes beyond crisis management. It opens deeper structural opportunities for financial inclusion and innovation.

Bringing the Unbanked Into the System

A significant portion of Bolivia’s population remains unbanked or underbanked, relying on cash and informal networks for most financial activities. High fees, documentation requirements, and geographic barriers have discouraged many from opening bank accounts.

As digital asset usage spreads, especially via mobile phones, integrating crypto and stablecoins into formal banking could encourage more people to join the regulated system. If banks can offer low-fee, easily accessible stablecoin accounts with simple digital onboarding, they may win over citizens who previously saw no benefit in traditional banking. This could improve savings behavior, expand access to credit, and allow more people to participate in formal commerce and state programs.

Boosting Fintech and Web3 Entrepreneurship

Bolivia’s move also sends a strong signal to fintech startups and Web3 developers. A banking system that openly supports crypto and stablecoin services creates space for new products, from payment apps and remittance platforms to on-chain credit scoring and tokenized assets.

If regulators provide clear licensing paths and interoperable infrastructure, local entrepreneurs could build solutions tailored to Bolivia’s specific challenges, such as rural connectivity, small-ticket remittances, and micro-lending. International firms specializing in stablecoin payments and crypto infrastructure are already paying attention to Bolivia as a potential growth market, particularly after seeing transaction volumes surge following the ban lift. In the long term, this blend of crypto integration and fintech innovation could help diversify Bolivia’s economy beyond commodities and traditional banking.

Risks and Challenges on the Road Ahead

Despite the optimism, integrating crypto and stablecoins into the banking system is not without serious risks and open questions.

Volatility and Stablecoin Counterparty Risk

While Bolivia plans to emphasize stablecoins, not all stablecoins are created equal. Some are fully backed by audited reserves; others rely on more complex or opaque mechanisms. If banks support poorly structured stablecoins and those assets fail, ordinary savers could be hurt and trust in both crypto and the banking system could suffer.

Even with stablecoins, exchange-rate risk remains. If a stablecoin is tied to the U.S. dollar and the dollar itself moves sharply relative to other currencies, the value of holdings in local terms can still swing. For more volatile cryptocurrencies, price risk is even higher. Banks will need strict policies on how such assets are used as collateral or held on balance sheet, to avoid amplifying systemic risk.

Education, Cybersecurity and Political Uncertainty

Another challenge is financial education. Many new users will encounter crypto-banking services for the first time. They may not fully understand private keys, transaction irreversibility, or the difference between on-chain holdings and custodial wallets. Public awareness campaigns and clear, simple disclosures will be critical.

Cybersecurity is another concern. Banks and fintechs will become targets for hackers trying to steal digital assets. Building robust, audited security systems, including cold storage and multi-signature controls, will be vital. Finally, Bolivia’s political environment remains fragile. Changes in government or policy priorities could alter the trajectory of crypto integration. Long-term success will depend on whether this move is treated as a broad national strategy rather than a short-lived experiment tied to a single administration.

Bolivia’s Move in the Global Crypto Narrative

Bolivia’s decision to integrate crypto and stablecoins into the banking system places it among a growing group of countries in Latin America experimenting with digital assets as tools of economic policy, not just speculative investments.

El Salvador made global headlines by adopting Bitcoin as legal tender. Other countries, such as Brazil, Argentina and Colombia, have advanced digital payment systems and are testing central bank digital currencies or bank-backed stablecoin rails. Bolivia, after years of resistance, is now moving rapidly toward a model where regulated banks and digital assets coexist.

What makes Bolivia’s story distinctive is the speed of the shift: from a full prohibition to legalization, and now to deep integration, all within a few years and under intense economic pressure. If this strategy succeeds in stabilizing payments, expanding inclusion, and attracting new investment, it could become a powerful example for other emerging markets facing similar crises.

Conclusion

“Bolivia makes historic move to integrate crypto and stablecoins into banking system” is more than a headline. It captures a fundamental rethinking of how money, technology, and policy interact in a country under strain. After lifting its ban in 2024 and witnessing a 530% surge in crypto transactions, Bolivia has chosen not to fight the tide but to guide it—bringing digital assets into the heart of its financial system through banks and regulated channels.

By starting with stablecoins, the government aims to offer citizens a more reliable digital store of value, improve remittances and trade, and rebuild trust in the financial system. At the same time, it is working with international partners, updating regulatory frameworks, and trying to ensure that innovation does not come at the cost of consumer protection or macroeconomic stability.

There are real risks: volatility, counterparty failures, cyber-attacks, and political reversals are all possible. But there are also real opportunities: greater financial inclusion, a more dynamic fintech sector, and a modernized payment system that can support growth even in the face of external shocks. For now, Bolivia’s choice to integrate crypto and stablecoins into its banking system stands as one of the most ambitious experiments in digital finance anywhere in the world. The coming years will show whether this bold bet pays off—and how other countries may follow.

FAQs

How exactly will banks in Bolivia use crypto and stablecoins?

Banks in Bolivia are being allowed to offer a range of services built around crypto and stablecoins, with an initial focus on dollar-pegged stablecoins. According to government statements, these services may include stablecoin savings accounts, payment cards linked to digital asset balances, and even loans that interact with crypto holdings. The goal is to let these assets function as practical payment instruments inside the formal banking system rather than remaining confined to offshore platforms or informal peer-to-peer markets.

Why did Bolivia change its stance from banning crypto to integrating it?

Bolivia’s reversal was driven by economic necessity and the reality of adoption on the ground. The country has faced a severe economic crisis, marked by dollar shortages, high inflation and a widening gap between the official and parallel exchange rates. As citizens increasingly turned to cryptocurrencies and stablecoins to protect their savings and conduct transactions, the government recognized that an outright ban was both ineffective and counterproductive. Lifting the ban in 2024 triggered a surge in activity, and the latest step to integrate crypto into banking is an attempt to harness that trend in a more controlled and productive way.

Are stablecoins legal and regulated for businesses in Bolivia?

Yes, stablecoins are now legal to use in Bolivia, and businesses have begun integrating them into operations, especially for cross-border payments and trade. The Central Bank’s decision to lift the ban in 2024 and subsequent regulatory updates created a framework where financial institutions can process virtual asset transactions through authorized channels. As of 2025, firms offering stablecoin on- and off-ramps have highlighted that businesses can legally receive and make payments in stablecoins, although they must still comply with tax, reporting and anti-money-laundering requirements.

What are the main risks for ordinary users when banks offer crypto services?

The main risks for ordinary users include asset volatility, potential failures of specific stablecoins, cybersecurity threats, and misunderstandings about how custody works. Even stablecoins can be exposed to reserve or regulatory shocks if their issuers mismanage funds or face enforcement actions. Users also need to understand whether their bank holds the crypto directly, uses third-party custodians, or relies on synthetic exposure. Finally, if someone is not familiar with how digital assets work, they may be more vulnerable to scams or phishing attacks. That is why education and transparent disclosures are crucial as banks roll out crypto and stablecoin services.

Could Bolivia’s approach influence other countries in Latin America?

Bolivia’s approach could certainly influence other emerging markets, especially in Latin America, where many countries are grappling with inflation, dollar shortages and low financial inclusion. By moving from ban to legalization and then toward full banking integration, Bolivia is demonstrating a pathway that combines innovation with regulation. Governments in similar situations may watch closely to see whether Bolivia’s experiment stabilizes payments, supports remittances, and attracts investment without creating new forms of instability. If the results are positive, this model of integrating crypto and stablecoins into the banking system may inspire wider reforms across the region.