Bitcoin price predictions 2025 Since its launch in 2009, Bitcoin has been the top cryptocurrency. The world is causing great buzz and volatility. As of March 2025, its price has crossed the $100,000 level. However, they which has many analysts and investors projecting audacious future developments concerning it. Although some estimates indicate that there is a limited 4% probability that Bitcoin might rise to $1 million, it is essential to investigate. The elements influencing such projections and grasp the more significant dynamics of the market.

Review of the Current Market

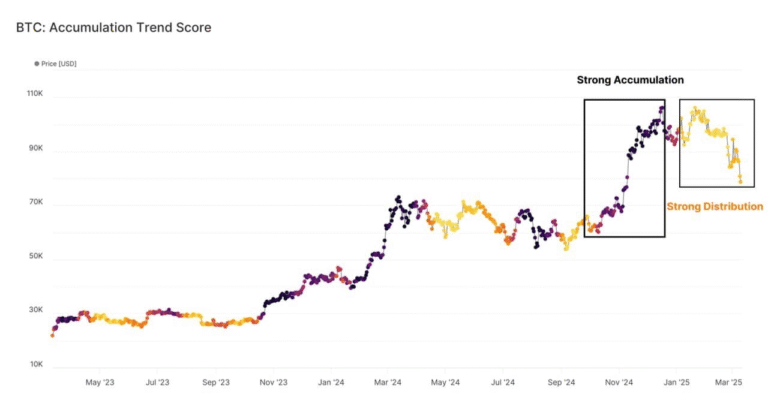

By exceeding the $100,000 mark and drawing both institutional and retail investors, Bitcoin has set major benchmarks for 2024. Multiple spot Bitcoin exchange-traded funds (ETFs) have helped to justify Bitcoin as a financial tool. Important financial organisations such as BlackRock and BNY Mellon have introduced investment products linked to Bitcoin, therefore boosting market stability and liquidity. These advances show increasing public interest in and acceptance of Bitcoin’s possible asset class value.

Although authorities have been closely examining Bitcoin over the past few years, it has proven tenacious against difficulties. While the network’s solid principles draw institutional players, the acceptance of Bitcoin ETFs has helped increase investor trust. Notwithstanding these encouraging indicators, economists disagree on the probability of notable price swings, and the future price movements of Bitcoin remain unknown.

Bitcoin Price Predictions for 2025

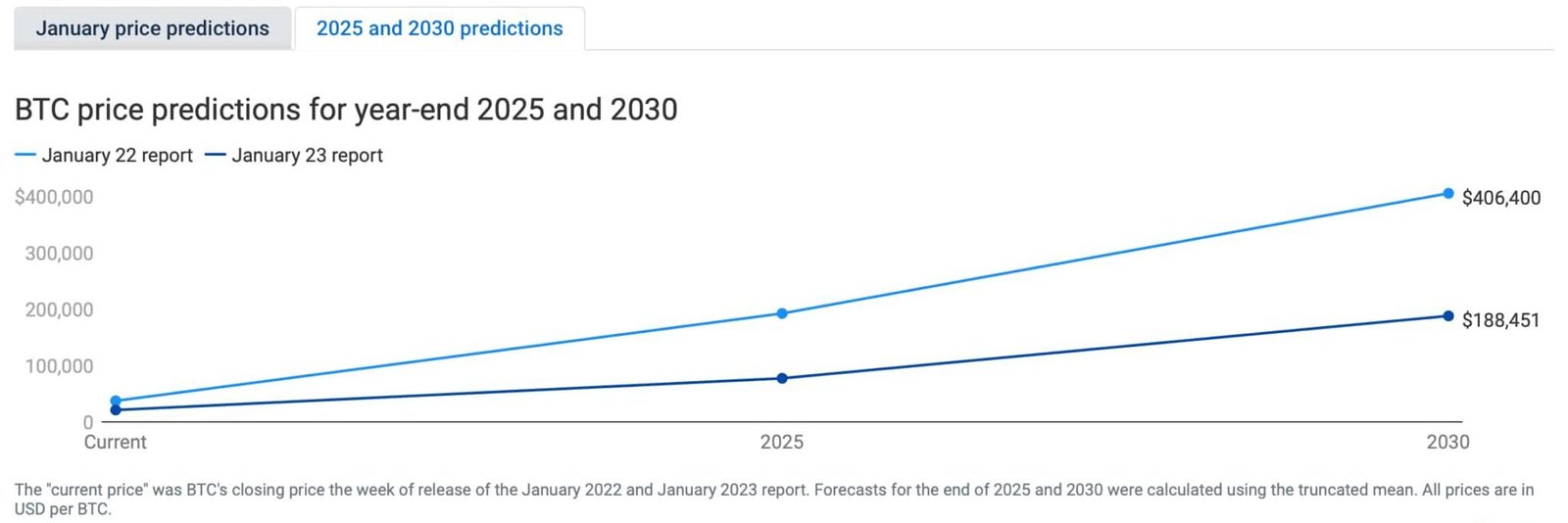

Notwithstanding the uncertainty, a number of financial experts have projected high prices for Bitcoin in the following years. By the end of 2025, some researchers estimate Bitcoin might be worth as much as $250,000. For example, Tom Lee of Fundstrat thinks the subsequent price increase will be sparked by the approaching Bitcoin halved event. Driven by the increasing institutional acceptance and the effect of spot ETFs, H.C. Wainwright has also predicted that Bitcoin would reach $225,000 by the same period.

Prominent investor Anthony Scaramucci has also forecasted that Bitcoin would hit $200,000 by 2025, citing substantial institutional support and positive legislative developments as the leading causes of this possible price rise. Although these forecasts are definitely optimistic, they also reflect a general agreement that Bitcoin’s price will keep appreciating, although at a slower rate than the past stratospheric climb. Still, this kind of forecast is not assured. It depends on various elements, including ongoing institutional involvement and regulatory clarity—two things that are still developing.

Is Bitcoin Reaching $1 Million Possible?

Within the bitcoin community, the highly speculative and divisive issue of whether Bitcoin might hit $1 million is hotly debated. For good reason, several models contend that there is only a 4% possibility of Bitcoin attaining such a pricing point. The elements driving Bitcoin to such heights are mostly hypothetical and call for an almost perfect confluence of events. These elements comprise hitherto unheard-of degrees of institutional acceptance, a worldwide legislative climate totally favourable to cryptocurrencies, and technological innovations enabling more efficient and scalable Bitcoin transactions than they now allow.

The idea of Bitcoin reaching $1 million is predicated on speculative events imagining broad worldwide acceptance of Bitcoin as both a medium of trade and a store of value. For this to occur—driven by both governments and institutions— Bitcoin would have to witness exponential demand rises. Though they are interesting, the possibility of these assumptions all lining up in the near future is low; they are only hypothetical at best.

Factors Affecting Bitcoin’s Price

Both internal and outside of the bitcoin market, a number of elements affect the price of the currency. For example, changes in regulations might significantly affect the acceptance and value of Bitcoin. Positive effects on the market have already come from the declaration of favourable legislation, such as the acceptance of Bitcoin ETFs in the United States, which raises investor confidence and drives up prices. On the other hand, as China’s crackdown on cryptocurrency mining shows, tight rules or outright prohibitions in some nations might have a detrimental effect on the price of Bitcoin.

Another crucial consideration influencing the price of Bitcoin is market liquidity. Market liquidity increases as more institutional participants join the market and new investment products connected to Bitcoin are presented, facilitating major transactions without appreciable impact on the price. Further, individual investors drawn by this liquidity help to drive demand even further.

Eventually

The future price path of Bitcoin is unknown; some experts forecast significant increases while others warn against unreasonable expectations. Although the likelihood of Bitcoin surpassing $1 million is still hypothetical, over time, its ongoing expansion and acceptance appear almost inevitable. Investors should approach Bitcoin with reasonable expectations, knowing both the possible benefits and hazards. Anyone engaged in Bitcoin investments will have to be constantly aware of legislative developments, market dynamics, and technology breakthroughs as the industry changes.