Crypto ETFs Stablecoins Trends Amidst the continuing bull market, the number of cryptocurrency wallets with positive balances has soared beyond 400 million, indicating increasing usage. Institutional and retail investors have been more active throughout the upswing, concentrating on dollar-pegged stablecoin transactions (Chainalysis, Dec. 5). The December 5 article noted a “seismic shift” in how people view and use cryptocurrency. As a result of financial institutions’ involvement with exchange-traded funds (ETFs) and similar products, a “convergence” between the digital economy and conventional finance was observed.

Crypto ETFs Surge, Stablecoins Reign Supreme

“Introducing Crypto ETFs has likely driven rallies in the broader market. These funds offer a regulated, mainstream way to invest in cryptocurrencies.” As for the on-chain scene, stablecoins are king, often as a bridge between fiat and Crypto. Their handling % demonstrates their significant market impact on 75% of all on-chain transactions since the beginning of 2024.

Stablecoins have a long history of serving as entry and exit points, but they are now also viewed as valuable assets, especially in developing nations. Latin American countries and Venezuela are seeing the rise of U.S. dollar-backed stablecoins as a means of remittances and liquidity, particularly in areas where dollars are scarce or capital controls are tight. Legislators are taking notice of stablecoins due to their potential widespread utility.

Fed, Treasury, and Market Bubble Warnings

In a speech on 18, October-October 18Federal Reserve Governor Christopher Waller recognized their ability to lower costs associated with cross-border settlement. The Borrowing Advisory Committee of the United States Treasury also acknowledged their contribution to the increase in demand for Treasury bills in a report dated OctoberOctober 30of America (BofA), chief investment strategist Michael Hartnett has expressed concern that the US stock and cryptocurrency markets may have become overpriced due to recent surges.

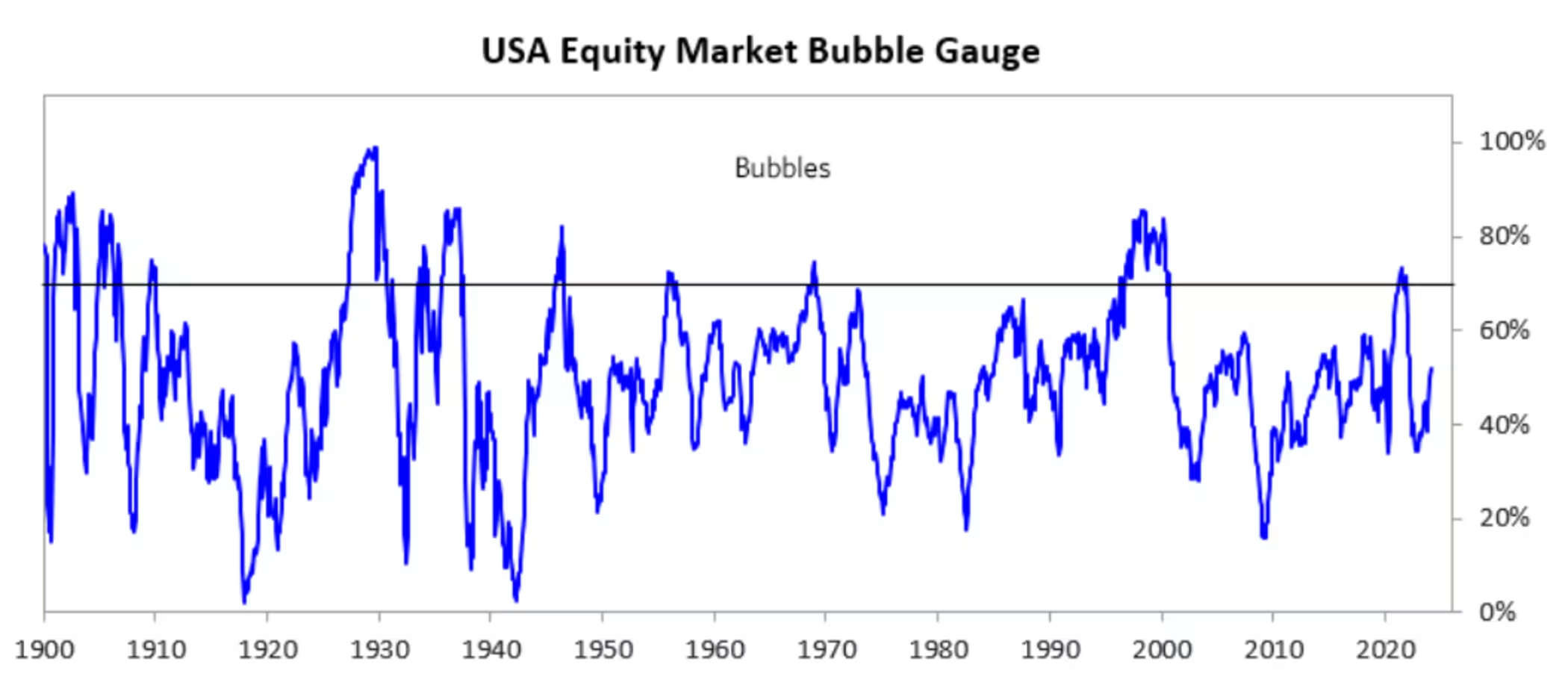

Hartnett recently expressed concern in an interview with Bloomberg about the possibility of an “overshoot” in early 2025 if the S&P 500 reached 6,666 points, which would be almost 10% higher than its present level and indicate the emergence of a dangerous bubble. Compared to the record high of 5.5 recorded during the tech bubble in March 2000, the price-to-book ratio of the S&P 500 has increased to 5.3 times in 2024, according to data from Bloomberg.

Stock Market Rallies as Bitcoin Tops $100K

Although the stock market has significantly increased, BofA’s bull-and-bear indicator suggests that investors are still cautious. With gains of around 27% this year, the S&P 500 has seen its greatest performance since 2019. Anxieties about artificial intelligence and the “America First” ideas of the incoming president are fueling the boom.

This week, Bitcoin briefly surged beyond $100,000, and Hartnett noted that this was partly due to Trump’s Crypto position. Now that its market valuation has surpassed $2 trillion, Bitcoin is on par with the eleventh biggest economy in the world.

Summary

Cryptocurrency adoption is booming, with over 400 million wallets holding positive balances. Stablecoins dominate on-chain transactions, accounting for 75% in 2024, and are crucial in developing nations for remittances and liquidity. Crypto ETFs are driving market growth, bridging traditional and digital finance.

However, concerns of market overvaluation persist. Analysts warn of potential bubbles, with the S&P 500 up 27% and Bitcoin briefly surpassing $100,000, reaching a $2 trillion market cap. Despite these milestones, investor caution remains due to uncertainties around AI and political shifts in Crypto policies.

[sp_easyaccordion id=”5966″]