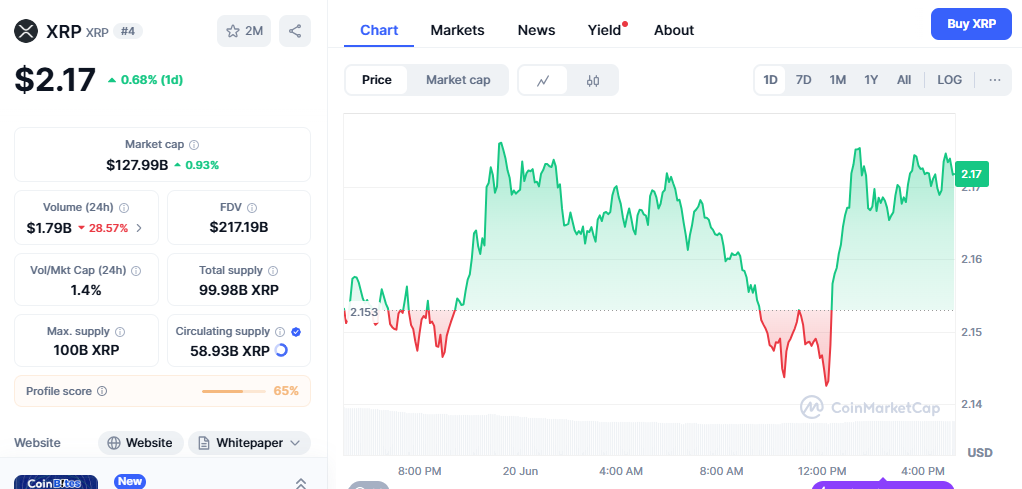

The cryptocurrency market continues to witness intense speculation around XRP’s potential to reach the $3 milestone, but recent on-chain data paints a different picture. Despite trading around $2.16 as of June 2025, multiple key indicators suggest that XRP faces significant headwinds, making the $3 target increasingly elusive in the near term.

Current Market Position and Trading Range

XRP has been consolidating within a tight trading range of $2.05 to $2.33 over the past month, indicating indecision among traders and investors. The digital asset reached its 2025 peak of $3.40 on January 16, but has since struggled to maintain momentum above the $2.25 resistance level. This consolidation phase reflects broader market uncertainty and specific challenges facing the XRP ecosystem.

The current price action demonstrates a classic pattern of range-bound trading, where neither bulls nor bears have been able to establish clear dominance. Market analysts point to this sideways movement as a critical juncture that could determine XRP’s direction for the coming months. The inability to break above key resistance levels has created a scenario where downside risks are becoming more pronounced.

Declining Network Activity Signals Weakening Demand

One of the most concerning indicators for XRP’s near-term prospects is the significant decline in network activity on the XRP Ledger. On-chain data from Glassnode reveals that the number of new daily addresses has plummeted dramatically from the 2025 peak of 15,823 addresses created on January 16 to just 3,500 new addresses on recent trading days. This represents a decline of more than 75%, indicating reduced interest and adoption of the network.

The situation becomes even more telling when examining daily active addresses (DAAs), which experienced a sharp drop to 34,360 on Thursday from a three-month high of 577,000 addresses recorded on Saturday. This dramatic fluctuation suggests that network engagement remains highly volatile and has not established a sustainable growth pattern. Such declining network activity typically precedes periods of price stagnation or downward pressure, as reduced transaction volume directly impacts liquidity and buying momentum.

However, recent developments have shown some positive signs, with data from Santiment indicating that active addresses on the XRP Ledger jumped from a three-month average of 40,000 to 295,000, representing the highest level seen in 2025. This surge coincided with Canada’s launch of an XRP ETF, though the sustainability of this increase remains to be proven over time.

Open Interest Decline Reflects Trader Sentiment

Another critical factor undermining XRP’s path to $3 is the substantial decrease in open interest across derivatives markets. According to data from CoinGlass, XRP’s open interest has decreased by approximately 30% to $3.89 billion, down from $5.53 billion over the past month. This decline suggests that investors are actively closing positions with expectations of lower prices in the future.

The significance of this open interest decline cannot be understated, as it mirrors previous patterns that preceded major price corrections for XRP. Historical analysis shows that the current scenario bears striking similarities to the market conditions in January 2025, which ultimately led to a 53% price drop to a multi-month low of $1.61 on April 7. The pattern suggests that when institutional and retail traders begin unwinding their positions en masse, it often signals a decline in confidence in the asset’s near-term prospects.

Despite this recent decline, it’s worth noting that XRP’s open interest had reached unprecedented highs earlier in 2025, with some reports indicating levels of $5.42 billion in January. The current consolidation in open interest, at around $3.89 billion, still indicates substantial market participation; however, the downward trajectory raises concerns about sustained institutional interest.

Technical Analysis Reveals Key Resistance Barriers

From a technical perspective, XRP faces significant obstacles in its quest to reach $3. The cryptocurrency is currently trapped below a crucial resistance zone between $2.22 and $2.40, where all major simple moving averages (SMAs) converge. This confluence of technical indicators creates a formidable barrier that bulls must overcome to establish any meaningful upward momentum.

The historical pattern indicates that when XRP has previously broken below these key trendlines, it has typically traded sideways for extended periods, ranging from 30 to 65 days, before ultimately declining to lower levels. XRP trader and analyst CasiTrades recently noted that “as long as this remains resistance, it increases the likelihood that we’ll sweep the lower levels: $2.01, $1.90, even $1.55 are still on the table.”

Technical analysis also reveals the formation of a descending triangle pattern, which traditionally indicates bearish continuation. If the crucial support level at $2.00 is lost, this pattern suggests a potential 45% decline toward $1.20. The Relative Strength Index (RSI) has already dropped to 51 from overbought conditions at 81 on January 20, indicating an increase in bearish momentum and reduced buying pressure.

Market Dynamics and Institutional Positioning

The broader cryptocurrency market dynamics also play a crucial role in XRP’s price trajectory. Current market conditions show declining volatility, with XRP trading in a symmetrical triangle pattern between $2.13 and $2.18. This consolidation phase, while potentially preceding a significant move, currently lacks the volume and momentum necessary to push prices toward the $3 target.

Institutional positioning appears mixed, with some positive developments including the approval of Canada’s first spot XRP ETF, which has generated renewed interest in the asset. The number of wallets holding over 1 million XRP has reached a record 2,700, suggesting that large holders, or “whales,” continue to accumulate despite the price stagnation. This whale accumulation could provide a foundation for future price appreciation, but it has not yet translated into the momentum needed to break key resistance levels.

The regulatory environment continues to influence market sentiment, with recent comments from SEC Chair Paul Atkins hinting at a more innovation-friendly regulatory approach. This shift in regulatory tone has contributed to some recovery in futures open interest, but the impact on spot prices has been limited.

Looking Ahead: Challenges and Opportunities

While the current on-chain data suggests that $3 remains out of reach for XRP in the immediate term, the cryptocurrency market’s inherent volatility means that conditions can change rapidly. The key factors that would need to align for XRP to reach $3 include a significant improvement in network activity, renewed institutional interest leading to increased open interest, and a decisive break above the $2.40 resistance zone.

Some analysts argue that XRP’s prolonged consolidation period below $3 may be setting the stage for a significant upward move, similar to the pattern that preceded the strong breakout in 2017. This perspective suggests that the current sideways trading could be an accumulation phase before a significant rally, potentially targeting levels as high as $5 to $10 based on symmetrical triangle breakout scenarios.

However, the immediate risks appear to outweigh the opportunities, with multiple technical and fundamental indicators pointing toward potential downside pressure. Traders and investors should closely monitor the $2.00 support level, as a break below this threshold could trigger the descending triangle pattern and lead to substantially lower prices.

Conclusion

The convergence of declining network activity, decreasing open interest, and challenging technical conditions creates a formidable barrier for XRP’s ascent to $3. While the cryptocurrency has shown remarkable resilience and continues to maintain significant market capitalisation and trading volume, the on-chain data indicates that current market conditions do not support a sustainable move to higher price levels.

Investors considering XRP positions should carefully weigh these factors against their risk tolerance and investment timeline. The current market structure indicates that XRP may require patience to challenge $3, and technical patterns suggest that dips to $1.90 or possibly $1.55 are possible.