Finding the best Ethereum price prediction today has become increasingly crucial for investors navigating the volatile cryptocurrency market in 2025. With Ethereum continuing to evolve through technological upgrades and institutional adoption, understanding current price forecasts can make the difference between profitable investments and costly mistakes.

Today’s Ethereum market presents unique opportunities as the network solidifies its position as the leading smart contract platform. Professional analysts and trading experts are closely monitoring key technical indicators, market sentiment, and fundamental developments to provide the most accurate predictions. Whether you’re a seasoned trader or new to cryptocurrency investing, having access to reliable ETH price forecasts is essential for making informed decisions in today’s rapidly changing market environment.

This comprehensive analysis combines insights from top-tier analysts, technical chart patterns, and market fundamentals to deliver the most reliable Ethereum price predictions available today.

Current Ethereum Market Overview

Today’s ETH Price Performance

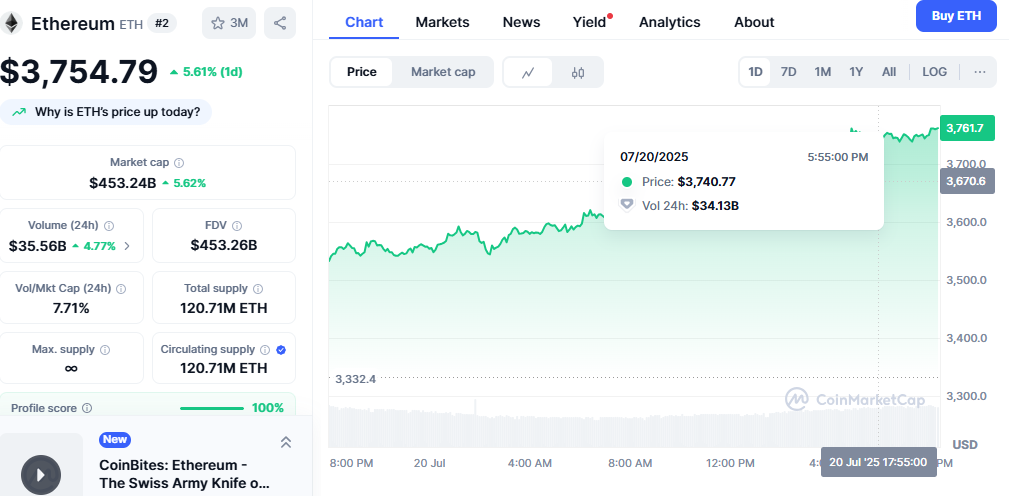

Ethereum’s price action today reflects broader cryptocurrency market trends influenced by regulatory developments, institutional adoption, and network upgrades. Current trading levels show ETH maintaining crucial support zones while testing resistance areas that could determine short-term price direction.

The recent price movements have been shaped by several key factors, including increased institutional demand, ETF inflows, and positive regulatory clarity in major markets. These developments continue to support bullish sentiment among professional traders and long-term investors.

Key Market Indicators

Professional analysts are monitoring several critical indicators that influence today’s Ethereum price predictions:

- Trading Volume: Current 24-hour volume indicating market participation levels

- Market Capitalization: ETH’s position relative to Bitcoin and other major cryptocurrencies

- Network Activity: On-chain metrics showing actual usage and adoption

- Institutional Flow: ETF inflows and corporate treasury additions

Best Ethereum Price Prediction Today Expert Analysis

Short-Term Price Targets (Next 7-30 Days)

Leading cryptocurrency analysts are providing optimistic short-term forecasts for Ethereum based on current technical patterns and market conditions. The consensus among experts suggests ETH could test higher resistance levels in the coming weeks.

Technical Analysis Insights:

- Support Levels: $3,200 – $3,400 range providing strong buying interest

- Resistance Zones: $3,800 – $4,100 acting as potential profit-taking areas

- Trend Direction: Bullish momentum supported by increasing volume

Several prominent trading firms have updated their near-term targets, with many expecting Ethereum to benefit from continued institutional adoption and positive market sentiment surrounding the recent regulatory developments.

Medium-Term Outlook (1-6 Months)

The medium-term perspective for Ethereum remains strongly bullish, with several analysts raising their price targets based on fundamental improvements and growing ecosystem adoption. Network upgrades and layer-2 scaling solutions continue to enhance Ethereum’s value proposition.

Key Drivers for Medium-Term Growth:

- Network Upgrades: Continued improvements to scalability and efficiency

- DeFi Expansion: Growing total value locked (TVL) in decentralized finance protocols

- Institutional Adoption: Increasing corporate and institutional investment

- Regulatory Clarity: Improved legal framework supporting broader adoption

Technical Analysis

Moving Averages and Trend Analysis

Current technical indicators suggest Ethereum is maintaining a bullish trend structure across multiple timeframes. The 50-day and 200-day moving averages are providing dynamic support, while momentum indicators show increasing buying pressure.

Key Technical Levels:

- 50-Day MA: Acting as dynamic support around $3,300

- 200-Day MA: Long-term trend support at $2,900

- RSI: Currently in bullish territory without showing overbought conditions

- MACD: Positive crossover indicating strengthening momentum

Volume Profile and Market Structure

Volume analysis reveals strong accumulation patterns at lower price levels, suggesting institutional and long-term investors are building positions. This creates a solid foundation for sustainable price appreciation.

The current market structure shows a higher lows and higher highs pattern, which typically indicates a healthy uptrend. Professional traders are watching for any breaks above key resistance levels that could trigger accelerated price movement.

Fundamental Analysis What’s Driving ETH Higher

Network Development and Upgrades

Ethereum’s continuous development roadmap provides strong fundamental support for positive price predictions. Recent network improvements have enhanced transaction throughput while reducing gas fees, making the platform more attractive for developers and users.

Recent Network Improvements:

- Layer-2 Integration: Successful scaling solutions reduce transaction costs

- Proof-of-Stake Efficiency: Energy-efficient consensus mechanism

- Smart Contract Optimization: Enhanced developer tools and frameworks

- Cross-Chain Compatibility: Improved interoperability with other blockchains

Institutional and Corporate Adoption

The growing institutional interest in Ethereum represents a significant catalyst for long-term price appreciation. Major corporations are integrating Ethereum-based solutions for various business applications, from supply chain management to digital identity verification.

Notable Institutional Developments:

- ETF Inflows: Consistent investment flows into Ethereum ETFs

- Corporate Treasuries: Companies adding ETH to balance sheets

- Financial Services: Traditional banks offering Ethereum custody services

- Payment Integration: Major payment processors supporting ETH transactions

Read More: Best Crypto News Sources for Beginners 2025 Your Ultimate Guide

Price Prediction Models and Methodologies

Quantitative Analysis Approaches

Professional analysts employ various quantitative models to generate accurate Ethereum price predictions. These models combine historical price data, on-chain metrics, and macroeconomic factors to forecast potential price movements.

Primary Prediction Models:

- Time Series Analysis: Statistical models based on historical price patterns

- Monte Carlo Simulations: Probability-based forecasting using multiple scenarios

- Machine Learning Algorithms: AI-powered predictions incorporating vast datasets

- Network Value Models: Valuations based on actual network usage and adoption

Sentiment Analysis and Market Psychology

Market sentiment plays a crucial role in short-term price movements, and analysts are monitoring social media, news sentiment, and investor behavior to gauge market psychology. Current sentiment indicators suggest optimism among both retail and institutional investors.

Sentiment Indicators:

- Social Media Trends: Positive discussions about Ethereum’s future prospects

- News Coverage: Increasingly favorable media coverage of ETH developments

- Investor Surveys: Professional surveys showing bullish sentiment

- Options Flow: Derivatives markets indicating upside expectations

Risk Factors and Market Considerations

Potential Downside Risks

While current predictions are largely positive, responsible analysis must consider potential risks that could impact Ethereum’s price trajectory. Understanding these risks helps investors make more informed decisions and manage their exposure appropriately.

Key Risk Factors:

- Regulatory Uncertainty: Potential changes in cryptocurrency regulations

- Market Volatility: General cryptocurrency market fluctuations

- Competition: Emerging blockchain platforms competing for market share

- Technical Issues: Potential network vulnerabilities or upgrade complications

Market Volatility Management

Experienced traders emphasize the importance of risk management when acting on price predictions. Even the most accurate forecasts can be affected by unexpected market events or broader economic conditions.

Risk Management Strategies:

- Position Sizing: Appropriate allocation based on risk tolerance

- Stop-Loss Orders: Protecting against significant downside moves

- Diversification: Spreading risk across multiple assets and timeframes

- Regular Review: Continuously updating positions based on new information

Expert Opinions and Analyst Forecasts

Leading Analyst Predictions

Top cryptocurrency analysts from major financial institutions and specialized research firms are providing updated Ethereum price targets based on current market conditions and fundamental developments.

Consensus Price Targets:

- Conservative Estimates: $4,000 – $4,500 within 3-6 months

- Moderate Projections: $5,000 – $6,000 by end of 2025

- Bullish Scenarios: $8,000+ in favorable market conditions

- Long-term Vision: $10,000+ over 2-3 year timeframe

Institutional Research Reports

Major investment banks and cryptocurrency research firms are increasingly covering Ethereum in their regular market reports, providing professional-grade analysis for institutional clients. These reports often influence broader market sentiment and investment flows.

Key Research Themes:

- Technology Leadership: Ethereum’s dominant position in smart contracts

- Ecosystem Growth: Expanding DeFi and NFT markets

- Institutional Adoption: Growing corporate and institutional interest

- Regulatory Progress: Improving legal clarity and compliance frameworks

Investment Strategies Based on Current Predictions

Dollar-Cost Averaging Approach

Many financial advisors recommend dollar-cost averaging as an effective strategy for investing in Ethereum based on current price predictions. This approach helps reduce the impact of short-term volatility while building long-term positions.

DCA Implementation:

- Regular Purchases: Systematic buying regardless of price fluctuations

- Time Diversification: Spreading purchases over extended periods

- Emotional Discipline: Removing emotion from investment decisions

- Cost Basis Management: Achieving favorable average purchase prices

Active Trading Strategies

Experienced traders are using current price predictions to implement various active trading strategies, taking advantage of expected price movements while managing downside risks.

Popular Trading Approaches:

- Swing Trading: Capturing medium-term price movements

- Breakout Trading: Trading momentum following key level breaks

- Range Trading: Buying support and selling resistance levels

- Options Strategies: Using derivatives for enhanced returns or protection

Conclusion

Finding the best Ethereum price prediction today requires careful analysis of multiple factors, including technical indicators, fundamental developments, and expert opinions. Current market conditions suggest a positive outlook for Ethereum, with most analysts projecting continued price appreciation over the coming months.

The combination of strong institutional adoption, ongoing network improvements, and favorable regulatory developments creates a supportive environment for Ethereum’s price growth. However, investors should remember that cryptocurrency markets remain volatile and unpredictable.