The Bitcoin price prediction landscape has taken a dramatic turn as the world’s leading cryptocurrency faces mounting pressure from intensified profit-taking activities. With BTC currently trading near critical support levels, investors are questioning whether the digital asset will crash below the psychological $100,000 threshold. The recent surge in profit-taking behavior has created significant headwinds for Bitcoin’s price momentum, prompting analysts to reassess their short-term and long-term forecasts.

Understanding the current market dynamics, technical indicators, and investor sentiment becomes crucial for anyone looking to navigate the volatile cryptocurrency landscape. This comprehensive analysis explores whether Bitcoin is truly on the verge of a significant correction or if this represents a temporary consolidation phase before the next major bull run.

Current Bitcoin Market Analysis and Price Action

The cryptocurrency market has witnessed unprecedented volatility as Bitcoin Price Prediction Is BTC Crashing Below models struggle to account for the massive influx of profit-taking activities. Recent data indicate that long-term holders have begun liquidating their positions, creating substantial selling pressure across major exchanges. This shift in investor behavior represents a significant departure from the accumulation phase that characterized much of 2024 and early 2025.

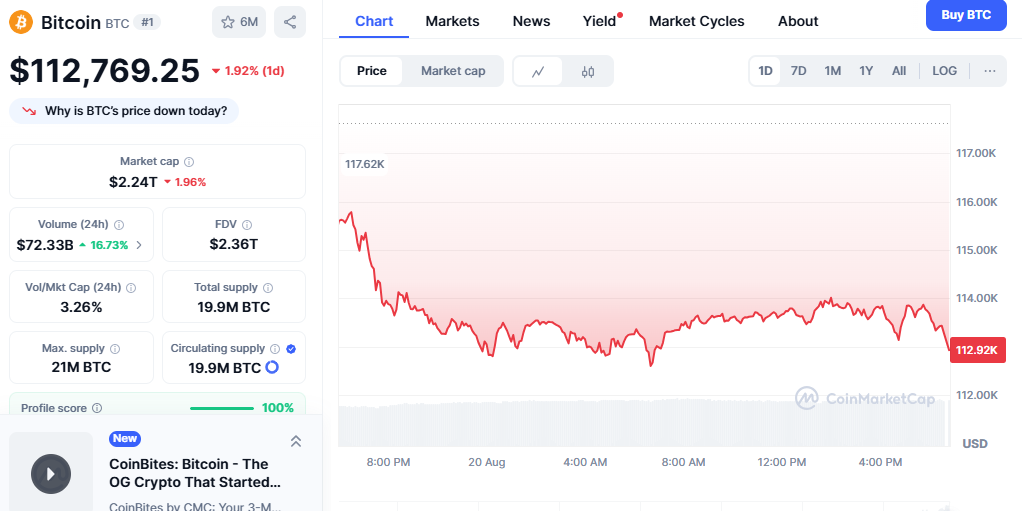

Market participants are closely monitoring key technical levels that could determine Bitcoin’s short-term trajectory. The $100,000 psychological support level has emerged as a critical battleground between bulls and bears. If this level fails to hold, analysts warn that BTC could experience a more pronounced correction, potentially targeting lower support zones around $85,000 to $90,000.

The current market structure suggests that Bitcoin is experiencing a natural cooling-off period after reaching new all-time highs. However, the intensity of profit-taking activities has raised concerns about the sustainability of the current price levels. Trading volumes have increased significantly during selloff periods, indicating that the market is actively processing the supply from profit-taking investors.

Understanding the Profit-Taking Phenomenon in Bitcoin Markets

Profit-taking represents a natural market mechanism where investors liquidate their holdings to realize gains after significant price appreciation. In the context of Bitcoin price prediction, understanding profit-taking patterns becomes essential for forecasting potential price movements. The current wave of profit-taking activities appears to be driven by several factors, including institutional rebalancing, individual investor risk management, and macroeconomic uncertainties.

Long-term Bitcoin holders, often referred to as “HODLers,” have begun showing signs of distribution after maintaining their positions through multiple market cycles. This behavioral shift suggests that even the most committed Bitcoin investors are becoming more tactical in their approach, taking profits at strategic price levels. The magnitude of current profit-taking activities has surprised many analysts who expected stronger hands to continue holding through potential short-term volatility.

The profit-taking phenomenon has been amplified by the maturation of cryptocurrency markets and the increasing participation of institutional investors. These sophisticated market participants often employ systematic profit-taking strategies, creating more predictable selling pressure at certain price levels. Understanding these dynamics is crucial for accurate Bitcoin price prediction and risk management strategies.

Key Support and Resistance Levels

From a technical perspective, BTC is currently navigating a complex web of support and resistance levels that will likely determine its near-term price direction. The immediate support zone around $100,000 represents not only a psychological level but also a technical confluence where multiple indicators converge. A decisive break below this level could trigger accelerated selling pressure and potentially lead to a cascade of stop-loss orders.

The resistance levels above current prices have strengthened due to increased selling pressure from profit-taking activities. The $120,000 to $125,000 range has emerged as a significant overhead resistance zone, where multiple attempts to break higher have been met with substantial selling pressure. This resistance zone represents an area where many investors who missed earlier selling opportunities are likely to liquidate their positions.

Technical indicators across multiple timeframes are painting a mixed picture for Bitcoin Price Prediction Is BTC Crashing Below? While longer-term indicators remain bullish, shorter-term momentum oscillators are showing signs of weakness. The Relative Strength Index (RSI) has retreated from overbought levels, potentially creating room for further downside movement. Additionally, moving average convergence is showing signs of potential bearish crossovers, which could signal additional downward pressure.

Market Sentiment and Investor Psychology

The current market sentiment surrounding Bitcoin Price Prediction Is BTC Crashing Below has shifted from extreme optimism to cautious uncertainty. Social media sentiment analysis reveals a growing concern among retail investors about the sustainability of Bitcoin’s recent price gains. This shift in sentiment often precedes more significant market corrections, as fear and uncertainty tend to amplify selling pressure.

Institutional sentiment appears more nuanced, with some large investors viewing current price levels as attractive for strategic accumulation, while others are implementing profit-taking strategies. The dichotomy between institutional and retail sentiment creates additional complexity in predicting Bitcoin’s short-term price movements. Survey data suggests that while long-term confidence in Bitcoin remains strong, short-term expectations have become more conservative.

The Fear and Greed Index, a popular sentiment indicator in cryptocurrency markets, has retreated from extreme greed levels witnessed during Bitcoin’s recent all-time highs. This normalization of sentiment could be viewed positively, as extreme sentiment readings often coincide with market turning points. However, the rapid shift from greed to neutral sentiment also indicates the fragile nature of current market psychology.

Also Read: Bitcoin Price Prediction Next Month Analysis Expert Insights August 2025

Expert Bitcoin Price Predictions and Forecasts

Leading cryptocurrency analysts have provided varying perspectives on Bitcoin price prediction in light of current market dynamics. In 2025, BTC is expected to move in the $77,000 to $155,000 area, according to recent forecasts from prominent research firms. However, these predictions assume that current profit-taking pressures will eventually subside, allowing for renewed bullish momentum.

Some analysts maintain bullish long-term outlooks despite short-term headwinds. Standard Chartered’s head of digital assets research predicted Bitcoin could reach $200K by the end of 2025, with interim milestones of ~$100K in the coming months. These optimistic forecasts are based on continued institutional adoption and the potential approval of additional Bitcoin-related financial products.

Contrarian viewpoints suggest that the current profit-taking wave could be more pronounced than many expect. These analysts point to historical precedents where similar profit-taking activities led to corrections of 30-40% from peak levels. If such a scenario unfolds, BTC could potentially test support levels significantly below $100,000, challenging bullish Bitcoin price prediction models.

Institutional Investment Trends and Their Impact

Institutional investment patterns play a crucial role in modern Bitcoin price prediction models. Recent data suggests that institutional flows have become more mixed, with some entities continuing to accumulate while others engage in strategic profit-taking. This divergence in institutional behavior creates additional complexity in forecasting Bitcoin’s price direction.

Exchange-traded fund (ETF) flows have shown signs of moderation after the initial surge following approvals. While inflows continue, the pace has slowed compared to the aggressive accumulation witnessed in early 2025. This moderation in ETF demand could contribute to the current consolidation phase and influence near-term price dynamics.

Corporate treasury adoption of Bitcoin has also evolved, with some companies implementing more sophisticated treasury management strategies that include periodic profit-taking. This professionalization of corporate Bitcoin holdings introduces additional layers of complexity to Bitcoin price prediction models, as corporate selling activities can be substantial and somewhat predictable.

Macroeconomic Factors Influencing Bitcoin Price

The broader macroeconomic environment continues to play a significant role in Bitcoin price prediction accuracy. Central bank policies, inflation expectations, and global economic uncertainty all contribute to Bitcoin’s price dynamics. Recent changes in monetary policy expectations have created additional volatility in risk assets, including cryptocurrencies.

Interest rate expectations have fluctuated based on evolving economic data, creating uncertainty about the opportunity cost of holding non-yielding assets like Bitcoin. When real interest rates rise, alternative investments become more attractive, potentially reducing demand for BTC and other cryptocurrencies. This relationship has become more pronounced as Bitcoin has gained mainstream acceptance as an investment asset.

Geopolitical tensions and currency instability in certain regions continue to support fundamental demand for Bitcoin as a store of value. However, the impact of these factors may be overshadowed by profit-taking pressures in the near term. Long-term Bitcoin price prediction models typically account for these macroeconomic tailwinds, but short-term volatility can obscure these underlying trends.

On-Chain Analytics and Network Fundamentals

On-chain analytics provide valuable insights for Bitcoin price prediction by revealing underlying network activity and investor behavior. Recent data shows that long-term holder distribution has increased, confirming the profit-taking narrative observed in price action. The movement of coins from long-term storage to active trading addresses often precedes periods of increased volatility.

Network hash rate and mining difficulty adjustments continue to reflect the robust security and decentralization of the Bitcoin network. These fundamental metrics remain healthy despite price volatility, suggesting that the underlying network strength supports long-term value propositions. However, short-term price movements may not always correlate directly with network fundamentals.

Transaction fees and network congestion patterns provide additional context for understanding market dynamics. During periods of intense selling pressure, transaction fees typically increase as users prioritize faster confirmation times. Monitoring these metrics can provide early warning signals for potential price movements and help refine Bitcoin price prediction models.

Risk Management Strategies for Bitcoin Investors

Given the current uncertainty surrounding Bitcoin price prediction, implementing robust risk management strategies becomes paramount for investors. Dollar-cost averaging remains a popular strategy for reducing the impact of short-term volatility while maintaining long-term exposure to potential Bitcoin appreciation. This approach helps investors avoid the challenges of timing market tops and bottoms.

Position sizing and diversification principles apply equally to Bitcoin investments as they do to traditional assets. The extreme volatility observed in cryptocurrency markets makes it essential for investors to limit their exposure to levels they can comfortably manage during adverse market conditions. Professional money managers often recommend limiting cryptocurrency allocations to 5-10% of total portfolio value.

Stop-loss strategies and profit-taking plans can help investors navigate volatile markets more effectively. However, implementing these strategies in cryptocurrency markets requires careful consideration of the unique characteristics of digital assets, including 24/7 trading and potential for rapid price gaps.

Regulatory Developments and Market Impact

Regulatory clarity continues to evolve and influence Bitcoin price prediction models. Recent developments in major jurisdictions have generally been supportive of cryptocurrency adoption, but regulatory uncertainty in some regions continues to create periodic volatility. The ongoing evolution of cryptocurrency regulations requires constant monitoring by investors and analysts.

Tax implications of cryptocurrency transactions have become more clearly defined in many jurisdictions, potentially influencing investor behavior and profit-taking decisions. Year-end tax planning considerations often contribute to increased selling pressure during certain periods, adding another layer of complexity to price forecasting models.

International regulatory harmonization efforts may reduce some sources of uncertainty over time, but the current patchwork of regulations across different countries continues to create challenges for global price discovery and Bitcoin price prediction accuracy.

Conclusion

The current Bitcoin price prediction landscape reflects a critical juncture where profit-taking pressures are testing the resolve of both bulls and bears. While the immediate outlook remains uncertain due to intensified selling activities, the fundamental factors supporting Bitcoin’s long-term value proposition remain intact. Investors should approach the current market environment with appropriate caution while maintaining perspective on Bitcoin’s revolutionary potential.

The question of whether BTC will crash below $100,000 ultimately depends on the duration and intensity of current profit-taking activities. Historical precedent suggests that such periods of consolidation often precede the next major bull run phases, but timing remains highly unpredictable. Successful navigation of current market conditions requires disciplined risk management, diversified investment strategies, and a clear understanding of individual risk tolerance.

For those seeking exposure to Bitcoin’s long-term potential, current market conditions may present strategic opportunities despite near-term volatility. The key to successful Bitcoin price prediction and investment lies in maintaining a balanced perspective that acknowledges both the opportunities and risks inherent in this dynamic and rapidly evolving market. Stay informed, implement robust risk management strategies, and consider consulting with qualified financial advisors before making significant investment decisions in the cryptocurrency space.