As Bitcoin continues to dominate headlines with its remarkable price movements in 2025, investors worldwide are seeking reliable Bitcoin price prediction next month analysis to make informed decisions. With Bitcoin recently surpassing $120,000 and demonstrating unprecedented institutional adoption, understanding the factors that could influence BTC’s price trajectory in August 2025 has become crucial for both seasoned traders and newcomers to the cryptocurrency space. This comprehensive analysis examines technical indicators, market sentiment, regulatory developments, and institutional factors that could shape Bitcoin’s performance in the coming month, providing you with the insights needed to navigate this volatile yet promising market landscape.

Current Bitcoin Market Overview and Recent Performance

Bitcoin’s journey in 2025 has been nothing short of extraordinary. The world’s largest cryptocurrency has experienced significant volatility while maintaining an overall upward trajectory, driven by several key factors including institutional adoption, regulatory clarity, and macroeconomic conditions.

Recent Price Action and Key Support Levels

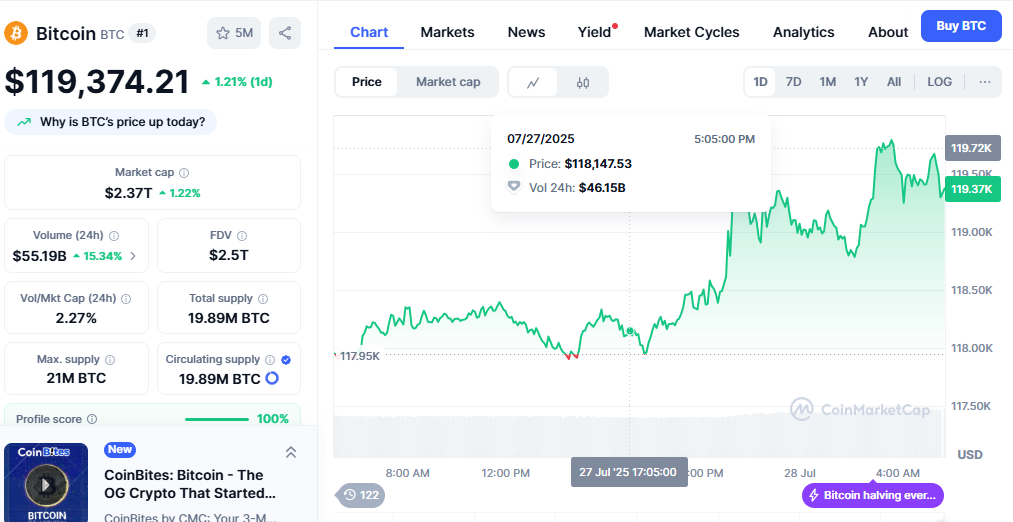

The current Bitcoin market shows strong momentum following a series of positive developments. Recent price action indicates that Bitcoin has established key support levels around $115,000, with resistance levels forming near $125,000. These technical levels are crucial for our Bitcoin price prediction next month analysis as they provide insights into potential price movements.

Trading volume has remained consistently high, suggesting sustained investor interest and market participation. The 24-hour trading volume has frequently exceeded $45 billion, indicating robust market liquidity that supports price stability during volatile periods.

Market Capitalization and Dominance Trends

Bitcoin’s market capitalization has reached unprecedented levels, currently hovering around $2.4 trillion. This massive valuation reflects the growing confidence in Bitcoin as both a store of value and a hedge against traditional financial market uncertainties. Bitcoin’s dominance over the broader cryptocurrency market has fluctuated between 52% and 58%, showing its continued leadership in the digital asset space.

Technical Analysis for Bitcoin Price Prediction Next Month Analysis

Technical analysis forms the backbone of any reliable cryptocurrency price prediction. By examining chart patterns, indicators, and historical price movements, we can identify potential scenarios for Bitcoin’s performance in August 2025.

Key Technical Indicators and Their Implications

Several technical indicators provide valuable insights for our analysis:

Moving Averages: The 50-day and 200-day moving averages continue to show bullish alignment, with Bitcoin trading well above both levels. This configuration typically indicates sustained upward momentum and suggests potential for continued growth in the short to medium term.

Relative Strength Index (RSI): The RSI currently sits in the 65-70 range, indicating that Bitcoin is approaching overbought territory but hasn’t reached extreme levels that typically signal imminent corrections. This suggests there may still be room for upward movement before a significant pullback occurs.

MACD (Moving Average Convergence Divergence): The MACD indicator shows positive momentum with the signal line above the baseline, supporting bullish sentiment for the coming weeks.

Support and Resistance Levels to Watch

Critical support levels for August 2025:

- Primary support: $115,000-$117,000

- Secondary support: $110,000-$112,000

- Strong support: $105,000-$108,000

Key resistance levels:

- Immediate resistance: $125,000-$127,000

- Major resistance: $130,000-$135,000

- Psychological resistance: $140,000

Chart Patterns and Trend Analysis

Current chart patterns suggest Bitcoin is forming a bullish flag pattern following its recent surge past $120,000. This technical formation typically indicates continuation of the previous uptrend after a brief consolidation period. The pattern suggests potential targets in the $135,000-$145,000 range if the breakout occurs as expected.

Fundamental Factors Affecting August 2025 Bitcoin Outlook

Beyond technical analysis, fundamental factors play a crucial role in determining Bitcoin’s price trajectory. These underlying market forces often drive long-term trends and can override short-term technical signals.

Institutional Adoption and Corporate Treasury Holdings

Institutional adoption continues to be a primary driver of Bitcoin’s price appreciation. Major corporations have increasingly added Bitcoin to their treasury reserves, with companies like MicroStrategy, Tesla, and Block leading the charge. Recent announcements from Fortune 500 companies regarding Bitcoin allocation strategies suggest this trend will continue throughout August 2025.

The approval and success of Bitcoin ETFs have also contributed significantly to institutional demand. These investment vehicles have attracted billions in capital from traditional investors who previously lacked exposure to cryptocurrency markets.

Regulatory Environment and Policy Developments

The regulatory landscape for Bitcoin has shown remarkable improvement in 2025. The passage of favorable cryptocurrency legislation, including the GENIUS Act, has provided much-needed clarity for institutional investors and businesses operating in the crypto space.

Recent statements from regulatory bodies suggest a more accommodating approach to Bitcoin and cryptocurrency regulations, which could positively impact price sentiment throughout August. However, investors should remain vigilant for any unexpected regulatory announcements that could influence market dynamics.

Macroeconomic Factors and Market Sentiment

Global macroeconomic conditions continue to influence Bitcoin’s price movements. Factors such as inflation rates, interest rate policies, and geopolitical tensions all play roles in determining investor appetite for alternative assets like Bitcoin.

The current economic environment, characterized by concerns about traditional currency devaluation and monetary policy uncertainty, has positioned Bitcoin as an attractive hedge for many investors. This narrative is likely to remain influential throughout August 2025.

Also Read: Bitcoin News Today Price Analysis Expert Market Predictions & Trading Insights 2025

Market Sentiment and On-Chain Analytics

Understanding market sentiment and on-chain metrics provides additional layers of insight for our Bitcoin price prediction analysis.

Fear and Greed Index Analysis

The Bitcoin Fear and Greed Index has fluctuated between “Neutral” and “Greed” territory throughout July 2025. This indicator, which measures market sentiment based on various factors including volatility, trading volume, and social media sentiment, suggests that while optimism remains high, the market hasn’t reached extreme euphoria levels that often precede major corrections.

On-Chain Metrics and Network Health

Key on-chain metrics support a bullish outlook for August:

Hash Rate: Bitcoin’s network hash rate has reached all-time highs, indicating strong miner confidence and network security. This metric often correlates with price appreciation as it reflects the overall health and adoption of the Bitcoin network.

Active Addresses: The number of active Bitcoin addresses has shown steady growth, suggesting increasing adoption and usage of the network. This fundamental metric indicates genuine utility rather than purely speculative interest.

Exchange Reserves: Bitcoin reserves on exchanges have continued to decline, suggesting that investors are moving their holdings to long-term storage. This trend typically indicates bullish sentiment and reduced selling pressure.

Whale Activity and Large Transaction Monitoring

Recent whale activity analysis shows that large Bitcoin holders (addresses containing 1,000+ BTC) have been accumulating rather than distributing their holdings. This behavior from sophisticated investors often precedes significant price movements and supports a bullish outlook for August 2025.

Expert Predictions and Analyst Consensus

Leading cryptocurrency analysts and market experts have shared their perspectives on Bitcoin’s potential performance in August 2025.

Bullish Scenarios and Price Targets

Several prominent analysts have outlined bullish scenarios for Bitcoin in August:

Continued Institutional Adoption – If institutional buying pressure continues at current levels, analysts predict Bitcoin could reach $135,000-$145,000 by the end of August.

ETF Inflow Acceleration – Increased capital inflows to Bitcoin ETFs could drive prices toward the $150,000 level, representing a significant breakthrough above current resistance levels.

Regulatory Clarity Boost – Additional positive regulatory developments could provide the catalyst for Bitcoin to test new all-time highs in the $160,000+ range.

Bearish Scenarios and Risk Factors

Balanced analysis also considers potential downside scenarios:

Risk Factor 1: Profit-Taking Pressure – Extended periods at high prices often lead to profit-taking by long-term holders, which could pressure prices back toward the $110,000-$115,000 support zone.

Risk Factor 2: Macroeconomic Headwinds – Unexpected changes in global economic conditions or monetary policy could reduce risk appetite and impact Bitcoin’s price negatively.

Risk Factor 3: Technical Correction – Overextended technical indicators suggest a healthy correction could bring Bitcoin back to the $105,000-$110,000 range before resuming its upward trajectory.

Trading Strategies and Risk Management

For investors and traders looking to capitalize on Bitcoin’s movements in August 2025, understanding effective strategies and risk management techniques is essential.

Short-Term Trading Approaches

Swing Trading: Traders can look for opportunities to buy on dips toward support levels around $115,000-$117,000 and take profits near resistance levels at $125,000-$127,000.

Breakout Trading: Monitoring for breakouts above $127,000 could signal continuation toward higher targets, while breaks below $115,000 might indicate deeper corrections.

Dollar-Cost Averaging: For long-term investors, systematic purchasing regardless of short-term price movements can help reduce the impact of volatility.

Long-Term Investment Considerations

Long-term Bitcoin investors should focus on fundamental factors rather than short-term price fluctuations. The continued adoption by institutions, improving regulatory environment, and Bitcoin’s fixed supply cap suggest positive long-term prospects despite potential short-term volatility.

Risk Management Guidelines

Effective risk management remains crucial:

- Never invest more than you can afford to lose

- Consider position sizing based on portfolio allocation strategies

- Use stop-loss orders to limit downside risk

- Stay informed about market developments and news that could impact prices

- Maintain a long-term perspective while managing short-term volatility

External Market Influences and Global Events

Bitcoin’s price movements are increasingly influenced by global events and external market factors that extend beyond the cryptocurrency space.

Traditional Market Correlations

Bitcoin’s correlation with traditional financial markets has evolved significantly. While maintaining some independence, BTC often shows increased correlation with technology stocks and risk assets during periods of market stress. Understanding these relationships is crucial for predicting how external market movements might affect Bitcoin in August 2025.

Geopolitical Events and Their Impact

Global geopolitical tensions, trade relationships, and international monetary policies all influence Bitcoin’s appeal as an alternative store of value. Recent developments in international relations and currency policies will likely continue to impact Bitcoin sentiment throughout August.

Mining Economics and Network Dynamics

The Bitcoin mining ecosystem provides important insights into the network’s health and potential price implications.

Mining Profitability and Hash Rate Trends

Current mining profitability remains strong despite increased network difficulty. The hash rate continues to reach new highs, indicating that miners remain confident in Bitcoin’s long-term prospects. This miner confidence often translates into price stability and support during market downturns.

Energy Consumption and Sustainability Narratives

The ongoing discussion about Bitcoin’s energy consumption and environmental impact continues to influence market sentiment. Recent developments in sustainable mining practices and renewable energy adoption by mining operations may positively impact Bitcoin’s ESG narrative throughout August.

Conclusion

This comprehensive Bitcoin price prediction next month analysis reveals a generally optimistic outlook for August 2025, supported by strong technical indicators, continued institutional adoption, and improving regulatory clarity. While potential targets range from $135,000 to $150,000 under bullish scenarios, investors should also prepare for possible corrections toward the $110,000-$115,000 support zone.

The combination of robust on-chain metrics, sustained institutional interest, and favorable macroeconomic conditions creates a supportive environment for Bitcoin’s continued growth. However, the inherent volatility of cryptocurrency markets means that risk management remains paramount for all market participants.

As we move through August 2025, staying informed about market developments, maintaining disciplined trading strategies, and focusing on long-term fundamentals will be key to navigating Bitcoin’s price movements successfully. Whether you’re a seasoned trader or a long-term investor, this Bitcoin price prediction next month analysis provides the foundation for making informed decisions in the evolving cryptocurrency landscape.