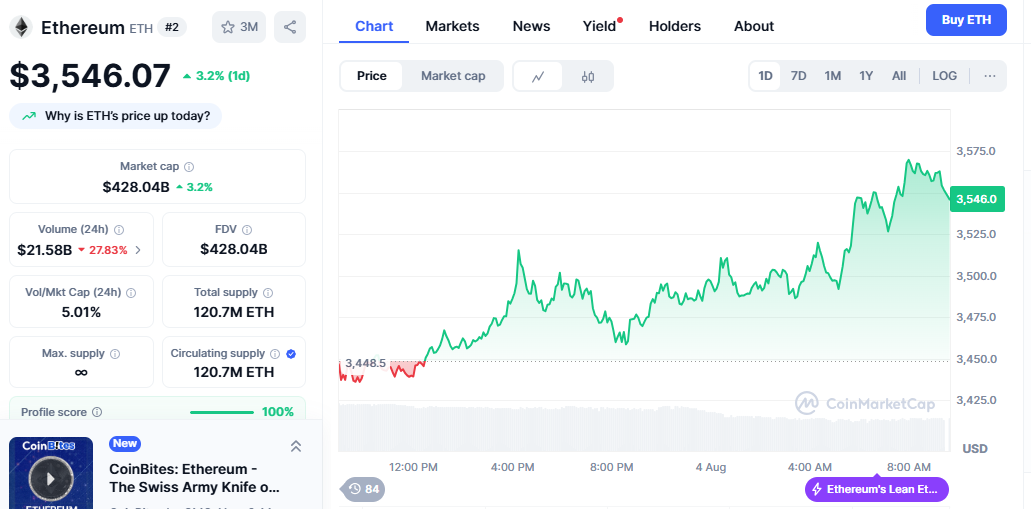

Ethereum (ETH) continues to dominate the cryptocurrency landscape as the world’s second-largest digital asset by market capitalization. The live price of Ethereum is currently trading around $3,353-$3,498 per ETH with a current market cap of approximately $404-419 billion USD. As we navigate through August 2025, Ethereum price prediction models suggest significant potential for growth, with analysts projecting targets ranging from $4,000 to $15,000 in the coming years.

The ETH market analysis reveals a complex interplay of technical indicators, institutional adoption, and market sentiment that continues to shape Ethereum’s trajectory. Recent market data shows ETH has experienced 21/30 (70%) green days with 15.02% price volatility over the last 30 days, indicating sustained bullish momentum despite short-term fluctuations.

Ethereum’s real-time analysis points to several key factors driving current price action: increasing institutional interest through ETF inflows, growing DeFi adoption, and upcoming network upgrades. Spot ETH ETFs saw $17M+ daily inflows, with BlackRock’s ETHA leading at $18.27M on July 31, demonstrating strong institutional confidence in Ethereum’s long-term value proposition.

The cryptocurrency market forecast for Ethereum remains predominantly bullish, with technical indicators showing a neutral Bullish 69% market sentiment. At the same time, the Fear & Greed Index displays a score of 55, indicating a balanced but optimistic market outlook.

Live Ethereum Price Analysis: Current Market Conditions

Real-Time ETH Price Movement

Ethereum is currently down 8.18% in the last 24 hours with a 24-hour trading volume of $38.24B USD, reflecting typical cryptocurrency volatility. However, the broader trend remains positive, with ETH live price showing resilience above key support levels.

Current Ethereum market metrics:

- Price Range: $3,353 – $3,498

- Market Cap: $404-419 billion

- 24h Volume: $13.49 – $38.24 billion

- Circulating Supply: 120.47 million ETH

Technical Indicators Overview

Moving Averages Analysis: On the weekly time frame, Ethereum is currently trending bullish with the 50-day moving average currently sloping up and below the current Ethereum price, which could act as a support. The 200-day moving average is also trending upward, indicating strong long-term momentum.

RSI and Momentum Indicators: The 14-day relative strength index (RSI) is currently at 70.83, indicating Overbought conditions, suggesting potential short-term correction before the next leg up.

Technical Analysis: Key Support and Resistance Levels

Critical Price Levels for ETH

Immediate Support Levels:

- $3,400: Primary support level for maintaining bullish structure

- $3,200-$3,300: Secondary support zone for consolidation

- $3,000: Major psychological support level

Key Resistance Targets: The first major uptrend resistance for ETH is at the $3,786 level, it needs to close above that level to continue to move higher. Additional resistance levels include:

- $3,940: July 2025 high resistance

- $4,000: Major psychological resistance

- $4,173: Technical target based on Fibonacci analysis

Chart Pattern Analysis

ETH has made a ‘Long-Legged Doji’ candle at the recent high, indicating indecision in trend. We may expect some consolidation or minor profit booking from these levels. The formation suggests a potential pause in the current uptrend before the next directional move.

Technical Pattern Indicators:

- Cup and Handle Pattern: Potentially forming on longer timeframes

- Ascending Triangle: Multi-year pattern suggesting bullish continuation

- Bullish Flag: Short-term consolidation pattern

Ethereum Price Predictions for 2025

Short-Term ETH Forecast (August-December 2025)

August 2025 Predictions: In August 2025, the cost may drop to a minimum of $3,472.84. The expected peak value might be $4,173.43 in August 2025. Multiple analysts suggest Ethereum Price Prediction Today Live targets of $3,900-$4,000 for early August.

Q4 2025 Outlook: Ethereum price is anticipated to close 2025 with a price range of $3500 to $3700, marking its yearly high. However, more bullish projections suggest potential for higher targets if institutional adoption accelerates.

Medium-Term Price Targets

2025 Annual Predictions:

- Conservative Estimate: $3,500-$4,200

- Moderate Bullish: $4,500-$5,925

- Highly Bullish: $6,500-$7,000

As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $5,925, driven by continued institutional adoption and network improvements.

Read More: Crypto Price Predictions June 2025: Bitcoin, Ethereum & Top 10 Coins

Long-Term Ethereum Market Forecast (2026-2030)

Multi-Year Price Projections

2026-2027 Outlook: According to our Ethereum price prediction, ETH is forecasted to trade within a price range of $3,469.29 and $6,520.17 next year. The expansion of institutional investments and layer-2 solutions could drive significant growth.

2030 Long-Term Target: According to our Ethereum Price Prediction 2030, the ETH coin price could reach a maximum of $15,575 by 2030. This projection reflects the potential for widespread adoption of Ethereum’s blockchain technology across multiple industries.

Factors Supporting Long-Term Growth

Network Development:

- Scalability Improvements: Layer-2 solutions reducing transaction costs

- Energy Efficiency: Proof-of-Stake consensus mechanism

- DeFi Ecosystem Growth: Continued expansion of decentralized finance

Institutional Adoption: Spot ETFs bought 7x more ETH than network issuance, indicating strong institutional accumulation that could support higher prices long-term.

Market Sentiment and Whale Activity Analysis

Institutional Interest and ETF Impact

ETF Performance: Recent Ethereum ETF data shows sustained institutional interest, with significant daily inflows supporting price stability. On August 1, Ethereum ETFs experienced $153 million in outflows, ending a 20-day inflow streak. In July, spot Ethereum ETFs saw a record $5.43 billion in net inflows.

Whale Accumulation Patterns: Data from on-chain trackers shows one whale accumulated $50 million worth of ETH over the weekend at an average price of $3,714. Separately, crypto analyst Ali Martinez reported that Ethereum whales bought over 500,000 ETH in two weeks.

Market Psychology Indicators

Fear and Greed Index: Current market sentiment shows a balanced approach with the Fear & Greed Index at 55 (neutral), suggesting neither extreme fear nor greed is driving current price action.

Social Sentiment: Despite the buying frenzy, many traders remain bearish on Ethereum’s prospects. Crypto Banter called it “the most hated rally right now” on social media, noting unusually high short positioning. This contrarian indicator often suggests potential for continued upward movement.

Risk Factors and Market Challenges

Potential Downside Risks

Technical Risks:

- Support Break: If ETH fails to hold above the $3,400 breakout level, it may enter a consolidation phase between $3,200–$3,300

- Overbought Conditions: Current RSI levels suggest potential for short-term correction

- Resistance at $4,000: Historical significance as a major psychological barrier

Fundamental Challenges:

- Regulatory Uncertainty: Potential government policy changes affecting crypto markets

- Competition: Other blockchain platforms challenging Ethereum’s dominance

- Market Correlation: Continued correlation with traditional financial markets during stress periods

Risk Management Strategies

Trading Considerations:

- Stop-Loss Levels: Consider placing stops below $3,200 for risk management

- Position Sizing: Account for Ethereum’s volatility in position calculations

- Time Horizon: Align investment strategy with price prediction timeframes

Expert Predictions and Analyst Opinions

Professional Forecasts

Industry Expert Views: Some forecasts suggest that Ethereum could reach new all-time highs, potentially exceeding $6,500 in 2025, driven by increased demand and continued network improvements. Leading analysts provide varying perspectives based on different methodologies.

Technical Analysis Perspectives: In 2025, ETH is forecasted to move to $5515 as per predictive research, with institutional adoption serving as a key catalyst for higher prices.

Consensus Range

Short-Term (2025): $3,500 – $6,500 Medium-Term (2026-2027): $5,000 – $8,000 Long-Term (2030): $10,000 – $15,575

Conclusion

Ethereum price prediction models consistently point toward significant long-term potential, despite short-term volatility. The combination of institutional adoption, technological improvements, and growing DeFi ecosystem usage creates a compelling case for Ethereum’s continued growth.

Current real-time ETH analysis suggests that while immediate resistance exists around $3,800-$4,000, the broader trend remains bullish. The broader trend remains bullish as long as ETH stays above $3,000 key support.

For investors considering Ethereum market forecast data, the convergence of technical indicators, fundamental developments, and institutional interest suggests that ETH remains well-positioned for substantial gains over the medium to long term. However, as with all cryptocurrency investments, proper risk management and thorough research remain essential.